Buy, Hold and Sell: It’s just twigged – Fortescue shares look a relative bargain

Many please. Via Getty

Here’s this week’s Stockhead: Buy, Hold and Sell with Michael Gable, managing director of Fairmont Equities.

IT’S A BUY

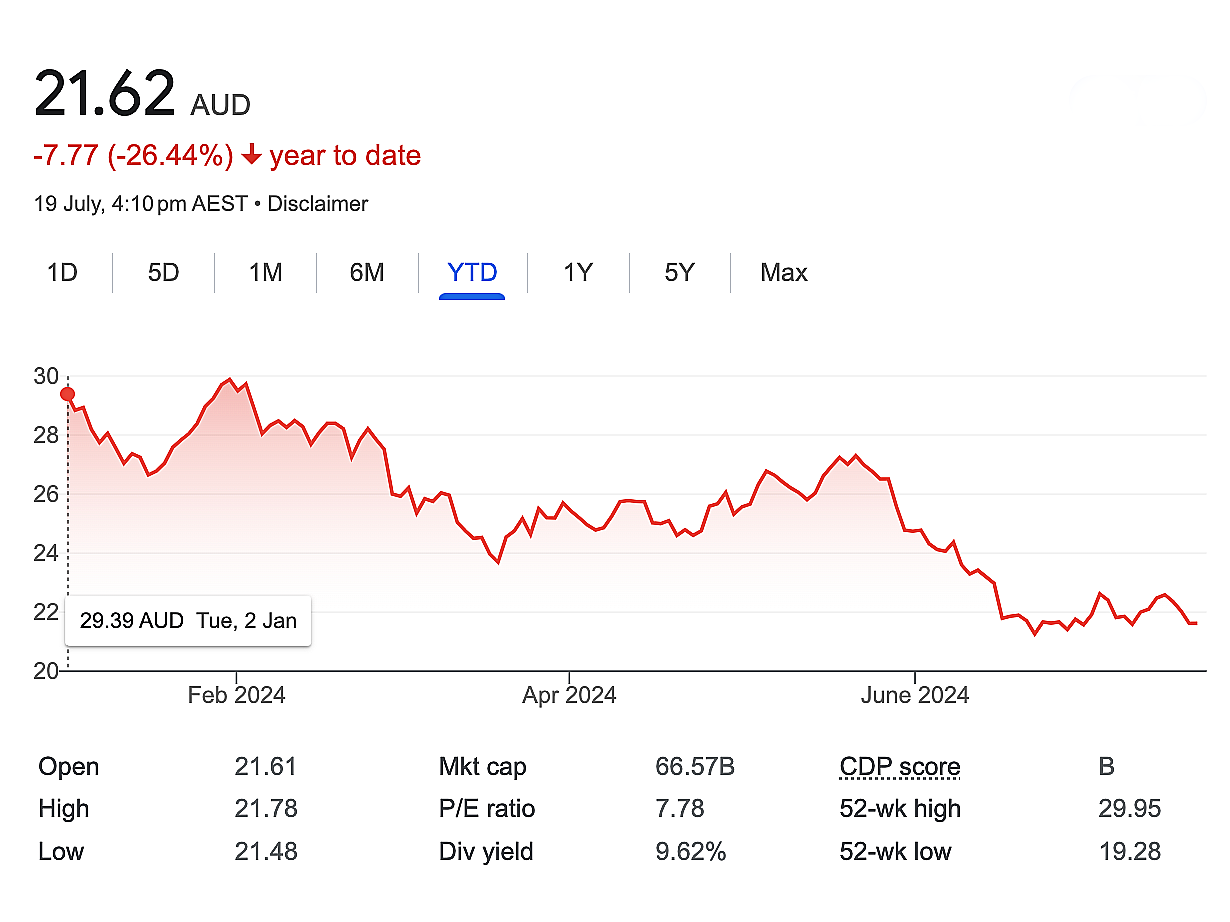

Fortescue (ASX:FMG)

We see the recent pullback in FMG shares as another buying opportunity, Michael Gable reckons.

“Current levels are a buying opportunity and we expect FMG to rally back up towards $29.00 before consolidating again,” he told Stockhead.

The declining share prices of Australia’s major iron ore diggers reflects some of the structural challenges facing the global iron ore sector, while doubts around China’s economic recovery and broader global economic uncertainty has undermined investor sentiment.

And they’ve been pulling back all year:

Selling in FMG accelerated into June, when an institutional investor triggered a sell-off, by dumping a stonkingly large bag of Fortescue worth some $1.1 billion in a searing block trade at significant 6% discount from FMG’s previous closing price of 22.980, as per reuters.

