Broking Good: SmartParking grabs a Buy rating on global plans; Kinatico given juicy price target

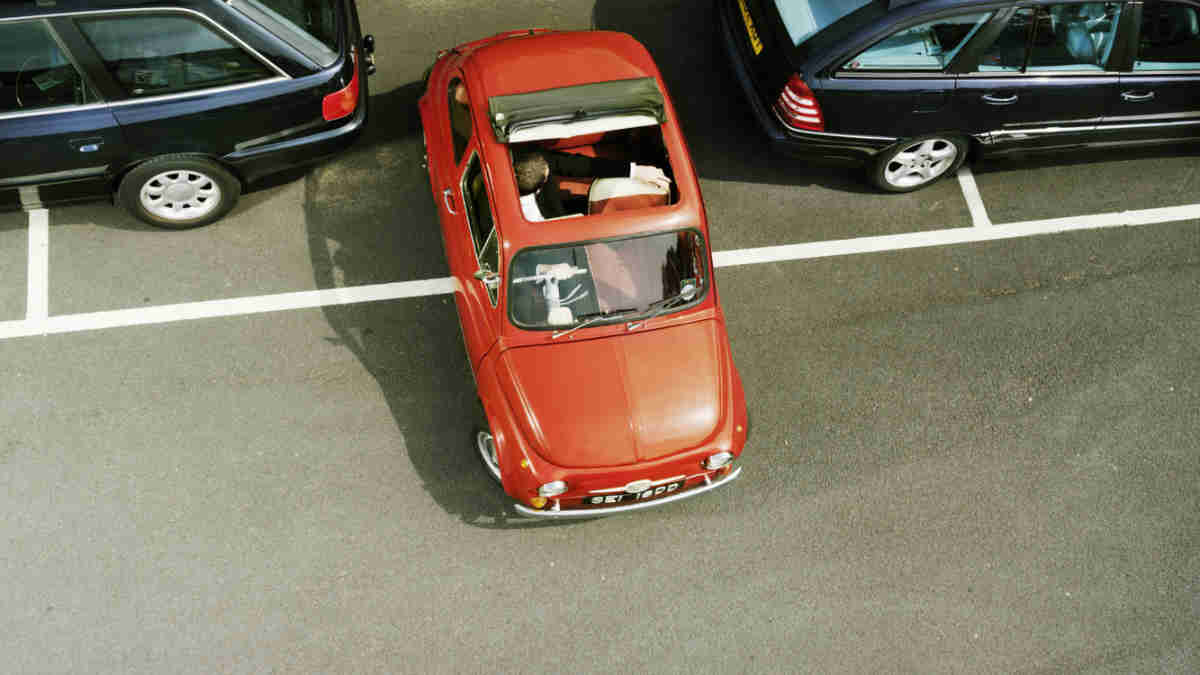

SmartParking slapped Buy rating with price target raised to 75c. Picture Getty

- SmartParking gets a Buy rating with price target raised to 75c

- Kinatico given Outperform rating with price target up to 15c

- SmartParking focuses on US growth, Kinatico invests in scaling its operations

SmartParking could scale if US plans succeed

SmartParking (ASX:SPZ) has been given a Buy rating from Canaccord Genuity, with an upgraded price target of 75c (versus the previous 70c and the current share price of 61c).

SmartParking is a technology-enabled parking management provider operating through two core divisions: Parking Management, which makes up the bulk of its revenue, and Technology.

Its core IP (intellectual property), the SmartCloud software, leverages automatic number plate recognition (ANPR) technology to automate all aspects of parking management, including real-time parking availability and payment.

Canaccord’s upgrade comes on the back of SmartParking’s impressive FY24 financial results and its promising guidance.

For FY24, SmartParking reported revenue of $54.3 million, marking a 21% increase year-on-year, coming in just under Canaccord’s expectation of $55 million.

This growth was fuelled by strong results in its core UK market and improving performance in new regions like New Zealand, Germany, and Denmark. Although Denmark is still in its early stages, initial traction there has been encouraging.

The company’s gross profit rose by 27% to $42.5 million, exceeding forecasts, and its gross margin remained strong at 27%.

Looking ahead, SmartParking’s FY25 trading forecast also looks promising.

The company said it’s on track to exceed 1,500 sites under management ahead of the stated December 2024 target date. It has now already reported record revenue months in June and July, with its site count climbing to 1,465.

SmartParking is also in advanced talks to secure a debt facility for international expansion and potential acquisitions.

“On our call, management highlighted the US as a focus for recent due diligence, with Texas and Florida being called out as the most prospective regions (population 50 million),” said the note from Canaccord.

“We see strong upside if SPZ can execute on its global expansion efforts to accelerate growth, given the quality of the businesses unit economics.

“We maintain a Buy rating and increase our price target to $0.75/share after updating our DCF (discounted cash flow).”

Kinatico’s growth spurs 50pc price hike forecast

Meanwhile, Kinatico (ASX:KYP) has recently been assigned an Outperform rating by Taylor Collison, with a price target of 15c (versus current price of 10c).

The rating reflects the company’s solid performance and promising outlook, says Taylor.

Kinatico is a regulatory technology (Reg-Tech) workforce software business, primarily focusing on daily workforce management through its OnCite platform.

The company acquired Bright People Technologies for $15m in 2021, a move described as transformative for KYP as it allowed an accelerated move into the workforce compliance sector.

KYP is primarily targeting the healthcare, energy & utilities, education and professional & financial services sectors to simplify their compliance management.

Following the release of its full FY24 results in August, Kinatico demonstrated impressive growth that has caught the attention of analysts.

The company reported a 90% increase in SaaS revenue, reaching $9.7 million, and saw a 43% uplift in EBITDA to $3.7 million. Net profit after tax (NPAT) also improved, rising from $0.2 million to $0.8 million.

Although these results aligned with expectations, Taylor Collison has adjusted the company’s earnings forecasts for FY25, lowering the EBITDA estimate by $0.7 million to $4.3 million.

This adjustment accounts for the company’s planned acceleration in investment, which is viewed as a positive strategic move rather than a concern.

The company’s development strategy is robust, with a $4.2 million sales pipeline and a customer base of over 10,000 corporate clients generating approximately $20 million in verification revenue.

“We retain our blended valuation of $0.15 per share, continuing to recognise value in KYP’s rapid shift towards high-quality SaaS revenue, favourable regulatory tailwinds and significant existing pipeline to capitalise on,” said the note from Taylor Collison.

“With further catalysts to come, including the launch of self-service components this year, we believe KYP will continue to convert and win new customers in its target sectors.”

This story does not constitute financial product advice. You should consider obtaining independent advice before making any financial decision.

The views, information, or opinions expressed in this article are solely those of the brokers and do not represent the views of Stockhead. Stockhead does not provide, endorse or otherwise assume responsibility for any financial product advice contained in this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.