Broker Upgrades: Lithium prices are on the rebound, putting these ASX stocks in the driver’s seat

E&P says there is optimism for Australian lithium stocks. Picture via Getty Images

- E&P Capital notes challenges for EVs in US and Europe, as China leads market

- Lithium prices are stable but could be limited in growth

- E&P says there is optimism for Australian lithium stocks

Forecast for EVs

E&P Capital’s latest report, “Under the Hood on EVs”, takes a look at how the electric vehicle market is changing and what that means for lithium demand.

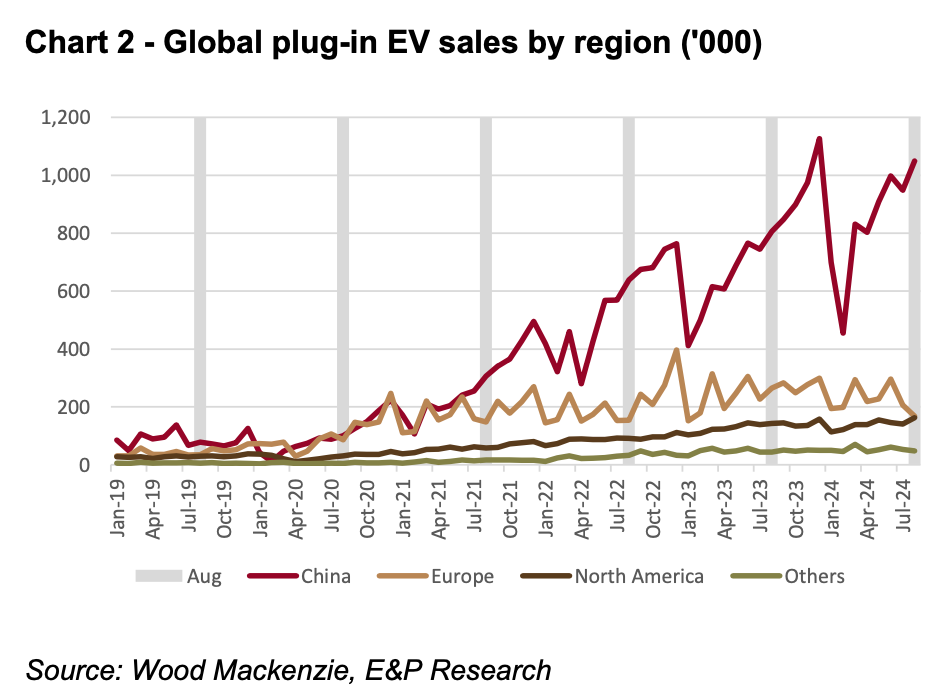

There’s a noticeable move towards hybrids, says E&P, especially plug-in hybrids (PHEVs), which now make up about 8% of total vehicle sales and 40% of all EVs sold globally.

While EV growth in the US and Europe is flat, China boasts a 50% market share, with Chinese brand BYD leading globally. Tesla, meanwhile, is facing tough competition, which has hurt its sales.

Wood Mackenzie has downgraded EV sales forecasts for Europe and the US due to higher tariffs on Chinese EVs and a lack of competitive local options, but it has raised forecasts for China.

E&P noted that recent corporate events indicate Western demand for EVs is expected to grow, but affordable local options won’t be ready until 2026. This could slow growth outside of China over the next 18 months.

