Around the ASX in 7 companies at the Pinnacle of their game

A wizard (disguised as a wizard) pulls strings from behind a tree during a nearby quest to save a world.

Last week the Aussie-listed, multi-affiliate investment management Group, Pinnacle Investment (ASX:PNI) held its annual investment summit, a festival of ASX-absorbed fundies sharing canapés and cunning plans amid like-minded fin-geeks, high-conviction compeers and stockmarket stickybeaks.

This is not about what we know of the ASX-listed Pinnacle, but rather what Pinnacle knows about ASX-listed opportunities.

… and yet, Pinnacle, being an ASX-listed small cap itself, it’s hard for a peripatetic penny stock obsessive like myself not to pause a moment and admire this cap agnostic and entirely fascinating business; it’s oddly eccentric collection of experts, and the rather triffic trajectory its fairly unique business model is taking.

So. Here’s a bit of Pinnacle background…

For circa 17 years now, Pinnacle IM’s been building, according to the crew – ‘a robust and diverse business positioned to succeed across market cycles. ‘

More recently they’ve gone about expanding their global coverage all the while building a kind of investing (small f) fellowship of the ring, by partnering with Aragorn-esque (capital A) Affiliates, led by management teams with memorable track records in businesses with demonstrative growth potential.

Basically, along with holding equity interests in the Affiliates, Pinnacle provides any seed funding, easy access to global institutional and retail distribution, and ‘industrial grade’ middle office and infrastructure services – which means there’s a lot of securities and investments WD40 in the cloak room.

The model is simple – Pinnacle provides and handles all the variety of non-investment services for the fellowship, allowing the actual ring bearers to focus on delivering the One Ri… ahem investment excellence to their clients. Yes. They are the Gandalf.

