The Ethical Investor: ‘Use every weapon at our disposal’ as Bitcoin now seen as one solution to climate change

Analysts say that Bitcoin could be the solution to climate change. Picture Getty

- Bitcoin used to be the poster bad boy for climate change

- But now, analysts say that Bitcoin could be the solution to climate change

- Bitcoin whales could also increase investment into renewables

Bitcoin used to get a bad rap for exacerbating the problem of climate change.

A report in 2022 suggested that “Bitcoin mining may be responsible for 65.4 megatonnes of CO2 per year”, and 0.1% of world greenhouse gas emissions.

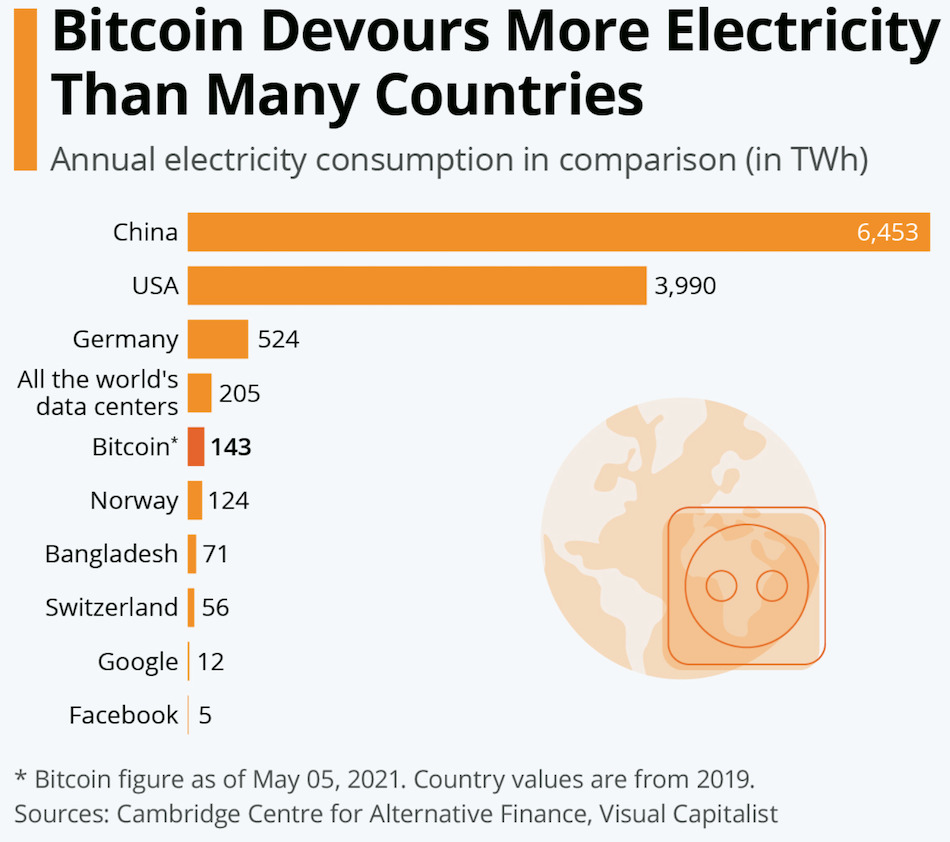

The argument was that Bitcoin miners used a massive amount of electricity, using energy sources that are often traced back to fossil fuels.

Another study indicated that Bitcoin emissions alone could push global warming beyond 2°C in less than three decades.

The White House had even chimed in, saying that mining Bitcoin could impede US efforts to combat climate change, while Elon Musk said that Tesla would not be accepting Bitcoin payments anymore.

Tesla & Bitcoin pic.twitter.com/YSswJmVZhP

— Elon Musk (@elonmusk) May 12, 2021

But in recent months, analysts have been taking a softer approach and even making a radical about-face in their assessment of BTC.

Some now claim that the digital coin could instead help mitigate the climate change emergency.

These new claims come as swathes of the northern hemisphere experience extreme heatwaves, with temperatures breaking records worldwide.

Nigel Green of the deVere Group believes that amidst this global climate change emergency, Bitcoin is emerging as a surprising contender for a potential solution.

“Contrary to belief in some quarters, this revolutionary digital currency has the capacity to drive positive change and aid in the fight against climate change,” Green said.

He argued that Bitcoin is positioned to play a crucial role in transitioning to a more sustainable and eco-friendly future.

