4 pizzas and a funeral: Here’s a 2023 Australian retail outlook where Kogan is no longer what the cat dragged out

Getty Images

- Aussie retail forecast to weaken next year with higher rates and living costs

- Online retailer KGN a top pick of Morningstar with upside for servicing plays like Domino’s

- Demand for furniture, home appliances, consumer electronics et al expected to return in FY23

Australia’s retail sales are set to weaken in the next six months, according to Morningstar gun Johannes Faul, offering some hard truths in his latest opus Australian Retailing: Fourth-Quarter 2022 report.

Morningstar’s director of equity research, Faul reckons that despite the RBA’s best efforts to clip the Aussie economy, consumer spending is holding up… for now.

“Some people will be pulling back [on spending] while others are still spending like crazy, but on average people are spending like crazy,” he says.

“(But) aggressive rate hikes could see retail spending soften near-term.”

Morningstar believes the record high levels of household savings have allowed Australian consumers to continue spending in a higher interest rate environment.

In 2020, the saving ratio for Australian households increased from 9.7% in March to 23.7% in the June quarter.

While currently, Australians are still consuming more than before the pandemic, Faul anticipates goods and services consumption to structurally revert to pre-COVID-19 norms.

“Aggressive rate hikes could see retail spending soften near-term,” Faul wrote.

He says the rising cost of living pressures – like rampant food price inflation and rent increases – are also beginning to bite.

“Australians with limited budgets are likely to prioritise consumer staples like food and liquor over discretionary goods such as consumer electronics and sporting goods. “

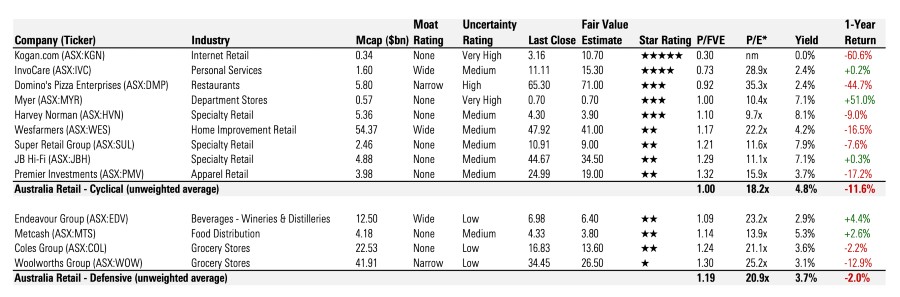

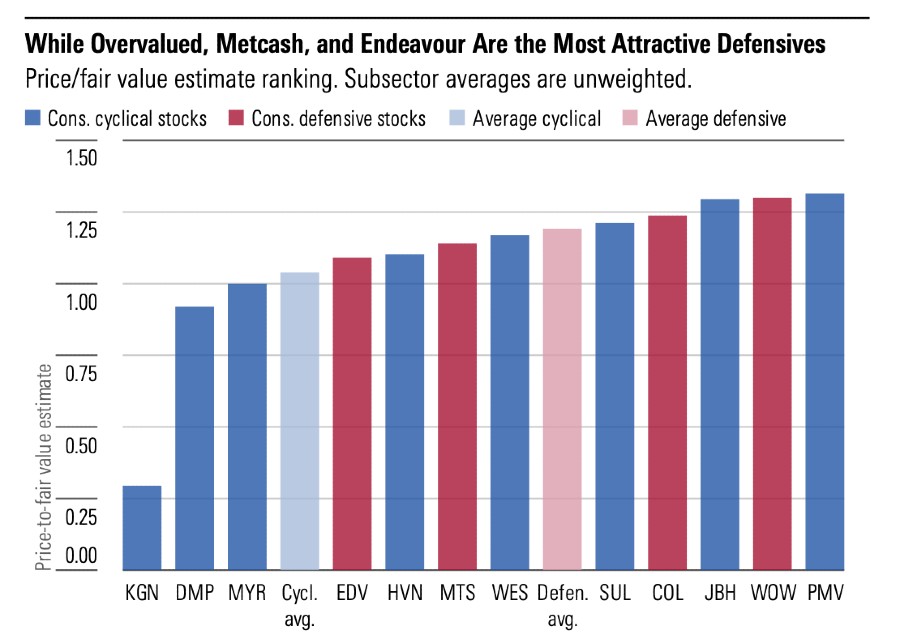

In their hunt for yield, investors bid up the PE ratios of the most reliable income stocks in the defensive retail sector while interest rates were ultra low.