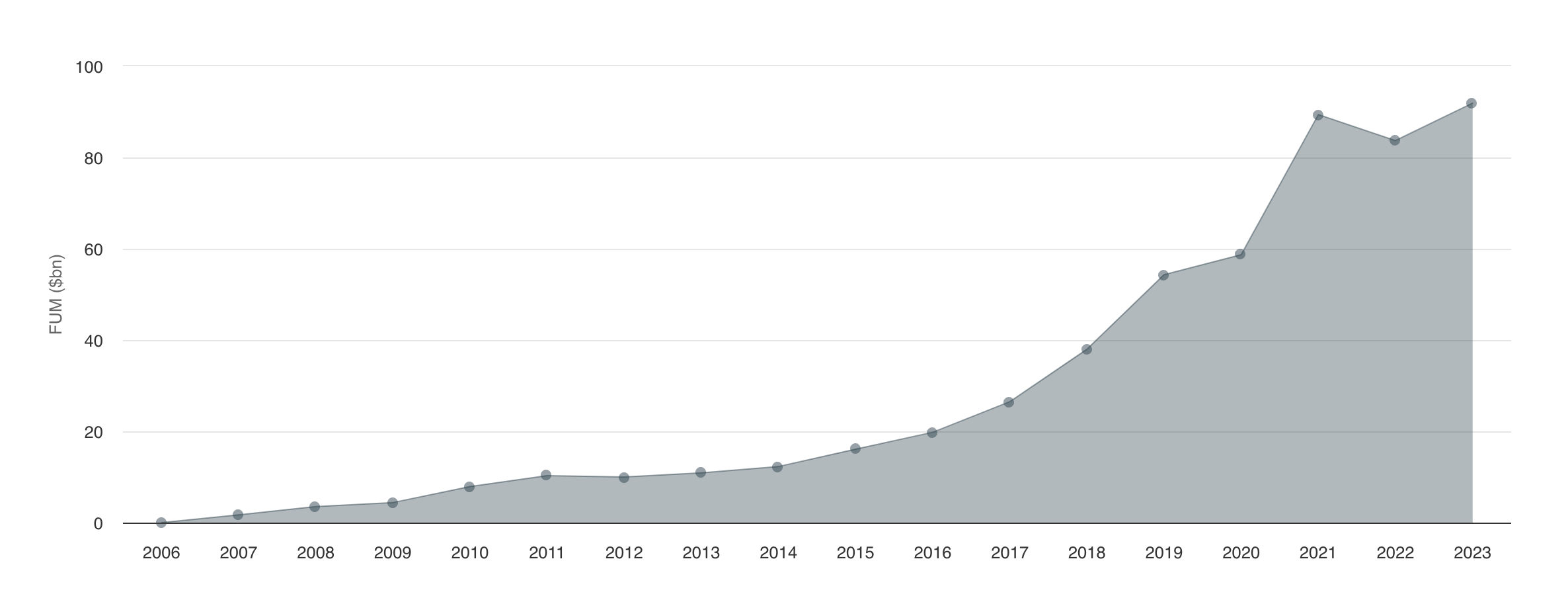

Here’s a graph of the fellowship heading toward the Pinnacle Investment (ASX:PNI) of what the metaphor demands be the unfortunately named (by Tolkien) Mount Doom:

Also not afraid to get down and diversity: Here’s a breakdown and comparison of funds under management for Pinnacle ’23:

Meantime, last week at the event, nine members of the wider PMI family shared investment insights and views on the outlook for stock markets in the year ahead.

Top stock picks from the 2023 conference

Firetrail Investments: Domino’s Pizza (ASX:DMP) and Incitec Pivot (ASX:IPL)

First up, Firetrail is an investment management boutique that specialises in high conviction investing.

FT’s portfolio manager Blake Hendricks shares his take on how investing in “uncomfortable opportunities” is a great way to achieve strong stock market returns.

Blake named Incitec Pivot (ASX: IPL) as a stock to watch.

“Incitec Pivot is a company that takes gas and turns it into fertiliser or explosives. It’s not a household name – its been very, very unpopular – the price in the past 12 months has gone from $4 to below $3 a share. This is due to falling fertiliser prices, poor plant reliability, and then the CEO stepped down just two months ago,” said Hendricks.

“What we see is Incitec Pivot offering up an uncomfortable cyclical opportunity. The company is radically simplifying – what you are going to be left with is a pure play explosives business and this is where it get really interesting.

“There is a very large shortfall in the amount of explosive available in the Australian market. The explosives business has gone through 10 years of underperformance, and we think it is a really great opportunity to buy an unpopular stock.”

Blake also got in deep pan on Domino’s Pizza (ASX: DMP).

“Domino’s went from being a huge Covid winner to a big inflation loser,” he said.

“Inflation absolutely ravaged Domino’s – their food costs went up, their labour costs went up, they then tried to push prices up, but they did it in a very clunky way – and customers started leaving, so they faced seven downgrades in two years.

“Domino’s over time makes money when they sell more pizza, they sell more pizza by rolling out stores. They’ve gone from 500 stores in 2010 to 3,800 today. Even in the toughest year, last year, they increased their stores 6%.

“Domino’s has a delivery focused model with small format stores. It’s cheap to roll them out. You can probably roll them out in Australia today for about $500,000 and they typically pay back in about four years.

“So, for a franchisee this is a great investment. It is a rare proven franchise.

“We see store growth being able to average about 7% per annum. Each store does a little bit better every day – 3% per year. So you’re talking about a business that can grow its revenue at 10% and its earnings even higher.

“These inflation headwinds in Domino’s have created an investment opportunity.”

Solaris Investment Management: Cochlear (ASX:COH) and Altium (ASX:ALU)

Solaris is a Brisbane-based bottom-up, fundamental active Australian Equities Fund Manager.

Chief investment officer Michael Bell discussed how long-term quality earnings drive share prices and Solaris believes that’s the key to investing.

Bell went for Cochlear (ASX: COH) and Altium (ASX: ATL) as two stocks to watch in the year ahead.

“Altium does software for printer circuit boards and Cochlear does the ear implants,” said Bell.

“Both companies are strong leaders in their industry with strong pricing power. They both have good balance sheets and good management and they both had a history of strong revenue growth and earnings growth and we expect that to continue going forward.

“Those two companies have shown over time that they have very strong earnings quality… That is really important and that gives us the confidence to invest in these companies.

“So, what is the bottom line? Earning drives share prices in the long term. Quality earnings drives share prices but as a fundamental manager you need to do the work particularly in those factors that are told to you by management.”

Spheria Asset Management:Supply Network (ASX:SNL)

Spheria are specialists in smaller companies – micro, small, and mid cap Australian funds.

