5 charts that show how the investing landscape has changed

Pic: Getty Images

- Dominant macro themes, including the restructuring of global trade, national security and geopolitical risk, and the energy transition will shape markets

- Inflation is cyclical and structural and both are in play today

- Investors will need to balance short-term and longer-term structural trends to preserve capital and extract return opportunities

Following the pandemic recovery, markets have been burdened with the task of ‘normalising’ from unprecedented levels of monetary and fiscal support.

Finding natural market pricing after the COVID-driven distortions of the past two years is unlikely to be an orderly process, particularly given the very different world we find ourselves in today.

Jay Sivapalan, head of Australian fixed interest at Janus Henderson, says dominant macroeconomic themes must be incorporated into investment decisions going forward, rather than assuming a return to pre-pandemic norms.

In this article, Sivapalan discusses key themes to watch, the risks and opportunities within fixed interest and how investors can navigate the path ahead.

The ‘big picture’ themes

Trading blocs or de-globalisation

Investors have been able to make certain assumptions when pricing assets due to the stable state of global trade over the past four decades.

But in recent years, while events such as Brexit and the US/China trade wars have led to the growing view that markets are de-globalising, Sivapalan says Janus Henderson believes rather than the start of de-globalisation, we have been witnessing the re-arrangement of global trade into like-minded trading, security, and defence blocs.

The TPP is the Trans-Pacific Partnership, NAFTA is the North American Free Trade Agreement, and T-TIP is the Transatlantic Trade and Investment Partnership.

“We see two main groups emerging – democratic, capitalist developed nations along with their aligned developing partner nations, and socialist, communist nations with their developing nation peers,” he said.

“Recent geopolitical events, such as the West’s condemnation and sanctions due to Russia’s invasion of Ukraine have provided a glimpse into these alliances in action.

“While we see the global economy heading towards these trading blocks, where raw materials or efficiency is too hard or too costly to substitute, we expect trade to continue across economic block lines thereby limiting the economic impact.”

Nationalisation or national security?

Again, given the relative peace and stability experience over the past 70 years, markets have been able to make certain assumptions when pricing assets.

But today, assertive action from Russia and China aimed at challenging the US’ status as ultimate superpower is becoming more commonplace.

“The pandemic laid bare the vulnerabilities of nations to supply dislocations and weaknesses in their manufacturing sectors (domestic mask manufacturing are a case in point) when cut off from the rest of the world,” Sivapalan said.

“We believe that rather than nationalism, economies are more likely to pursue national resilience and security, while remaining open to trade with chosen trading partners.”

Energy transition: A cost burden or benefit?

The transition to renewable energy and targeting net zero emissions is likely to give rise to both opportunities and threats for investors.

Risks range from physical asset risk, stranded asset risk and revenue loss risks, while the potential opportunities resulting from this multi-trillion dollar, long-term investment thematic are broad and include initiatives related to green hydrogen, solar, wind, hydro power generation, battery storage and the infrastructure required to enable the electrification of the economy.

Cyclical inflation

Supply side inflation has been exacerbated by “a global economy that froze during the pandemic” and has since been trying to get back on its feet with soaring energy prices and supply dislocations across multiple items such as semiconductors, shipping containers, pallets and building materials.

On the other hand, demand-side inflation has varied considerably, Sivapalan says.

In countries such as the US, higher supply prices are passed on by producers to consumers, whereas in Australia there is mounting evidence of the coming wages inflation led by consumer prices, albeit lower than some other economies.

“Exceptionally strong economic growth typically comes with some growing pains,” Sivapalan explains.

“In our assessment, inflation is likely to be higher than most expect in the near-term, is likely to be sticky and eventually moderating at a higher level.

“Nevertheless, in our view, economies are in the eye of the storm from a cyclical perspective at present, but this should subside over time.”

Structural inflation

Many of the prior considerations for structural inflation, including excess savings, an ageing population, high debt levels and technological disruption have not disappeared, Sivapalan says.

“Markets previously ran with the theme of ‘Japanification’ and deflation, which sat at odds with our assessment despite being in agreement about many of the underlying currents.

“The flaw in that thought process was to not properly distinguish between an economy like Japan with other countries like Australia where aspects such as net migration and rising female participation more than offsets the ageing population issue in terms of supply side estimates of GDP growth,” he said.

It is important to take a balanced view about the future structural inflation and not to assume it is a given over the long-term.

