The Ethical Investor: How to research and screen potential ‘ethical stocks’, and some tools you can use

Here’s how to do your own research on ethical investments. Picture Getty

Ethical or responsible investing means not only aiming for profits, but also making sure those profits come from companies and practices that align with your beliefs.

One way to do this is through “negative screening,” where you choose not to invest in companies or industries that go against your values, whether it’s because of environmental issues, social concerns, humanitarian reasons, or animal welfare.

On the flip side, there’s “positive screening,” where you actively invest in areas that you support and believe in, like renewable energy, healthcare, or social enterprises, because you think they’ll give you a good return.

Lastly, there’s “advocacy,” mainly for big investors, where they engage with companies they invest in or want to invest in, pushing for better behaviour or changes that would make those companies fit into ethical investment criteria.

Where do you start?

When it comes to putting your money into ethical investments, investors have several options to choose from.

You can check if your super fund offers ethical choices, or engage a financial adviser who specialises in helping you make informed decisions that align with both your financial goals and your ethics.

If you decide to manage your investments independently, how much you want to focus on ethical investing will determine how easy it is to do.

Doing research here is paramount, especially in understanding how companies handle ESG issues. It’s easier to avoid investing in certain industries like tobacco or coal, but trickier to assess if a company, for example, has questionable labour practices.

And remember, while returns matter, so does risk. The same rules that apply to regular investing also apply to ethical investing.

To start with ethical investing, define your goals and timeframe, then identify the areas you want to support and avoid, and match that with your risk tolerance and return expectations.

How to conduct your own research

Doing your own research and determining whether a company is ethical or sustainable involves assessing various factors.

The first step would be to look for the company’s annual reports, quarterly reports or prospectus and review data and discussions related to their sustainability efforts.

“Does the historical data match up with their claimed efforts to show they are taking measurable actions?” said a note from Green Associates (GA).

“Are there any legal records that show a history of greenwashing or deceptive practices? You can even look at their previous marketing materials to screen for patterns of exaggerated or misleading statements that might indicate a history of greenwashing.”

Then look for certifications or awards related to sustainability and ethical practices, such as Fair Trade certification, LEED certification for buildings, or recognition from industry organisations such as B-Corp.

“What makes the B-Corp certification stand out from others is that it is a holistic assessment with a rigorous certification process as well as requirements to re-certify every 3 years,” said GA.

The next step would be to assess the company’s corporate governance structure, including the composition of its board of directors, transparency in financial reporting, and adherence to ethical business standards.

Dow Jones Sustainability Australia Index

To help you in your research journey, index providers like Dow Jones and MSCI have created indices featuring companies that meet rigorous sustainability standards.

These indices offer valuable guidance for individuals seeking to invest their money responsibly.

For example, the Dow Jones Sustainability Australia (DJSA) Index, introduced in February 2005, represent the top 30% of companies in the ASX200 based on long-term economic, environmental and social criteria.

Companies included in the DJSA Index undergo assessments based on these long term criteria. This evaluation encompasses all industry sectors, from mining to gaming, with the index undergoing annual reviews.

Criteria such as climate change strategies, energy usage, human resource development, knowledge management, stakeholder engagement, and corporate governance are also examined.

