Are Aussie stocks immune to the tech wreck led selloff? Here’s what fundie T. Rowe Price has to say

T.Rowe Price talks about how Aussie stocks will sail amid a selloff globally. Picture Getty Image

- In 2022, the US S&P 500 index has had its worst start since 1970

- Tech stocks have driven most of the selloff

- T. Rowe Price’s Head Australian of Equities explains why Aussie investors should be cautious

On May 20, the US S&P 500 index officially tipped into bear market territory – defined as a 20% fall from the most recent high.

On that day, the index fell to 3,810, a 21% drop from its 52-week high of 4,818 set in January.

Despite a 6% rebound last week, it’s been the worst start for the S&P 500 in any year on Wall Street since 1970.

With its exposure to the world’s largest tech companies, the US stock market has largely taken the brunt of investor selloff amid a flight to safety.

‘Tech Wreck’

According to Morningstar US analyst, Tom Lauricella, investors looking for the culprit can quite reasonably point to technology stocks as the source of their pain.

“It’s been a remarkable turn of events, with shareholders of the most dominant, innovative companies on the planet suffering losses of 30% or 40% in the span of just a few months,” he added.

Meta is down by 42% in 2022, Google by 22%, and Netflix has plunged by 67% so far this year.

“While the numbers around the tech stock losses are eye-popping, there’s an argument to be made that there are good reasons for their fall,” said Lauricella.

He said the key for investors is to play the long game, and use these kind of pullbacks as an opportunity to buy into some good companies.

“And as dramatic as the declines have been, it’s important for investors to look longer term at the market’s returns,” Lauricella explained.

“This may end up being a very, very bad year. But 2019, 2020, and 2021 were very, very good years.”

Where’s the ASX heading?

The Aussie market meanwhile, with its greater exposure to the Resources and Financials sector, has remained relatively resilient amid the sell-off.

At the time of writing, the ASX 200 is down only 4% for the year.

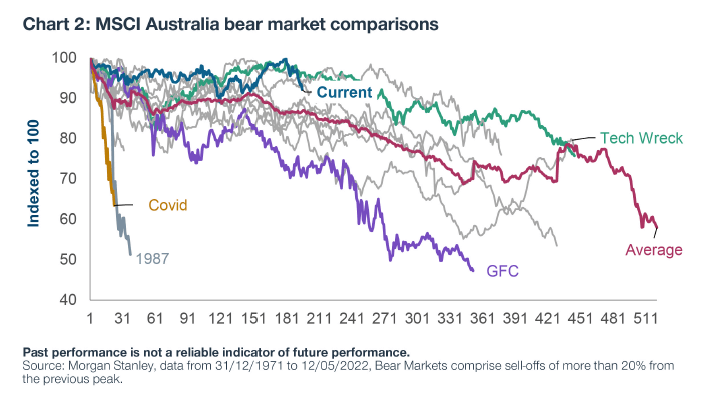

“Yet if history is a guide, we are likely in the early innings of a local bear market,” said Randal Jenneke, head of Australian Equities and portfolio manager at T. Rowe Price.

The chart indeed spells more trouble ahead for the ASX.

According to Jenneke, the most crucial metric going forward that will dictate the direction of the ASX is earnings.

“Earnings expectations have held up well globally, however we believe they are not pricing the full extent of the cyclical risk ahead,” he said, adding that markets remain vulnerable to weaker earnings.

“Higher costs and weaker demand are not a good cocktail for valuations in the near term.”

Jenneke believes that quality names (those higher profitability companies with lower earnings volatility and strong balance sheets) will perform well amid rising costs.

“We don’t believe there will be a clear winner in the growth vs value battle in this environment,” Jenneke said.

“The periods of decade-long rotations are likely behind us.

“As are the days where overoptimistic stories alone could drive extreme valuation re-ratings – earnings and fundamentals will be the focus in the bear market arena,” he said.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.