A big lithium rebound not on the horizon yet

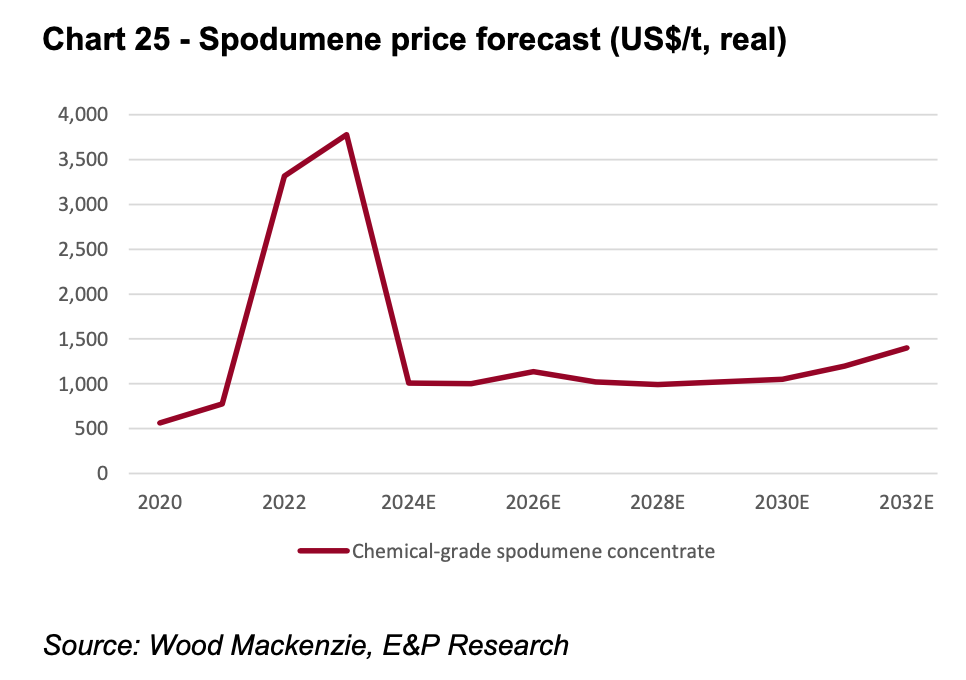

Right now, spodumene prices are hovering around the US $1.2–1.3k per tonne mark, which is pretty solid but suggests there’s a bit of room for growth.

“Consensus long-run pricing is in the order of US$1.3-1.5k/t, which suggests there could be modest upside from here,” wrote E&P.

However, recent share price jumps in lithium stocks mean the risk-reward balance is getting a bit tighter.

For large-capped lithium companies, they’re currently trading at about 7-8x their EBITDA for FY27, assuming a bounce back to US $1.5k per tonne spodumene.

But by FY28, those multiples could dip to around 6-6.5x, says E&P.

E&P also took a deep dive into the all-in costs (AIC) for Australian lithium mines, which is not too encouraging.

Even Greenbushes (IGO/Tianqi JV 51%, Albemarle Corporation 49%), one of the best hard rock lithium mines out there, is feeling the pinch at an AIC of about US $750-800 per tonne when growth capital expenditures are factored in.

And IGO (ASX:IGO)’s all-in cost could be closer to US $1,000 per tonne for FY25 when you account for its cash burn.

So given the high costs, can lithium stocks rise from here?

E&P Capital thinks they can.

Rio Tinto (ASX:RIO)‘s recent acquisition of Arcadium Lithium (ASX:LTM) suggests a potential bottoming out in the market, and lithium prices have recently stabilised, although further increases are needed to justify current valuations.

With China’s stimulus efforts creating potential upside, and the West keen to diversify its battery supply chains away from China, this could bode well for Australian producers, the research firm says.

Among Australian stocks, E&P said Pilbara Minerals (ASX:PLS) and Mineral Resources (ASX:MIN) stand out.

Following Rio’s acquisition, investors are speculating on further M&A targets and are now looking at potential mergers and acquisitions, with Pilbara and Liontown Resources (ASX:LTR) on the radar.

Pilbara is particularly attractive due to its solid balance sheet and cost structure. E&P said recent site visits to the company have highlighted opportunities for operational improvements, and its P1000 expansion project is making good progress.

The Arcadium deal could also bring institutional capital back into the lithium sector, positioning Pilbara as a lower-risk choice for investors.

In summary, E&P thinks that while the lithium landscape is a bit choppy, there’s cautious optimism for the future, especially with cost curves providing some support.

“We have marked-to-market our first-quarter FY25 commodity prices and lowered our lithium forecasts over the next six months.

“We previously assumed a gradual recovery in prices towards US$1.1k/t during 2H FY25. Lithium prices appear to have stopped falling but do not yet appear to be rebounding either.

“We now assume US$850/t in 2Q FY25 and US$1k/t in 3Q FY25.