The company portfolio manager Marcus Burns highlighted at the Summit was Supply Network (ASX: SNL)

“We think that the ‘economic’ laws of gravity will reassert over time. We think there will be a massive convergence over time in terms of performance we’ve seen between large and small caps,” noted Burns.

“Supply Network is like a Bapcor (ASX:BAP) for truck and bus parts. So, they supply independent mechanics with bus parts and truck parts and they’ve achieved an incredible rate of return since 2009.

“We compare the underlying free cash flow with reported EBIT. This keeps us out of trouble because we can really start to see where there’s accounting anomalies and we like businesses with a high cash flow conversion.

“Supply Network has a cash conversion rate of 66% over last 20 years and all that excess cash has been going back into working capital – an inventory as it grows, of business.

“The return on capital for Supply Network has actually expanded over time so as they deploy money the network effect is making the business more valuable and they’re getting incrementally higher rates of return – which is pretty, pretty rare.

“You put more dollars down, rates of return usually go sideways or down – but this business is seeing increasing rate of return which is pretty incredible and that business can be acquired for 22 times PE.”

Longwave Capital: Nanosonics (ASX:NAN) and CSR (ASX:CSR)

Longwave are a quality focused Investment Manager focussing on small caps. The firm’s approach combines human insight with information technology.

Chief investment officer, David Wanis, named Nanosonics (ASX:NAN) and CSR (ASX:CSR) as two stocks to watch.

“Nanosonics is a small-cap medical device company that specialise in disinfection of hospital devices,” said Wanis.

“The Trophon device is ‘their flagship’ product and that’s involved in disinfecting ultrasound probes in the hospital setting.

“It’s a classic razor and razor blade business model.

“Nanosonics sell the machine to the hospital but every year they’re selling consumables into that installed device. So over time they’ve had this very rapidly growing revenue base – product and consumables – that is recurring.

“This de-rating we are seeing of all stocks in small caps has presented opportunities to us in the repricing of high quality businesses.

“With Nanosonics we’re seeing an EBIT to sales multiple that approached 20 times now down closer to five times. Is that good value? Well, as part of their latest results Nanosonics disclosed the divisional profit of their Trophon product and that gives us some more insight.

“With Trophon we can now see that in two years’ time that business should earn about $70 million of EBIT. The company have said it’s likely to earn $50 million next year and on that basis we’re paying 16 times EBIT for Nanosonics against 31 times for Cochlear and 27 times for Fisher & Paykel Healthcare- FPH (ASX:)

“So high quality business, changing market sentiment, and evaluation opportunity relative to large caps that’s quite compelling.”

David added the following on CSR:

“CSR is a business that everyone knows but often the history of knowledge can weigh us down with what a company used to be,” he said.

“CSR, along with Boral, Fletcher Building, Brickworks, James Hardy, for many years, they operated in intensely competitive undifferentiated market segments. The result was low and volatile returns – they just weren’t great businesses – they had competition internally and competition from imports.

“Over the past two decades CSR have divested out of bulk concrete, out of glass, and they now have just a small position in aluminium.

“They’ve focused their business in building product categories where they’re either number one or number two in highly consolidated markets with very little competition.

“That results in an increase, a dramatic increase, in the return on capital in this focused business that they’re left with.

“CSR often sits with another group of stocks we look at in the market that are in a blind spot. It’s too small for a lot of large-cap investors and it’s not exciting enough for a lot of small-cap investors – who are trying to find the next lithium stock or the next Afterpay.

“So CSR’s a really interesting opportunity for us where we believe it’s a high quality business trading at less than 10 times earnings and often in a market that’s overlooked in our part of the universe.”

Langdon Equity Partners: Did a vid

Finally, being one of the more multi-financial media titles you’re ever likely to watch a random video of last week’s live (not so much now) interview with founder & lead investor at Langdon Equity Partners, Greg Dean, recorded for the Pinnacle Investment Summit 2023 in August, 2023.

All about the global small cap landscape and outlook:

The views, information, or opinions expressed in the interviews in this article are solely those of the interviewee and do not represent the views of Stockhead. Stockhead does not provide, endorse or otherwise assume responsibility for any financial product advice contained in this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.