Can your trading platform collapse like FTX? Sort of. And here’s how you can protect your shareholdings

Pic: Getty Images

- Collapse of crypto exchange FTX has investors questioning how to protect their shareholdings on trading platforms

- Experts say best way to keep Aussie holdings safe is through a CHESS/HIN ownership structure rather than custodian

- ASX warns inexperienced investors may not understand risks and should understand intermediaries with whom they’re dealing

The fallout from the collapse of global crypto exchange FTX is still to be fully realised and has been described as a ‘Lehmann moment’.

The collapse of FTX and downfall of its former billionaire founder and CEO Sam Bankman-Fried resulted from the cryptocurrency equivalent of a bank run after questions were raised about its solvency.

Last week ASIC suspended FTX Australia’s financial services licence. Voluntary administrators from KordaMentha have been reportedly appointed to help nearly 30,000 Australians and 132 Australian companies get their funds back from the failed crypto giant.

And while FTX platform investors globally worry about whether they will ever see their funds again, away from crypto and into traditional equity markets, how can investor protect their holdings if their brokerage platform ever collapses?

From chalkies to trading platforms

Firstly, a little history lesson. Before the internet investors would call their stockbrokers to place orders to buy or sell stocks.

You couldn’t check your stock price easily. You’d either wait for the newspaper to see the prices for the previous trading day or phone your broker to check a price during the day.

Alternatively, you could sit in the gallery of a chaotic stock exchange watching chalkies responsible for handling orders on the trading floor, and update long chalk boards.

If you wanted to trade a stock, you’d dash outside to a payphone to contact your broker.

Fast forward and there are now dozens of online trading platforms in Australia enabling retail investors to easily trade and build their portfolio.

While investors may consider aspects like fees, where and what they can trade, access to data, ease of use and support there are some other important aspects to consider as well, including who holds your holdings.

A game of CHESS anyone?

Stockspot founder and CEO Chris Brycki said to understand how share holdings are protected a CHESS lesson is needed. (Not the board game with kings, queens and pawns.)

Clearing House Electronic Subregister System (CHESS) is the computer system used by the ASX to manage the settlement of share transactions and to record shareholdings.

CHESS has been in the news of late with the ASX last week announcing it will reassess all aspects of a replacement project entailing a blockchain system upgrade following an internal assessment and independent review.

An ASX spokesperson told Stockhead the demise of the project, which had cost ~$250 million, had nothing to do with the fallout from FTX and consequent uncertainty in crypto and blockchain.

“As mentioned in the announcement last week, amongst other things, the report identified complexity in the integrated solution design, including in the way ASX requirements interact with the application and underlying ledger,” the spokesperson said.

“These complexities contribute to challenges in achieving the necessary supportability, scalability, and stability for clearing and settlement.”

The spokesperson said the announcement had nothing to do with FTX and was “purely coincidental”.

How CHESS works

Brokers and other market participants can settle trades via CHESS by themselves or on behalf of their clients.

Before being able to register ownership of shares on CHESS an investor needs a Holder Identification Number (HIN), which is like a bank account number.

But to be issued with a HIN an investor will need an authorised participant (usually a broker or trading platform) to sponsor them.