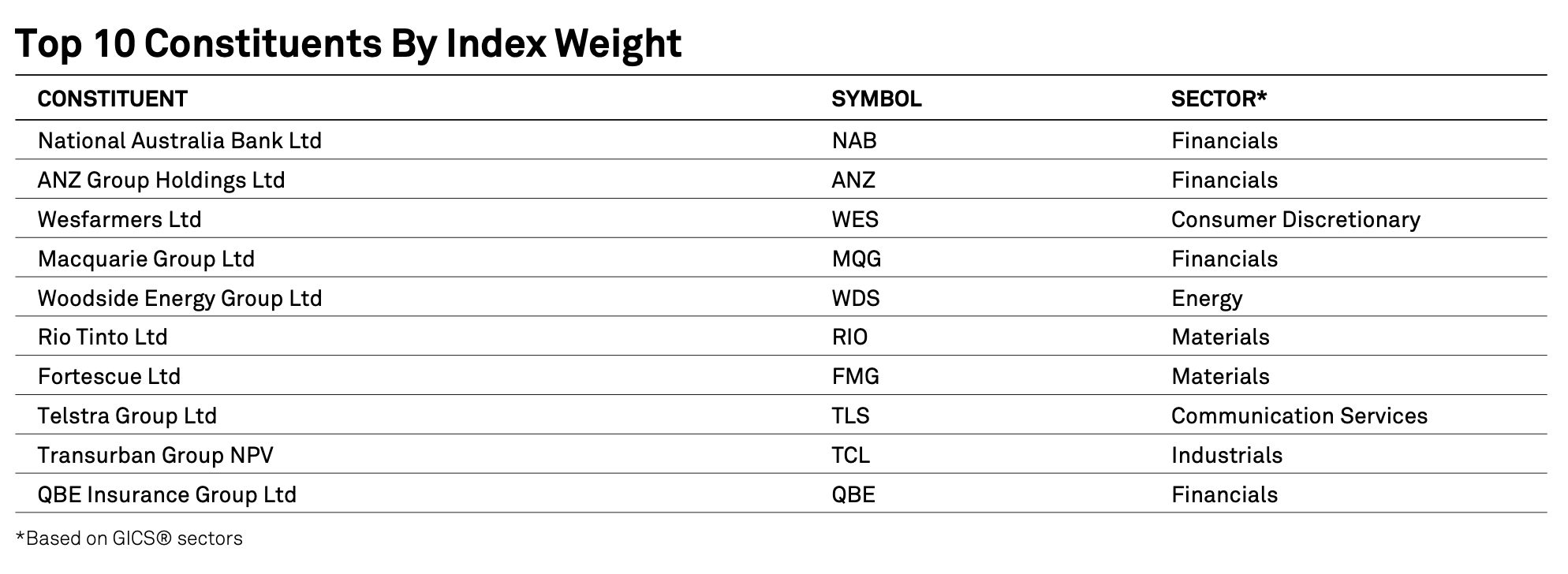

As of 30 April, the top 10 stocks making up the index based on the above criteria were:

Dow Jones Sustainability Australia (DJSA) Index TOP 10

The DSJA Index has returned around 3% over the last 10 years:

Dow Jones Sustainability Australia (DJSA) 10-year chart

MSCI Australia ESG Index

The MSCI Australia ESG Index, on the other hand, aims to represent companies that excel in ESG performance compared to others in their respective sectors.

This Index comprises large and mid-cap companies listed in Australian markets.

The Index’s goal is to provide investors with a comprehensive and diversified sustainability benchmark. The selection of companies for inclusion is based on data collected by MSCI ESG Research.