The current monetary tightening cycle could prompt investors to reconsider and seek higher dividend yields from defensive consumer staples stocks like Coles (ASX:COL), Endeavour (ASX:EDV), Metcash (ASX:MTS) and Woolworths (ASX:WOW).

While slightly overvalued, Faul believes Endeavour offers investors seeking exposure to staples retailing the most appealing value.

Christmas joy for troubled Kogan

And some Christmas goodies await the online retailer Kogan (ASX:KGN), which has endured a tough 2022 – going from pandemic panther to one of the years most obscenely shorted stocks on the ASX.

KGN delivered a messy, full-year loss of more than $35 million and has had to watch its previously beautiful share price tumble ~63% year to date.

Kogan, which sells everything from clothes, furnitures, electrical items, credit cards, insurance and pet gear, will no doubt be pleased to hear it has the support of Morningstar.

“Some discretionary retailers screen as attractive, including our top pick Kogan,” Faul noted.

Morningstar expects negligible e-commerce growth in fiscal 2023 and high-single digits long-term in the Australian retail outlook.

“While much lower than the 33% CAGR for the three years to fiscal 2022, we predict e-commerce to meaningfully outperform brick-and-mortar retailing long-term,” Faul wrote.

He believes Kogan is well placed to benefit from the structural shift away from physical stores.

“Similarly, we believe wide-moat Amazon’s long-term growth to be underpinned by e-commerce proliferation in the US, despite high inflation hurting consumers near term.”

Pizza and Funerals

We think there is upside for some service-exposed businesses like restaurants, including Domino’s Pizza Enterprises (ASX:DMP).

Although not a retailer as such Morningstar said funeral provider InvoCare (ASX:IVC) is also set to benefit from a reallocation of spending to services and is one of its top picks in the consumer cyclical sector.

We see the greatest risk of softening sales in categories with still-elevated consumer demand like recreational goods, household goods, and apparel.

Cyclical retailers screening as overvalued include Super Retail (ASX:SUL), JB Hi-Fi (ASX:JBH), Wesfarmers (ASX:WES) and Premier Investments (ASX:PMV).

Rising bond yield could change steady dividends

Faul noted consumer defensive stocks screen as more overvalued than consumer cyclical stocks on average. He said in the low interest rate environment, most reliable dividend stocks in the retail sector have tended to trade at a premium.

“However, rising bond yields could prompt investors to reconsider and demand higher dividend yields from defensive consumer staples stocks like Coles, Endeavour, and Woolworths,” he wrote.

“We expect demand for apparel and household goods to moderate and have a more cautious outlook on Premier and JB Hi-Fi than the market.”

Move from retail to services spending

In October 2022, absolute retail sales declined for the first time since December 2021. Faul expects total Australian retail spending to grow by only 2% in in nominal terms in FY23.

While lockdowns altered consumer spending patterns, shifting a greater share of consumption to goods from services Faul forecasts this may change with a fall in real income.

“We anticipate temporarily falling real income to prompt households to spend less on goods relative to services, exaggerated by increasing mortgages gradually coming off fixed rates in calendar 2023,” he wrote.