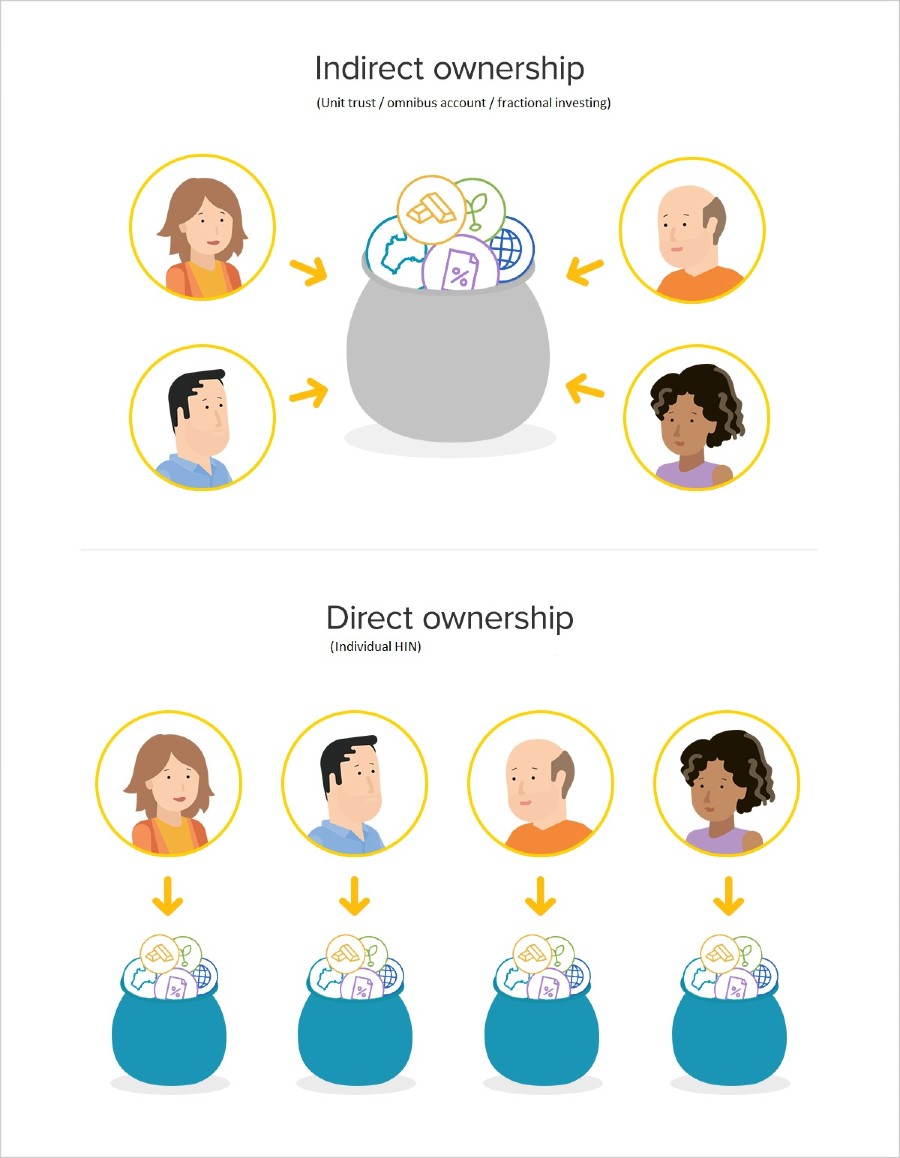

“An alternative to CHESS is called the custodian model where your investments are pooled with others and managed by a third party,” Brycki said.

“Under the custodian model, your investments are commingled with other investors and are held in the same account as others.”

Here’s a good graphic to explain.

Cost and tax difference between the two

There are also cost and tax differences between the CHESS and custodian models.

“Trading costs are incurred on an individual client level under CHESS which can make direct ownership more expensive,” Brycki said.

“With the custodian model trades are done in bulk while buys and sells are ‘netted’ to save on costs.”

Brycki said usually this netting benefit is earned by the investment company rather than passed on to clients.

“Under the CHESS model tax is calculated on an individual client basis based on the timing of each investment, income received and capital gains,” he said.

“Those investing indirectly under the custodian model can be impacted by the actions of others within the structure and can inherit a tax liability from others.”

“You might also miss out on some tax benefits.”

CHESS/HIN ownership structure is like insurance on your house

Brycki said Stockspot only uses the CHESS/HIN ownership structure where the risk to a client if a brokerage platform goes under is minimised.

“All investments are held on your own individual HIN so you retain full legal and beneficial ownership,” Brycki said.

“You have the flexibility to move your investments to a different broker or platform in the future.”

He said with the custodian structure, your investments are pooled with others and managed by a third party so you’re relying on their ability to accurately account for your investments.

“There is a risk that the shares may be sold or transferred without your knowledge, or worse, you may lose ownership of the shares entirely,” he said.

Another layer of protection

Pearler co-founder Nick Nicolaides said while there have been many share trading apps launched in the last few years, most of them are partnering with a market participant (registered broker) such as Open Markets or FinClear.

“This enables younger tech focused businesses like Pearler to focus more on the user experience whilst leveraging these much larger well-regulated businesses to ensure that consumer assets are safely maintained,” he said.

“While this system can create a clear line of sight on who really holds your shares, consumers should take steps to understand how their app processes their trades and who holds the assets. This info should be readily available in their app’s financial services guide.”

Nicolaides said for Australian shares traded on Pearler the CHESS/HIN ownership structure is used.

“This discussion of Aussies platforms offering individual HINS versus custodial ownership is uniquely Australian and in the US for example shares are legally held by the broker on behalf of the client as a standard practice,” he said.

“In the US this has paved the way for free brokerage because of the broker’s ability to aggregate trades for each stock and monetise other ways; for instance by selling order flow, a practice not possible in Australia.”

Australia a world leader in direct share ownership

The ASX spokesperson said Australia has one of the highest levels of direct share ownership in the world.

“We would never discourage participation in the market from informed investors of all types,” the spokesperson said.

However, the spokesperson said with an influx of new retail investors there are new dynamics and challenges to which we should be alert.

“As seen with GameStop (and other stocks) in the past, these dynamics include situations where large numbers of mainly new retail investors gather on social media, use ‘free’ online broker apps, share trading strategies that move stock prices, and sometimes use leverage by trading options,” the spokesperson said.

“In the case of GameStop, some were looking to profit, others to cause a short squeeze and punish hedge funds, and some probably didn’t know what they were getting into.”

It is this last group of inexperienced investors, who may not understand the risks, which is of greatest concern. The spokesperson said investors should understand the intermediaries with whom they are dealing.

“It’s important to note that shares held on a HIN registered in an investor’s name provides the investor with legal ownership of the shares,” the spokesperson said.

“Where multiple investors are pooled under a single HIN, those investors do not hold legal title to the shares, they have beneficial (not legal) ownership of the shares.”

Furthermore, investors who have a HIN in their name are afforded the protections of the NGF National Guarantee Fund.

“Investors in a pooled ownership structure would not be afforded all the same NGF protections available if their shares were held in a HIN in their own name,” the spokesperson said.

“Brokers have collapsed before – it’s rare, but it has happened more than once.”

The views, information, or opinions expressed in the interviews in this article are solely those of the interviewees and do not represent the views of Stockhead. Stockhead does not provide, endorse or otherwise assume responsibility for any financial product advice contained in this article

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.