“An often-overlooked point is that Bitcoin mining could speed up the transition from fossil fuels to renewables.

“Bitcoin miners, who need huge amounts of energy, could act as major buyers of last resort, providing substantial profit for investment and expansion.

“This would then enhance the renewables supply, which would go on to bring down prices for consumers and further drive demand,” said Green.

Can Bitcoin follow in Ethereum’s footsteps?

Some experts also postulate that Ethereum’s recent switch from Proof of Work to a Proof of Stake (PoS) mechanism (called The Merge) will be a game changer for the planet.

The Merge is predicted to slash Ethereum’s energy consumption by a whopping 99.95% – a huge outcome given the Ethereum network was previously estimated to use as much electricity annually as the country of Bangladesh.

People are now calling for Bitcoin to follow in Ethereum’s footsteps given that there is no technical obstacle to switching BTC to Proof of Stake.

“It’s time Bitcoin and its biggest investors take similar steps to reduce its heavy reliance on dirty electric grids and cheap fossil fuel energy sources – or risk being the cryptocurrency of the past,” said Ken Cook, president of the Environmental Working Group.

Bitcoin activists have hit back, saying that more than 50% of all Bitcoin mining is already using renewable energy for its power needs.

According to research by ESG analyst and investor Daniel Batten, hydropower makes up 23.12% of all energy used in BTC mining, while wind accounts for 13.98%, nuclear 7.94%, and solar 4.98%. Meanwhile, roughly 43% of all energy used in Bitcoin mining is still generated via gas and coal.

“Clearly, clean energy is the way forward, but their sources are sometimes irregular and there’s not enough storage capacity for when these sources generate excess energy,” said Green.

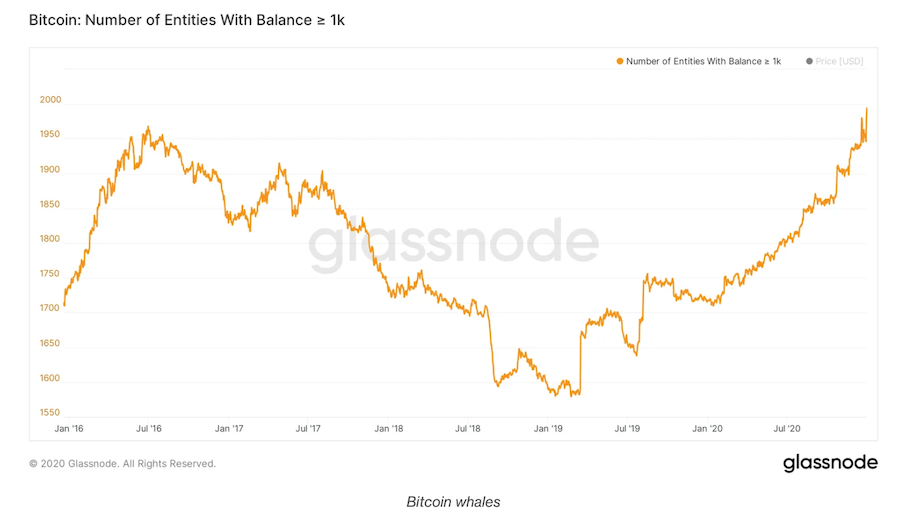

Bitcoin whales could drive renewable investments

Meanwhile, Bitcoin’s rise in popularity has resulted in wealth accumulation for early adopters and cryptocurrency enthusiasts.

Many individuals within this community are leveraging their newfound wealth to fund sustainable projects and initiatives.

“This philanthropic approach can lead to significant investments in renewable energy, clean technology, and other climate change mitigation efforts,” noted Green.

Chart showing the number of wallets with more than 1,000 BTC has increased:

Green also stressed the promotion of financial inclusion.

“Bitcoin has the potential to enhance financial inclusion for underserved populations around the world.

“By providing individuals with access to digital currencies and blockchain-based financial services, Bitcoin can empower the unbanked and foster economic growth in marginalised communities,” he said.

This increased access to financial resources could in turn enable individuals to invest in sustainable practices and contribute to climate change mitigation.

While no monetary system or investment is perfect, and the crypto ecosystem can still improve in many ways, Green said that the argument that digital currencies cannot necessarily form part of a climate change mitigation strategy does not stand-up to scrutiny.

“Indeed, as the emergency intensifies, we must use every weapon at our disposal to fight it – and Bitcoin is one of them.”

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.