Managing portfolios through inflation

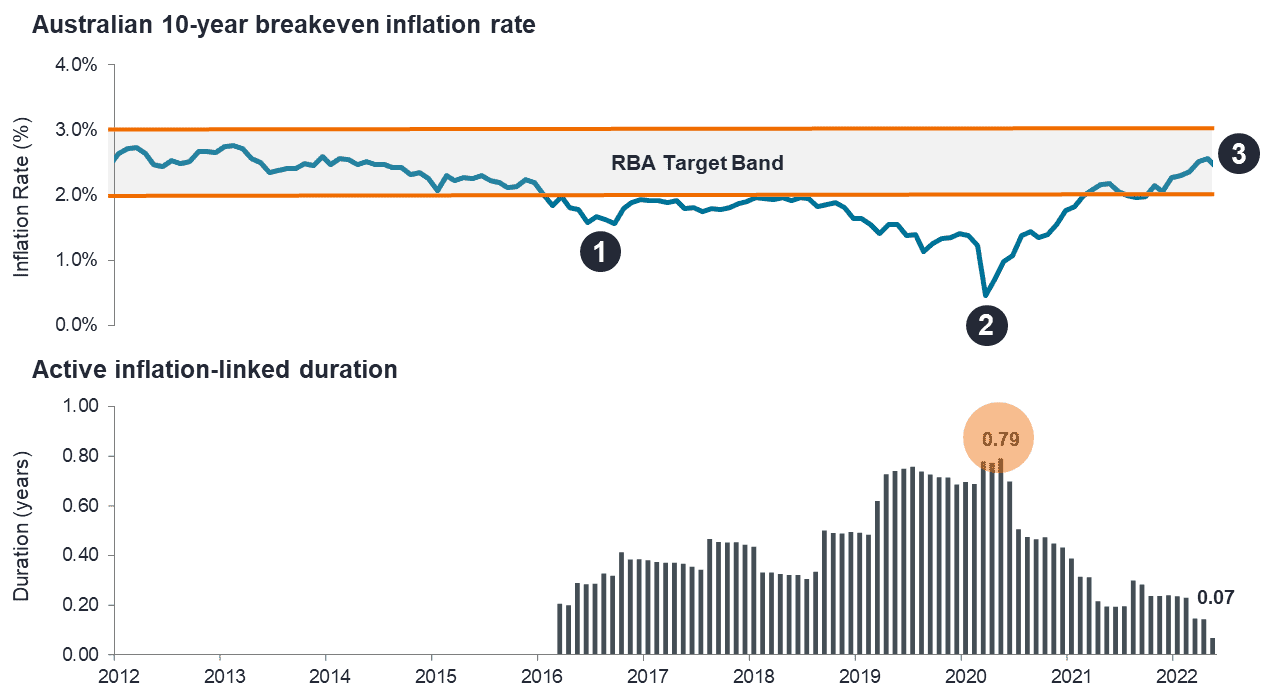

Sivapalan says it is important for investors to consider whether the pricing of inflation protection by the market, implied by breakeven rates, are cheap, reasonable or expensive.

“In our view, investors in 2020 were being paid to take inflation protection, in 2022 the cost of inflation protection is relatively cheap and we expect this will become expensive in 2022,” he said.

“Taking active views on inflation will offer opportunities to add value in portfolios.”

