The Ethical Investor: Implied Temperature Rise soon to be published alongside fund returns. So what is it?

Implied Temperature Rise or ITR could soon be published in funds returns. Picture Getty

- Implied Temperature Rise or ITR could soon be published in funds returns

- What is ITR and how do we calculate it?

- And are ASX companies on track to meet net zero?

You’ve heard of the acronyms ROE, NPAT, and EBIDTA.

But what about ITR?

It’s the latest addition to the alphabet soup of modern finance, and stands for Implied Temperature Rise.

ITR basically assesses a company’s projected carbon dioxide emissions against global temperature goals, specifically, the 2015 Paris Agreement’s goal of limiting global warming to well below 2C of pre-industrial levels. It helps investors compare companies’ progress toward their net-zero targets.

Giant investment managers like Blackrock, Fidelity and and Invesco have adopted and published ITR scores for some of their funds.

For example, Bloomberg Green reports that Invesco’s High Yield Fund UK has published an ITR of 3.7C, while various Fidelity International funds reported an ITR range of between 3.2C to 6C.

So how is an ITR value arrived at?

While there are several ways to compute it, in simple terms, the model uses a company’s current emissions and future decarbonisation targets to calculate its long term temperature trajectory.

Designed by research firm MSCI, the model then assesses whether that trajectory could keep within the firm’s carbon target based on its revenue and sector.

You can extrapolate the model to funds and indexes, which is what MSCI has done recently.

By taking the ITR scores of individual companies, an ITR score can be arrived at for funds and indexes by computing the average across the portfolio of companies.

MSCI Research explained that its methodology involves comparing the “current and projected greenhouse gas emissions of nearly every publicly listed company across all emissions scopes (based on the company’s track record and stated reduction targets), versus its share of the remaining global carbon budget for keeping warming this century well below 2°C.”

A company projected to emit carbon below budget can be said to “undershoot” the budget; while a company projected to exceed the budget “overshoots” it.

Implied Temperature Rise then converts the overshoot or undershoot to an implied rise in average global temperatures this century, expressed in degrees Celsius (°C).

An implied temperature of 1.5°C, for instance, indicates that a company is projected to remain within its share of a carbon budget that would keep warming this century to 1.5°C.

An implied temperature of 2.5°C or 3°C, in contrast, would show that the company’s emissions align with temperatures that keep rising, bringing greater harms.

What is Carbon Budget, and how it impacts ITR score

The key to understanding the Implied Temperature Rise is the concept of a Carbon Budget.

Carbon Budget basically refers to how much the world can emit and, by extension, how much a company can emit (across Scopes 1, 2 and 3) and remain within the limitations required to meet a 2°C warming scenario by 2100.

Like a household budget, a carbon budget sets the amount of greenhouse gases that can be ‘spent’ (emitted) for a given level of global warming. If we exceed this budget, global temperatures will become higher.

The world is on a budget because current global warming of about 1°C is causing significant changes in the Earth’s climate, while a warming of more than 2°C could result in a catastrophe.

According to the latest climate data, the baseline carbon budget for the 1.5°C target is 740 Gt C, assuming that we want at least a 66% chance of meeting this target.

Historical emissions of 585 Gt C already ‘spent’ must be subtracted from the baseline budget. The cost of not reducing the other GHGs and the cost of carbon cycle feedbacks also need to be adjusted in order to be compatible with a 1.5°C target.

Using a simple linear adjustment, these allowances are 155 Gt C and 55 Gt C, respectively.

This leaves a remaining global carbon budget of -55 Gt C at present.

Most ASX companies are way behind target

Sadly, a recent report by Morningstar’s Erica Hall suggests that no Australian-listed company is on track to reach net zero by 2050.

“Despite many companies pledging to decarbonise their businesses and achieve net zero emissions by 2050, current data reveals that we are not projected to make this milestone,” wrote Hall.

Morningstar Sustainalytics has developed its own ITR score through what it calls the Low Carbon Transition Rating.

The company’s research reveals that Qantas (ASX:QAN), a widely held company in investment portfolios, is one of the most severely misaligned, with an ITR of 6.0 degrees.

“Said differently, if all companies managed their greenhouse gas emissions in the same way as Qantas, the world would warm by 6 degrees,” said Hall.