Another move out of last week which usually chimes well with fundies is when a profitable company makes pre-emptive moves on the bottom line, in FMG’s case, axing 700 jobs, to stay “lean, impactful and agile” – in the words of founder Andrew ‘Twiggy’ Forrest’

In a statement to the ASX last week, Fortescue said it “must continually evolve to ensure maximum value for shareholders.”

Fairmont says circa 700 jobs will go across FMG’s global operations, with a redundancy program likely to be finalised by the end of this month.

“Iron ore prices have fallen this year and with it the price of FMG,” Michael told Stockhead.

But the Fortescue share price is usually on the coal face of major iron ore moves and has always proven as resilient as the commodity it sells, he says.

“Over the years we have seen that FMG can often be oversold on the back of an iron ore pullback, and the share price charts are once again displaying signs that FMG shares should bounce from oversold levels.”

Capricorn Metals (ASX:CMM)

Capricorn Metals’ flagship project is the Karlawinda Gold Mine, near Newman in WA’s Pilbara.

The deposit was actually first clocked by IGO (ASX:IGO) before Capricorn snapped it up circa 2016.

Karlawinda was hoped to be a 100-120,000 ounce a year mine amd it’s done just that producing within guidance since FY23, at a ASIC around US$1,200/oz.

Mike says he remains positive on the outlook for both CMM and gold in the next 12 months.

“CMM is a mid-tier gold producer with operations in Australia. They are a low cost producer with plenty of cash in the bank. The long-term chart of CMM also looks favourable for further upside from here.”

Earlier this month, CMM dropped strong Q4 numbers on the back of Karlawinda.

This brought the company’s total yearly production to 113,007oz – inside Capricorn’s guidance of 112,000-115,000oz, while forward guidance for the new FY is now expected to be within 110,000-120,000oz.

Mike says Capricorn is one of several gold miners on the ASX which has delivered remarkable returns to those who took the gamble.

“In the last five years, it has gained five-fold thanks to one gold mine in WA. And the company is about to bring a second mine into production, that could be even better than the original one.”

IT’S A HOLD

Santos (ASX:STO)

Santos is the no. 2 Aussie pure oil and gas exploration and production play (behind Woodside Petroleum (ASX:WPL), with all sorts of interests in all sorts of nearby hydrocarbon provinces like Indonesia, and Papua New Guinea.

Some prescient East Aussie coal seam gas buys followed by a few partial sell-downs have done big things for both STO and its balance sheet Mike says, and liquid natural gas is among them.

“Santos has positioned itself quickly as one of the country’s largest coal seam gas producers and continues to prove additional reserves and it’s the country’s largest domestic gas supplier.

“And we expect demand for gas and oil to increase over the next 12 months,” Mike says.

“Santos is well placed to capture that demand.”

STO shares remain “materially undervalued.” The effective delivery of the Barossa and Pikka projects seem likely potential catalysts for” further price appreciation.”

“Not only do the shares look undervalued here, but the share price chart is showing solid signs that a low is in place and buyer demand is already stepping up,” Mike adds.

WiseTech Global (ASX:WTC)

The logistics business continues to grow and recent acquisitions are also progressing very well, according to Fairmont.

Mike reckons the addressable market for WTC remains a “huge opportunity”.

“We expect current rates of earnings growth to continue. The share price chart also looks positive as WTC remain in a strong uptrend.”

IT’S A SELL

Platinum Asset Management (ASX:PTM)

“This fund manager continues to see an outflow of funds and this is impacting its earnings and profitability. The share price has been in a downtrend since its peak in 2015 and at this point there is nothing to suggest that this trend is going to reverse.”

That’s it.

Collins Foods (ASX:CKF)

CKF runs some of 279 of about 750 KFC outlets in Australia.

Mike says this fast food operator updated the market recently with earnings numbers that were not as bad as expected.

“The share price initially rallied, only to be sold down heavily as the reality of a negative outlook for consumers started to sink in.

“There are still too many uncertainty and challenges with the high cost of living to know when the downtrend will end for CKF shares,” Mike adds.

As a sudden competitor vs recent IPO Guzman y Gomez (ASX:GYG) it’s less known that CKF also runs a bunch of hitherto underperforming Taco Bells.

As Stockhead’s Tim Boreham noted a few weeks ago, consumer sentiment “is weighing down (CKF) like a dodgy Zinger hot and crispy double box and same-store growth has been negative for the first seven weeks of the current financial year.”

When it dropped results in June the stock jumped 7% on the day, but fell over by almost 10% the next.

Brokers at Jarden describe CKF as having a “mixed outlook with near-term challenges but long-term opportunity” – which Tim says: “sounds about right.”

The views, information, or opinions expressed in the interviews in this article are solely those of the interviewees and do not represent the views of Stockhead.

Stockhead does not provide, endorse or otherwise assume responsibility for any financial product advice contained in this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.