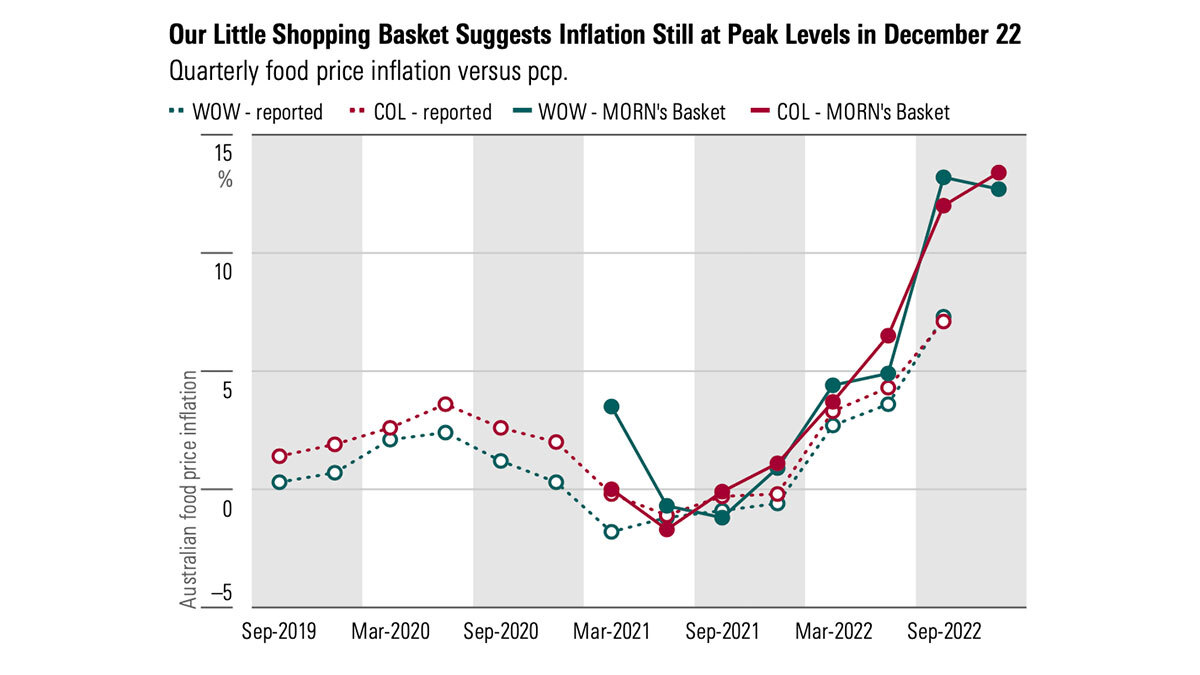

Supermarket shop to keep rising in 2023

Faul forecasts higher food prices to drive first-half fiscal 2023 Australian supermarkets sales growth despite post-pandemic volumes normalising and customers shifting to cheaper alternatives.

“However, the market could be overestimating the positive impact of food price inflation on supermarket earnings,” he wrote

“We forecast Coles and Woolworths cost of doing business to increase by more than sales—mostly due to higher wages—and constrain EBIT margins.”

While Coles sales growth has mostly underperformed to Woolworths despite Morningstar’s estimates of slightly cheaper shelf prices, Faul thinks this could change as more consumers return to shopping malls and centres where it has a greater exposure.

Other key points worth noting include:

- High demand for furniture, home appliances and consumer electronics expected to normalise in FY23 with only flat sales year on year

- Expect spending in apparel to slow to 3% in FY23 with Premier Investments and Myer (ASX:MYR) exposed to the sector

- Recreational, home office goods still in demand despite reopening but set to normalise with Super Retail Group’s sales reported to decline by 6% in FY23

Jobs and cash for rainy day may be saviour

Australia’s higher savings rate and low unemployment could prove a saviour during economic turbulence. The savings rate averaged 14% between March quarter 2020 and September-quarter 2022, well above the 6% long-term average, while Australia’s unemployment rate in October remained low at 3.4%.

“We estimate consumers accumulated some $250 billion in additional savings during the period,” Faul wrote.

“This reserve, together with the lowest unemployment rate since 1974, can support household consumption through a temporary period of declining real income.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.