Webjet (ASX:WEB), Whitehaven Coal (ASX:WHC), REA Group (ASX:REA), and Seven Group (ASX:SVW) meanwhile are the most misaligned, according to Morningstar, with ITRs ranging from 6.3 to 6.5 degrees Celsius.

Hall says that typically, indirect emissions (Scope 3) are where the bulk of carbon emissions occur. Depending on the company, they can be as significant as 75% to 90% of all emissions.

“While ever improving, most companies do not yet provide the quality and quantity of data required to properly assess their net-zero progress, particularly when it comes to indirect scope 3 emissions within company supply chains.”

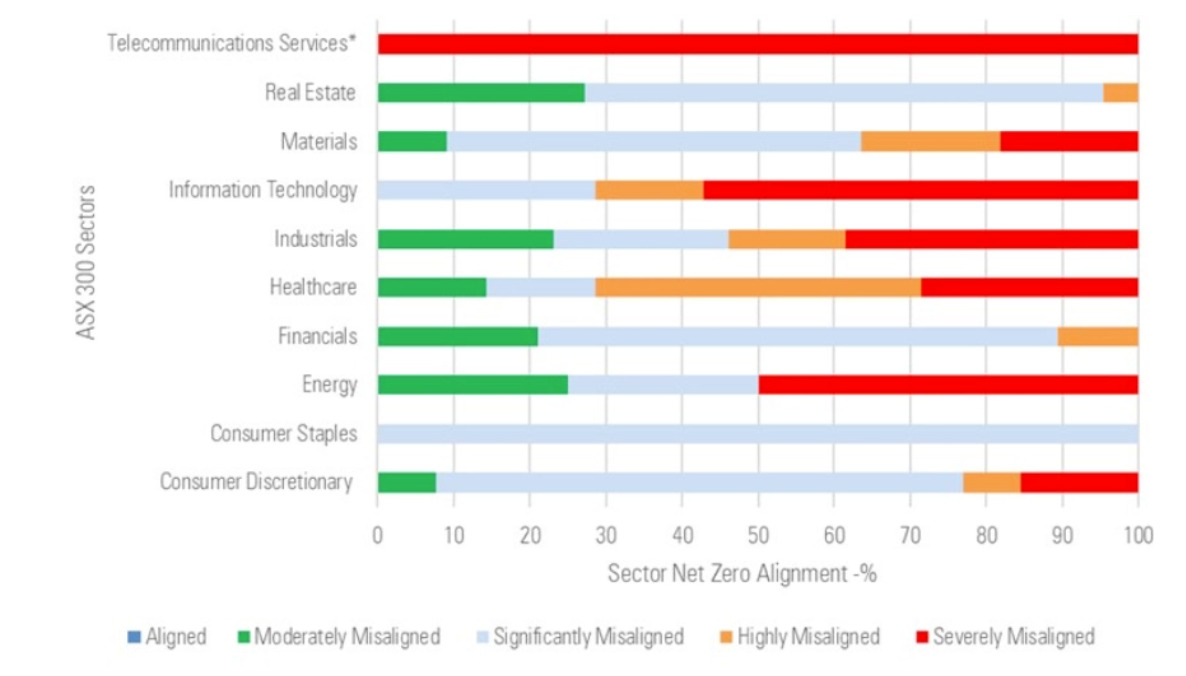

In the table below, Morningstar shows the most aligned and misaligned sectors on the ASX:

Dire warning if we miss 2050 target

The Australian Academy of Science (AAS) meanwhile has issued a dire warning, saying that at 3°C of global warming, many of Australia’s ecological systems would be unrecognisable.

“The decline of Australia’s natural resources would accelerate through changing distributions or loss of thousands of species and disrupted ecological processes such as habitat maintenance,” wrote the ASS in its report.

Declining rainfall will severely impact our food supply through the decimation of agriculture and livestock systems. Fisheries and aquaculture industries will also be impacted by ocean acidification and warming.

Further, close to 90% of Australians living in cities and towns will experience climate change impacts from the perspective of an urban environment, says the AAS.

“The risks of extreme events such as heatwaves, severe storms, major floods, bushfires and coastal inundation from sea level rise continue to increase, and will be more intense and frequent as temperatures exceed 2°C of warming.”

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.