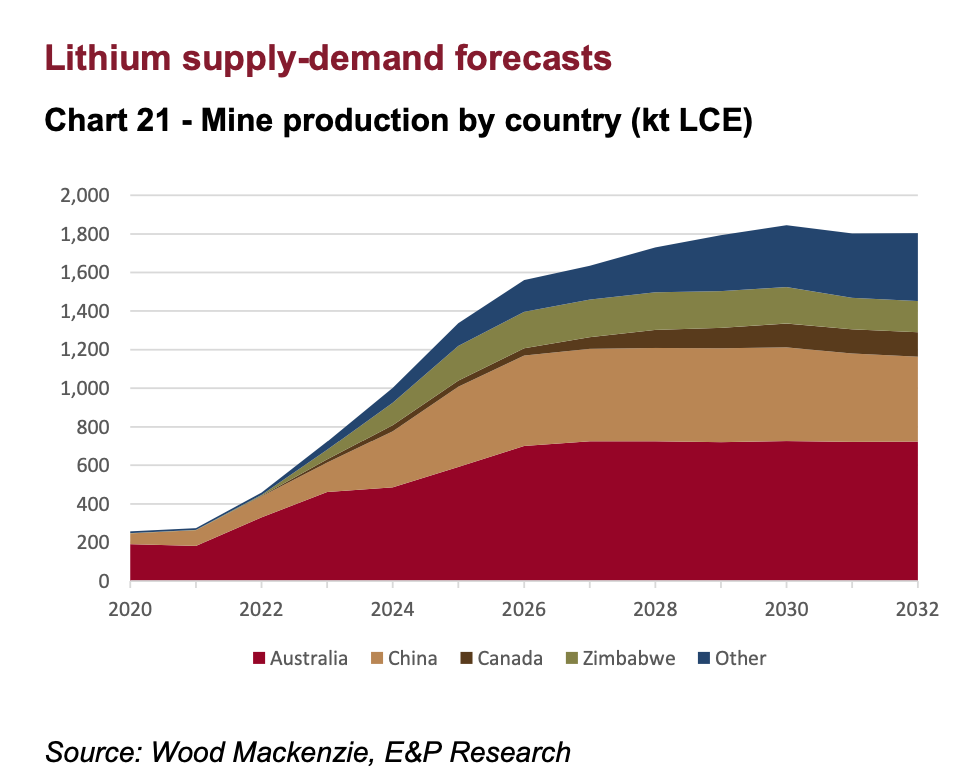

“But electrification is coming, it’s more the rate of build-up that’s at question, and whether the cost structure of some new incremental lithium supply (i.e. parts of Africa/China) is as low cost as speculated,” noted E&P.

What should we expect at the quarterlies?

The quarterly reporting season is just around the corner, and here’s what E&P is expecting from these lithium companies.

Pilbara Minerals (Positive, $4/share valuation vs current price of $2.87)

E&P has made some small tweaks to forecasts after a recent site visit.

It has increased PLS’ expected production for the first quarter of FY25 to 198,000 tonnes but slightly lowered the second quarter’s estimate to 185,000 tonnes due to maintenance timing changes.

With higher production, unit costs could end up lower than expected in the first quarter.

E&P predicts some ups and downs with production and costs throughout FY25 as the P1000 project wraps up. There may also be news about delaying non-essential spending because of current prices.

Mineral Resources (Positive, $67/share valuation vs current price of $50.57)

For MinRes, E&P expects some “high grading” at the Mt Marion site.

This means it might dig less from lower-quality ore to avoid extra waste, leading to more digging later on for that lower-grade ore.

E&P anticipates updates on recent cost-cutting goals, both operational and capital. It doesn’t expect Train 3 at Wodgina to be shut down, as it could be handy if prices bounce back.

IGO (Neutral, $7/share valuation vs current price of $5.47)

For IGO, the performance of Kwinana Train 1 after its maintenance turnaround in October is key.

This will impact ongoing losses and cash flow issues affecting the Greenbushes and Kwinana sites.

The results from Train 1 could also affect whether Train 2 goes ahead, though E&P thinks that’s unlikely. It doesn’t expect any changes to the outlook for Greenbushes.

Liontown (Neutral, $1.30/share valuation vs current price of $0.83)

Liontown’s management is thinking about lowering the target grade for spodumene to around 6%. This could help cut costs by using less reagent in the process.

The company is also exploring ways to reduce cash spending, possibly scaling back early work on its 4 million tonne expansion.

More detailed guidance on long-term plans is expected early in 2025, but it might come sooner, especially since Liontown is planning a field trip for investors to its Kathleen Valley asset in early November.

The views, information, or opinions expressed in this article are solely those of E&P Capital and do not represent the views of Stockhead.

Stockhead has not provided, endorsed or otherwise assumed responsibility for any financial product advice contained in this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.