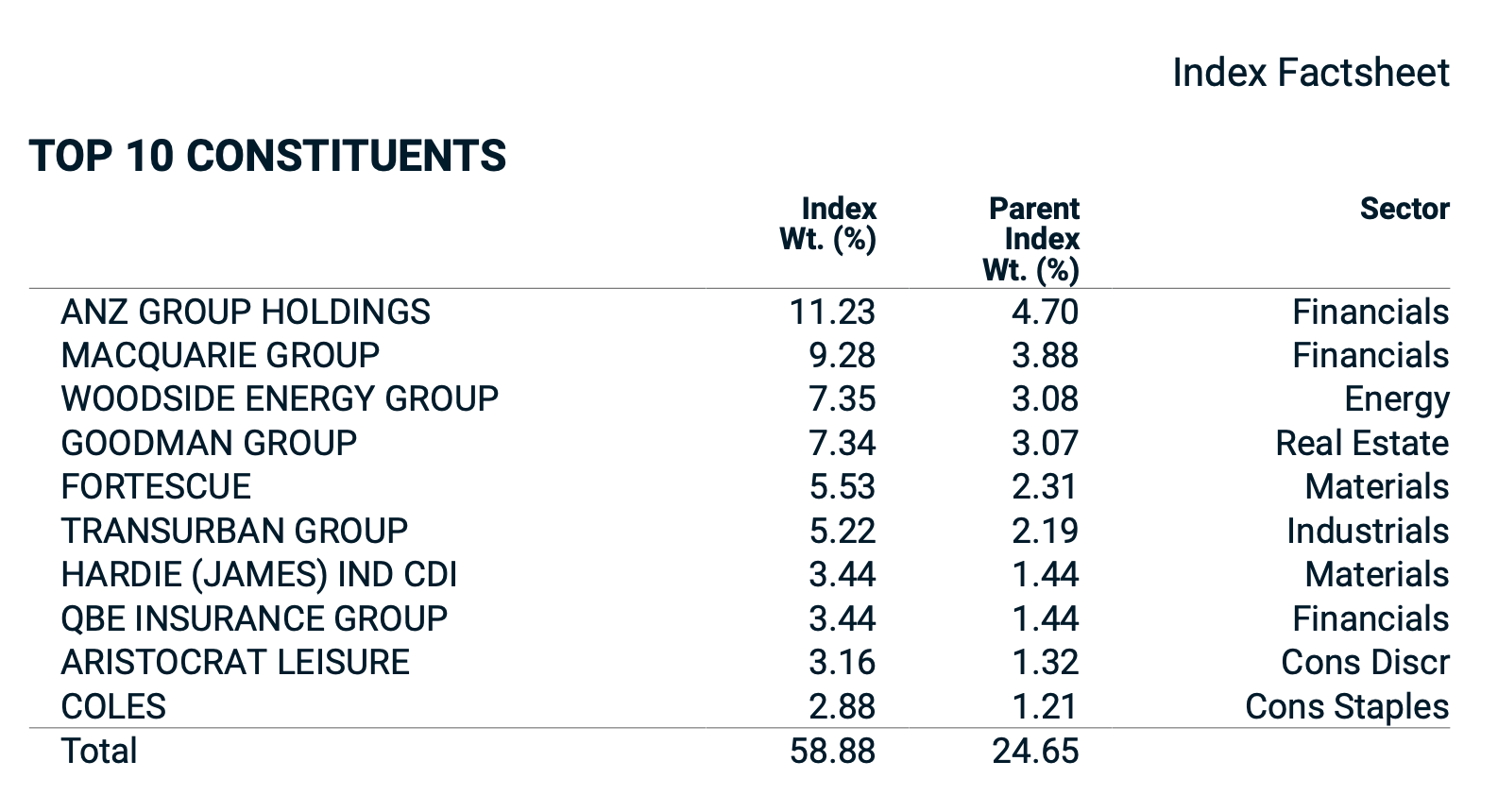

According to the Index’s fact sheet, the top 10 holdings of the Index as of March 29th were:

MSCI Australia ESG Index Top 10:

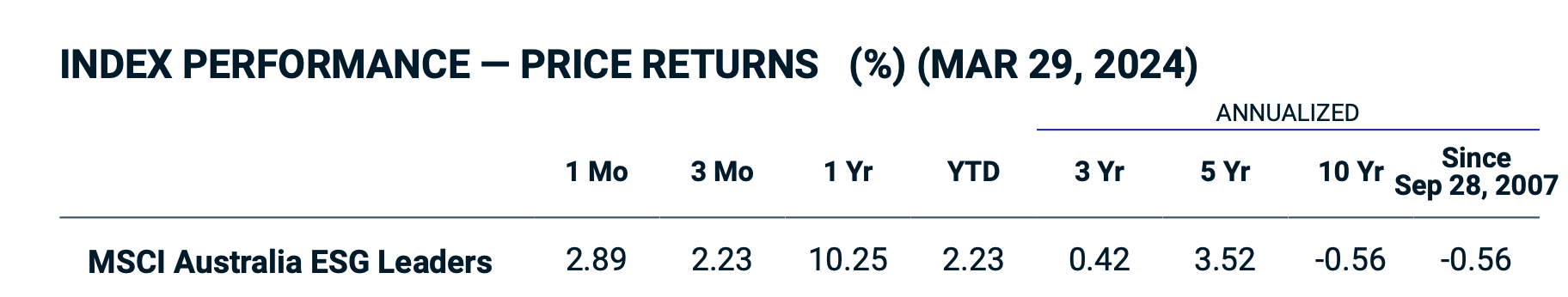

The MSCI Australia ESG Index has returned around 3.5% in the last 5 years, and -0.5% in the last 10 years.

MSCI Australia ESG Index’s performance

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.