The Ethical Investor: Farmland prices keep climbing, and ESG investors could own a piece of it

Investors eye farmland for stability and ethical returns. Picture via Getty Images

- Australian farmland values rise 12.2% from last year

- Investors eye farmland for stability and ethical returns

- Rural Funds Group offers REIT access to agricultural assets

As 2024 draws to a close, Australian farmland values are showing a consistent upward trend.

The latest update from Rural Bank indicates that while farmland prices continue to rise, the pace has eased slightly. Currently, the median price stands at $10,141 per hectare, which is a 12.2% increase from last year. This marks the 22nd consecutive half-year of year-on-year growth.

Neil Burgess, Senior Manager of Industry Affairs at Rural Bank, said that “at a national level, the story is essentially about stability in values with transaction volumes continuing to tighten as buyers increasingly fail to meet sellers’ price expectations.”

The number of transactions has hit a record low, down 18.7% year-on-year and 4.8% lower than the second half of 2023. This trend has persisted since peak transaction volumes in the first half of 2021.

Certain regions, however, have bucked this trend.

Queensland, particularly in the Central Highlands and Southeast, along with the Hunter and North Coast regions of New South Wales, has experienced significant growth, thanks to good seasonal conditions that are encouraging buyers.

Tasmania also saw impressive growth, particularly in the North, lifting its median price per hectare.

Conversely, Victorian farmland values have plateaued over the past 18 months, with a decline noted in the first half of 2024.

In Western Australia and South Australia, dry conditions during this period have likely contributed to a drop in median prices from the record highs seen in late 2023, although both states have experienced year-on-year growth.

The key drivers behind these farmland values – commodity prices, seasonal conditions, and interest rates – are varied across different regions.

While dry conditions pose challenges for much of southern and Western Australia, Queensland and New South Wales are benefiting from more favourable rainfall.

“The recovery of livestock prices after a disastrous 2023 and an easing in crop prices helps explain the variety in the median price movements we have seen around the country,” said Burgess.

“But if rainfall forecasts improve and interest rate cuts begin in early 2025, demand could strengthen again, providing a brighter future for the sector,” he added.

Australia’s most valuable farmland by state and region

Here’s a quick snapshot of where the highest prices are:

Tasmania – Northwest $28,827/ha

State median: $23,022ha

Victoria – South and West Gippsland $28,062/Ha

State median: $14,562ha

South Australia – Adelaide and Fleurieu $20,886/Ha

State median: $7,890ha

Western Australia – Southwest $17,236/Ha

State median: $6,846ha

Queensland – Southeast $16, 335/Ha

State median: $9,777ha

NSW – Hunter and North Coast $13,100/Ha (tied)

State median: $9,745ha

| Median price per hectare (H1-2024) | Price change from H2-2023 | Price change from H1-2023 | |

|---|---|---|---|

| National | $10,141 | -0.1% | 12.2% |

| QLD | $9,777 | 5.6% | 17.0% |

| NSW | $9,745 | 5.6% | 13.4% |

| VIC | $14,562 | -6.7% | 1.9% |

| TAS | $23,022 | 16.5% | 7.5% |

| SA | $7,890 | -11.0% | 7.7% |

| WA | $6,846 | -12.1% | 24.7% |

Why farmland could be a good ethical investment

When it comes to investing, many people immediately think of the stock market.

But is agricultural land a good investment if you’re not a farmer?

The consensus is pretty much yes, especially in Australia. Known for high-quality agricultural exports, Australia’s farmland is attracting foreign investors, which boosts land values.

Generally speaking, farmland is a unique asset that appreciates over time, making it a great way to diversify your portfolio and add stability.

It offers the potential for regular income and long-term capital gains, and experts believe it can keep pace with inflation, alongside gold and certain bonds.

With global food demand expected to soar as the population doubles by 2050, the value of agricultural land is set to rise. Only 7% of the world’s land is suitable for food production, and most of that is already in use.

Importantly, owning farmland doesn’t mean you have to farm it yourself.

“You can rent to tenants who wish to grow crops or raise animals. Or you can rent to renewable energy companies who wish to place wind turbines or solar panels,” said a recent note from BTC Bank.

Investing in agricultural land also appeals to ethical investors who want to make a positive impact while achieving financial returns.

By supporting sustainable practices that promote food security, ethical investors can help encourage biodiversity, reduce carbon footprints, and foster regenerative agriculture. This is increasingly important as consumers demand ethically sourced food.

Investors can back local farmers who prioritise organic farming, permaculture, and agroforestry, which improve soil quality, conserve water, and mitigate climate change.

Also ethical investors can enable farmers to adopt practices that promote animal welfare and reduce pesticide use.

As the Food and Agriculture Organization notes, “The alignment of financial and ethical goals makes agricultural land investment an attractive option for those looking to make a meaningful impact while securing their financial future.”

How do I get in?

Investors looking to enter the agricultural sector without the responsibilities of owning a farm have several options.

One popular way is through real estate investment trusts (REITs) that specialise in agricultural land. These REITs essentially allow investors to buy shares in a portfolio of farmland, providing exposure to farmland appreciation and rental income without the need for direct ownership.

Another option is agricultural-focused mutual funds and exchange-traded funds (ETFs). These funds invest in a variety of agricultural assets, including farmland, agribusinesses, and companies involved in food production and processing.