Bonds: Risks and opportunities today

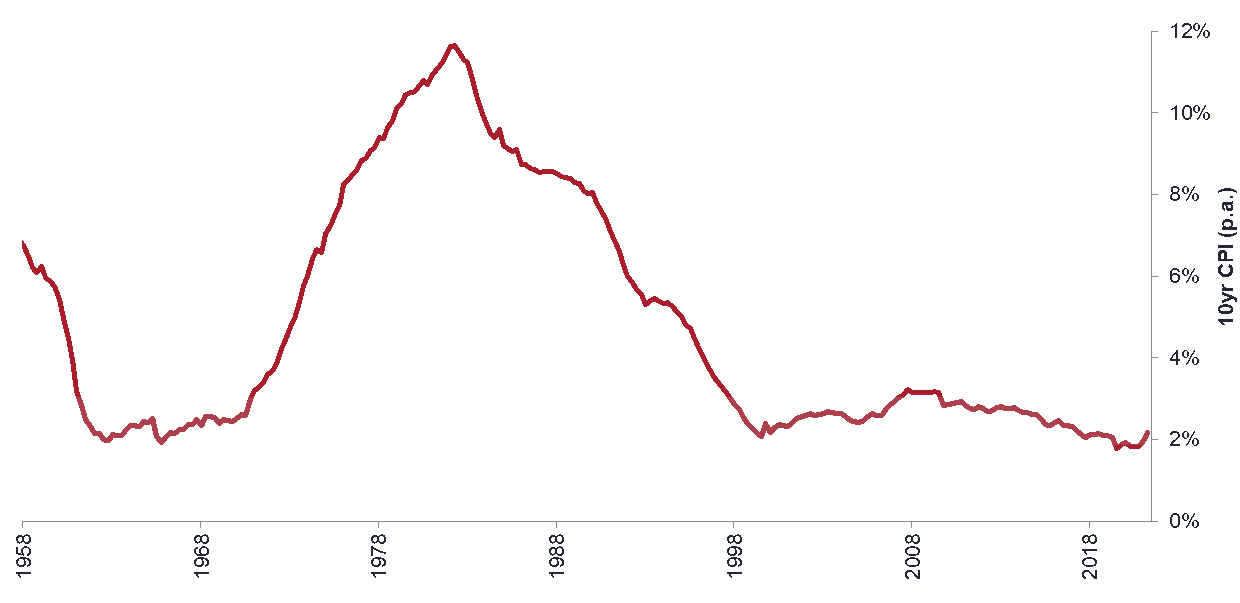

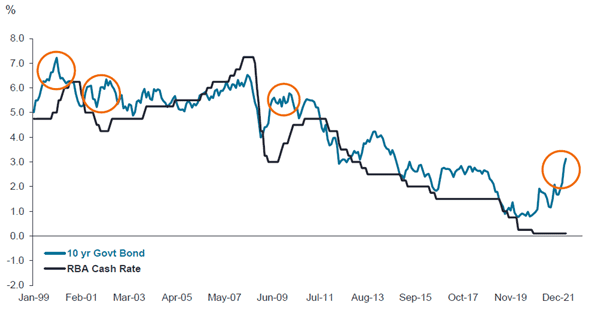

While bond yields have been a one-way journey over the past 40 years, declining from more than 10% to a low of close to zero, Sivapalan says over the past four decades, fixed interest has delivered returns well in excess of the coupon (income), with capital gains boosting returns.

In short, a lot of returns were brought forward as yields reached extreme lows during the pandemic, he says.

“The key questions for investors are what ‘normal’ looks like for bond yields, how much they have already re-priced and how quickly they will get back to normal.

“In our view, the first three of the past four decades was bond yields normalising (falling) following a period of extraordinarily high inflation, back towards the 100-year average.

“However, the past decade has seen excessive use of unconventional monetary policy by central banks and in our view, these actions pushed yields well below ‘normal’.”

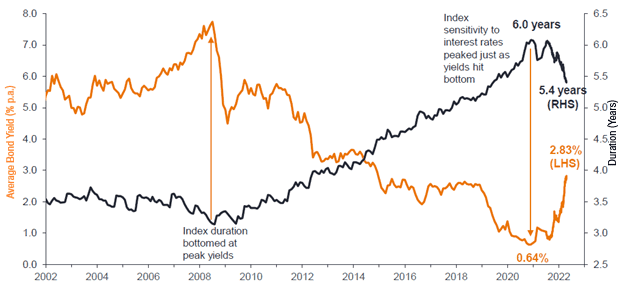

Most recently, we have witnessed a sharp reversal of the extreme valuations of bond markets globally.

Combined with the fact that the duration of bond markets was elevated from longer tenor supply, Sivapalan says this provided the perfect storm, with double digit negative returns from the asset class.

With markets having priced in 350bps of cash rate hikes in April by the RBA over the next 18 months, coupled with high levels of household debt, elevated house prices and a housing construction sector reliant on the healthy the state of household wealth, Sivapalan expects a dramatic slowdown in the Australian economy.

“We expect this not to be driven by defaults and financial stability concerns, but rather significantly lower consumption and economic growth,” he said.

From his point of view, the RBA will normalise policy swiftly in the initial stages, but take feedback from the economy and be more measured and drawn-out in the latter stages of this tightening cycle.

“Conventional thinking would favour short duration or defensive strategies, yet amongst the volatility lies some great targeted investment opportunities by taking both interest rate and spread risk within specific parts of the yield curve,” he said.

“An opportunity exists for investors to effectively ‘lock in’ the elevated yields in markets today that are unlikely to be delivered by the RBA over the next 12-24 months.”

All in all, there is still a journey ahead in the pandemic recovery and while it will neither be smooth or easily predictable, Sivapalan says careful analysis will be vital in navigating the risks and identifying the many opportunities that will emerge.

The views, information, or opinions expressed in the interviews in this article are solely those of the interviewee and do not represent the views of Stockhead.

Stockhead does not provide, endorse or otherwise assume responsibility for any financial product advice contained in this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.