Why investors favour Australian cash ETFs during economic volatility

Pic: Getty Images

- Investors are favouring cash and other Aussie income producing ETFs during global market volatility

- Australia has two major high quality cash ETFs with large amounts of assets under management

- Interest rate hikes passed on much quicker to investors with cash ETFs than bank savings or term deposits

Cash is king with more investors allocating shares to income producing ETFs with the rising costs of living due to economic instability and market volatility.

In the first of this three-part series, we look at cash ETFs listed in Australia. Stockspot founder and CEO Chris Brycki said they’ve seen more investors shifting to cash ETFs recently for a few reasons.

“Cash ETFs pay more than regular high interest savings accounts,” Brycki said.

Rates vary among savings accounts ranging from the CBA’s NetBank Saver where interest will increase following the latest RBA hikes to 0.85%, while Westpac will do the same with its eSaver base rate.

Rates get bumped across the main banks for new customers while term deposits are also higher but Brycki said it means your money is locked away for the set period.

“Interest rate hikes are passed on much quicker to investors with cash ETFs as opposed to the banks which usually drag their feet on raising savings rates,” he said.

And there is no need to open a new bank account or to shop for the best rate or a honeymoon rate, as this is done for you.

Two main ASX-listed cash ETFs

There are two main listed cash ETFs in Australia including the BetaShares Australian High Interest Cash ETF (ASX:AAA) and iShares Core Cash ETF (ASX:BILL)

AAA invests in term and notice deposits from major banks. The monthly income distributions exceed the 30-day Bank Bill Swap Rate (BBSW). Basically, BetaShares negotiates directly with the big banks to ensure AAA gets the best rate.

Assets are invested in deposit accounts held with selected banks in Australia. Income is paid monthly at a rate competitive with ‘at call’ bank deposits and term deposits.

AAA owns nothing other than cash deposits with major banks, providing high levels of capital stability.

As of August 8, AAA had funds under management of ~$1.84 billion. It returned 2.2% per annum since it was launched in 2016.

“We currently recommend the AAA ETF to clients via the Stockspot Savings account as it’s a great place to park your cash if you are waiting out market volatility or want to wait to see where the market goes next,” he said.

“We recommend this to clients because of its size, it’s very liquid, and it puts the funds invested at very reputable bank with good credit quality.

“We’re confident that our clients are getting a great rate by using AAA.”

BILL follows ASX Bank Bill Index

BILL works a little differently to BetaShares AAA. According to its website it “employs a passive investment strategy that aims to provide investors with the performance of the S&P/ASX Bank Bill Index”.

Bill says it offers the “ability to achieve capital preservation and regular income with a diversified portfolio of high-quality short-term money market instruments”.

BILL only holds investments in instruments that can be sold on a same day basis and ones which are usually only used by institutions.

These include negotiable certificates of deposit, which are a bit like term deposits only they can be traded every day.

As of August 5, 2022 it held ~$306 million worth of net assets. Since its inception in 2017 BILL has returned a cumulative return of 5.09%.

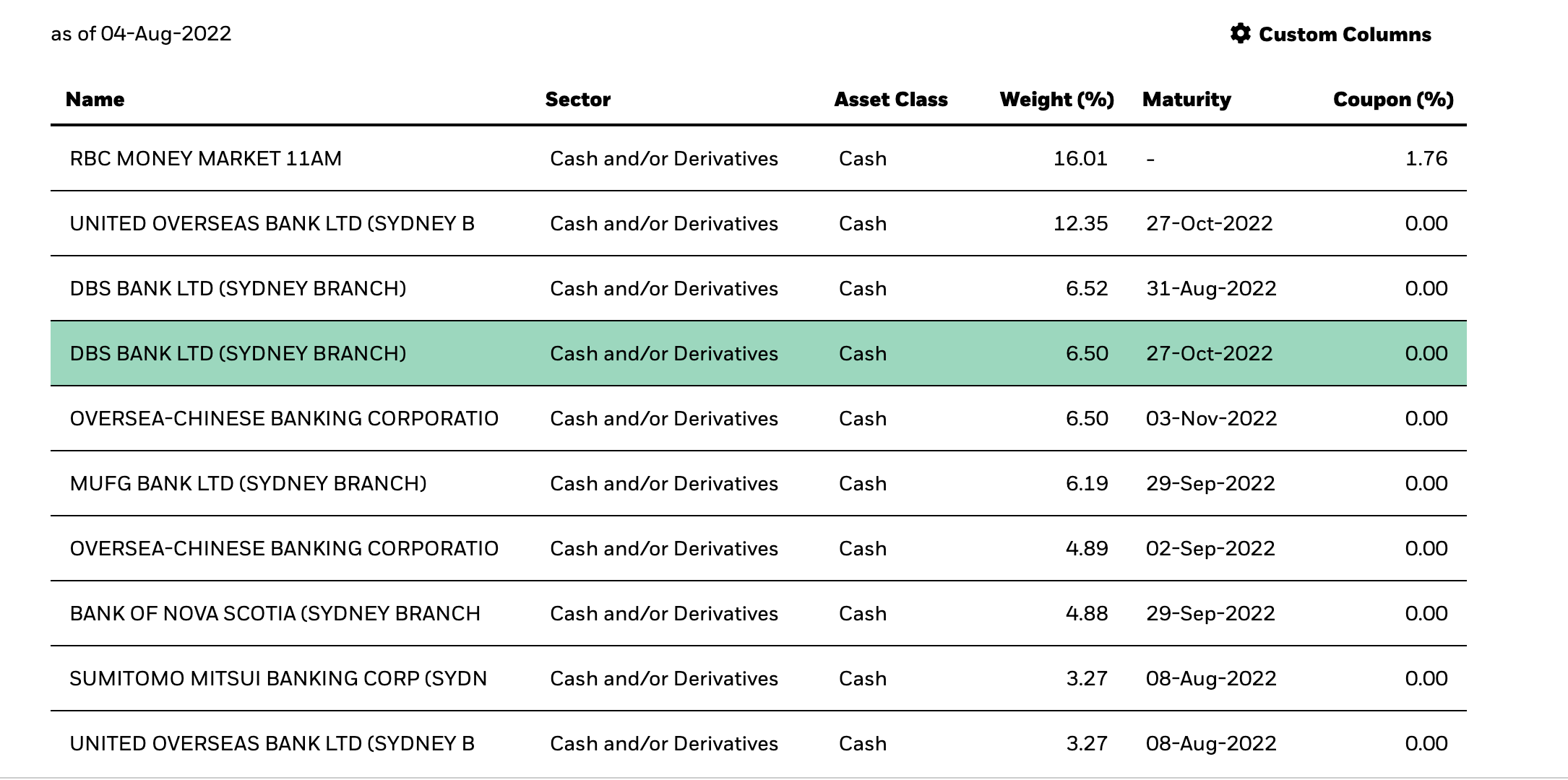

iShares BILL top 10 Holdings

“With interest moving up so quickly, savers will want to know they are getting the best rate available on their cash savings,” Brycki said.

“These cash ETFs have a good history of passing on rates increases in full and straight after interest rate changes so savers can be confident they are getting a good deal and not having to go shopping around every time there is a rate change.”

The views, information, or opinions expressed in the interviews in this article are solely those of the interviewees and do not represent the views of Stockhead. Stockhead does not provide, endorse or otherwise assume responsibility for any financial product advice contained in this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.