Also, crowdfunding platforms have emerged as a way for investors to pool resources for specific farmland projects or to purchase parcels of agricultural land.

These platforms typically offer investment opportunities in specific crops or farming operations, allowing investors to support particular initiatives and potentially earn returns based on the success of those projects.

ASX’s Rural Funds REIT

On the ASX, there’s a REIT operating in this space – the Rural Funds (ASX:RFF).

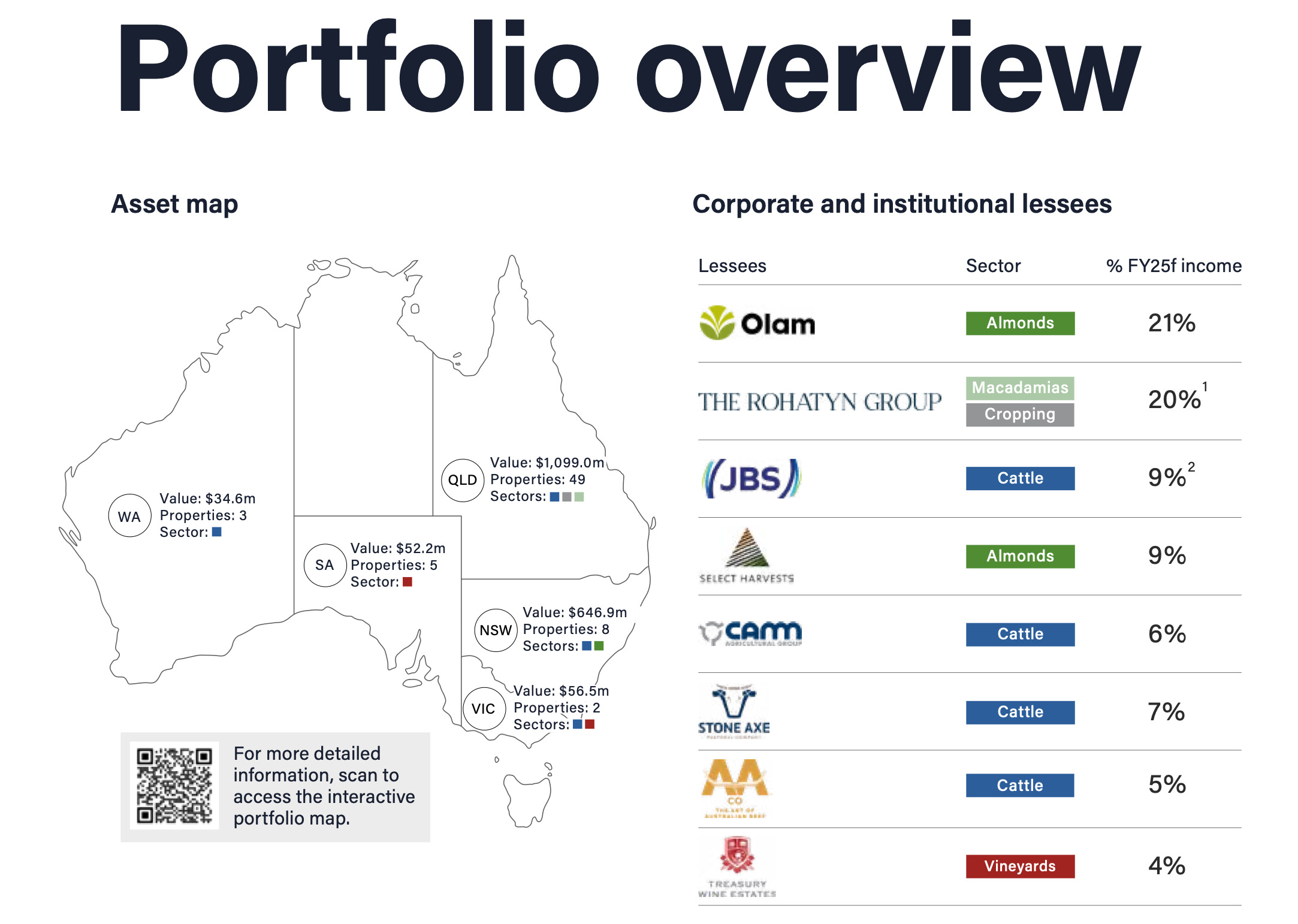

The REIT specialises in owning and managing a diverse range of agricultural assets across Australia. RFF’s main goal is to generate income and capital growth by developing and leasing these assets. Investors receive quarterly distributions from the income generated by the properties.

RFF is managed by Rural Funds Management Limited (RFM), which has over 27 years of experience in agricultural management.

RFM oversees more than $2.4 billion in agricultural assets, employing a team of experts, including fund managers and agronomists. The company says its focus is its slogan “managing good assets with good people”.

RFF’s strategy involves both leasing out properties and actively developing them to boost productivity. For instance, the group operates cattle farms and macadamia orchards to increase their value before leasing them out.

By improving these assets, RFF aims to increase the output and hence rental income from the land, which in turn supports its quarterly distributions to investors.

The group also emphasises sustainability, working on initiatives to reduce emissions and improve asset development practices.

The fund’s current portfolio of agricultural assets across Australia can be seen below:

This story does not constitute financial product advice. You should consider obtaining independent advice before making any financial decision.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.