The Ethical Investor: Green bonds offer alternative to ethical retirement investing, with zero tax after 10 years

Green bonds offer a tax effective alternative to ESG-focused equities. Picture Getty

- How to align personal values with your retirement investments

- Green bonds offer a tax effective alternative to ESG-focused equities

- Stockhead reached out to Foresters Financial’s Michael McQueen

Investing for retirement is a goal that most individuals strive for at some point in their lives.

Many have aligned their retirement investments to their own personal, environmental and social values, for example through climate-focused equities or ETFs.

But there’s one alternative out there that’s gaining a lot of steam recently – green bonds.

According to the RBA, around $13 billion of green bonds were issued in Australia in the first half of 2023, which is the highest annual amount on record.

Although the Aussie green bond market still lags its European counterparts, it is expected to grow strongly in response to increasing demand for environmentally sound investments.

So what exactly is a green bond?

Foresters Financial’s CIO, Michael McQueen, explained that while here is no formal definition, a bond can be classified as green if the money raised goes towards initiatives to reduce carbon footprints that make the issuer’s operations more sustainable.

“As an example, NBN Co’s green bond that was issued a couple of months ago was to help them take out electricity contracts for green energy sources, and update their fleet of equipment to hybrid and EVs. So that’s one example of a green bond,” McQueen told Stockhead.

“Another example of a green bond is when an issuer uses the bond proceeds to install solar panels, rainwater tanks, or upgrade their waste management – the sorts of things that make the issuer itself more green,” he added.

Another example of a green bond

Green bonds can be issued by various organisations, including companies, government entities, development banks, or even university funds.

In July for example, La Trobe University in Melbourne launched its first green bond, a $175m cap raise the university said would be used to fund a diverse range of eligible eco-friendly projects.

Possible projects include initiatives such as renewable energy, green building, sustainable water & waste management, and conservation.

In the renewable space, La Trobe says it will use the funds to invest in solar, wind, and hydro power to reduce its own carbon footprint.

The university also plans to improve its buildings to become more greener, such as adding electric vehicle charging stations, as well as implement energy-efficient technologies and practices across its campuses.

“Basically any issuer can issue a green bond, as long as the proceeds are used to reduce their carbon footprint, and to make their operations more sustainable,” said McQueen.

“So there are no actual restrictions on who can issue green bonds.”

Pay no tax after 10 years

At the moment, one problem for Aussie retail investors is that access to these bonds is very limited as they’re mostly issued and directly sold in big lots to institutional investors.

Foresters Financial’s sustainable bond products, however, include exposure to green bonds with a minimum investment of only $500.

Foresters is a member-owned financial services company, and is the only provider of investment bonds that offer members a sustainable option across all its bond products – funeral, education, and investment.

“In the last few years, the crypto bubble we had talked about democratising finance.

“Well, for $500, you can get a tax efficient investment bond, an education bond, or a funeral bond with a sustainable and ESG overlay. And that’s democratisation right there,” McQueen said.

Unlike term deposits or normal bonds that you’d buy through a broker, investment in one of Foresters’ bond funds falls under what’s called “tax paid investments”.

Under current ATO rules, all investment bonds in Australia are known as tax-paid investments.

This means that tax on earnings is paid by the bond issuer at the corporate rate of 30%, and investors don’t have to declare any income from the bond in their tax return.

“The entity pays your tax and everyone else’s at the entity level, which is a maximum rate of 30%.

“So you don’t need to go to you tax accountant every year to declare bond coupons coming through on your tax return, because there is none of that.

“This is fantastic for people who are at high marginal tax rates,” McQueen said.

However, there’s a some catch to it.

Under current tax rules, if you redeem or sell before eight years, 100% of the earnings on the investment bond will have to be included in your assessable income.

Withdrawals in the ninth year will see two-thirds of the earnings taxed, where the 30% tax offset applies.

“Whatever your marginal tax rate is, if that’s higher than the tax rate of the vehicle (30%), then you’ve got to pay tax on the difference,” McQueen said.

Any withdrawals after the 10th anniversary, however, will be free of any personal tax in your hands.

“So the idea is about staying invested for 10 years, at which time there will be no additional tax to pay at the member level.”

The future of green bonds

In terms of the risks for investors, McQueen says investing in green bonds has a similar risk profile to what you would normally have in your superannuation or diversified portfolio.

“There’s obviously sensitivity to interest rates, counterparty risk, market risk, so like other investments, there is a multitude of risks there,” he said, while adding that investing in green bonds could offer diversification to the equity market.

Although demand is rapidly increasing, McQueen sadly predicts that the green bond market won’t grow at an exponential level like it should be.

“I’m passionate about ESG, and I’d love to be inundated with green bonds more than I can handle. But I think the green bond market will develop at a pretty mediocre pace, unfortunately.

“It’s out of my hands because our role in the supply chain is just to advocate for these products, ie: we’re willing to invest in these products if you’re willing to bring them to the market.

“So whilst most people like me are obviously advocating for better outcomes from an environment, social, and governance point of view, there’s only so much I can do.

“The low barriers to entry of our product ($500) really helps because our success feeds into the success of sustainable investment outcomes.

“Because if people don’t make decisions to invest ethically, then it’s difficult for corporations to be held to account,” said McQueen.

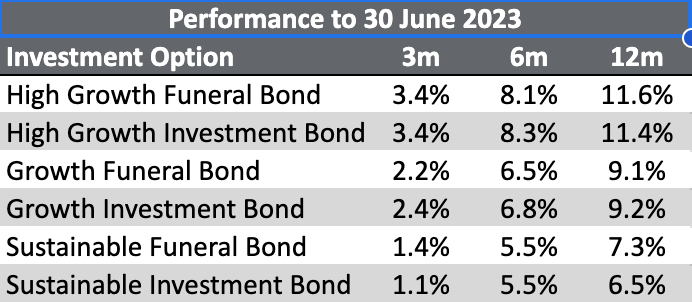

The below table is the performance of Foresters Financial funds to 30 June 2023 provided to us by Foresters Finacial.

The views, information, or opinions expressed in the interview in this article are solely those of the interviewee and do not represent the views of Stockhead.

Stockhead has not provided, endorsed or otherwise assumed responsibility for any financial product advice contained in this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.