The Ethical Investor: Ethical lending and why Beforepay and these ASX lenders are being sought after

Aussie borrowers are looking more and more into ethical lenders , as Beforepay named Ethical Lender of the Year. Picture Getty

- Aussie borrowers are looking more and more into ethical lenders

- Beforepay was named Ethical Lender of the Year

- Which other lenders on the ASX are considered ‘ethical’ ?

In Australia, the concept of ethical lending is rapidly gaining traction.

Ethical lending has a broad meaning, but it generally refers to lending practices that prioritise social responsibility.

These are often lenders that have chosen not to lend to industries considered harmful to society or the environment such as fossil fuel, weapons, alcohol, or the gambling industries.

Ethical lenders instead have a focus on investing in social projects such as affordable housing and renewable energy, a low carbon footprint, and immerse themselves in local communities as well as possessing a corporate culture free from scandals.

Screening of clients to ensure they are financially sound is also considered one of the hallmarks of an ethical lender.

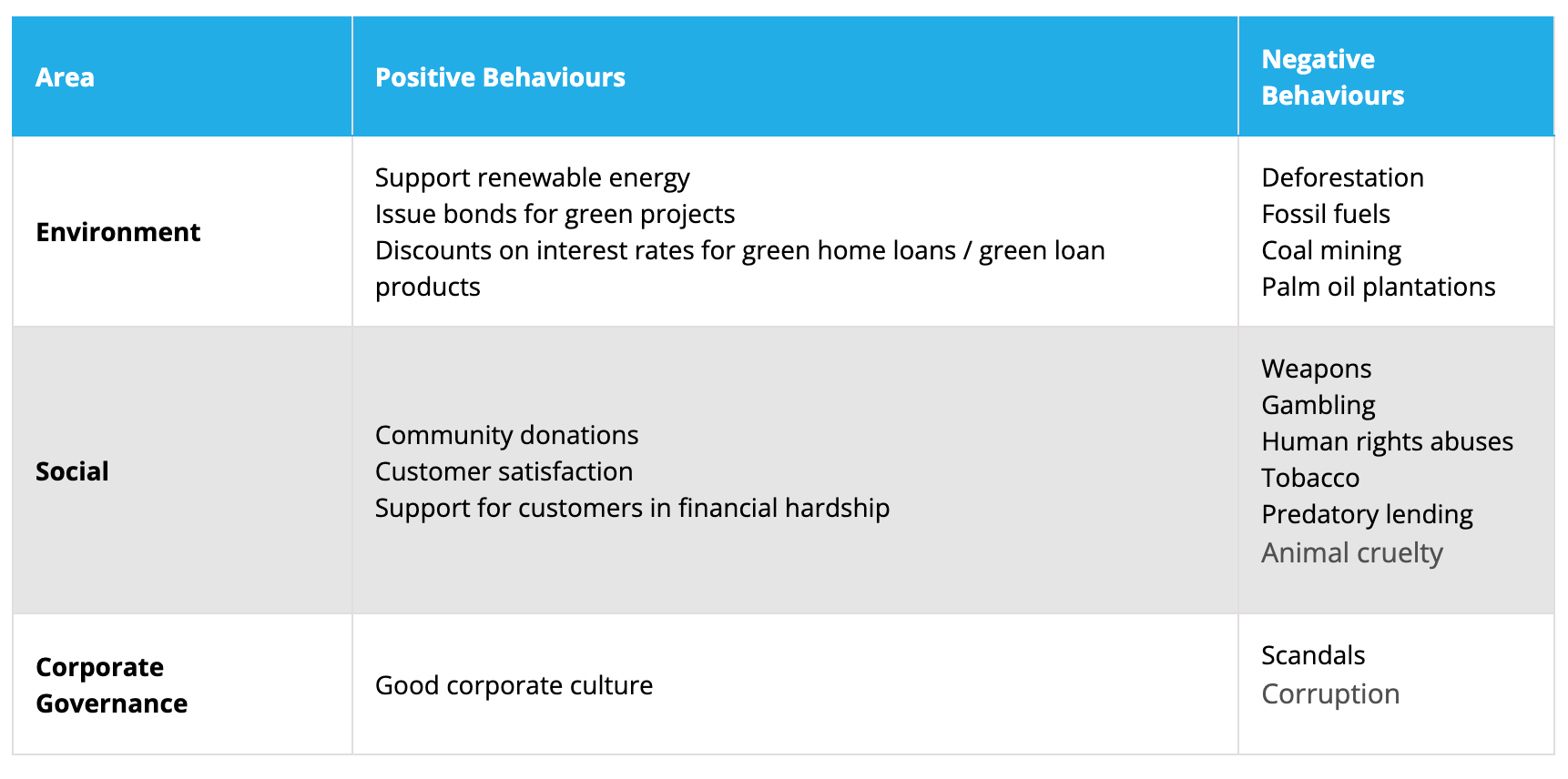

Here’s one take of the kind of behaviours expected of ethical lenders as they relate to the ESG principles:

Beforepay awarded Ethical Lender of the Year

On the ASX, a company that’s been ticking the boxes is non-bank lender, Beforepay Group (ASX:B4P).

The company was last week named Ethical Lender of the Year 2023 in the global Pan Finance Awards.

The award was given to acknowledge Beforepay’s commitment in supporting working Australians by providing affordable alternative to payday lending and revolving debt schemes.

Beforepay advances small sums of money against its customers’ future wages over short periods of time, helping them to overcome short-term challenges whilst not living beyond their means.

The company’s flagship product is a Pay Advance, which offers eligible customers up to $2000 for a 5% fee. There is no interest and no late fees, and the funds are sent to their bank account and available in minutes to cover expenses they may have.

The average advance is around $350 and is repaid, on average, in 3-4 weeks, with customers able to repay in instalments to further support them with managing their cash-flow. Customers can only take out an additional advance when they’ve fully repaid the previous one.

Unlike many traditional financial products that generate extra revenue through interest charges and hidden fees, Beforepay only charges a single fixed fee per advance.

Beforepay also encourages responsible money management, providing customers with budgeting and financial insights tools in the Beforepay App.

Jamie Twiss, CEO of Beforepay, explained that borrowing from traditional lenders is expensive and can lead to a debt spiral.

For instance, a payday loan can come with an establishment fee and additional monthly fees (until the loan is paid in full), while credit cards can charge interest fees until the balance is fully repaid.

On the other hand, Beforepay’s customers can expect to only ever pay a fixed fee.

“Beforepay is dedicated to the idea that Australians who need to borrow small amounts of money should not have to risk taking on long-term debt and paying compound interest,” Twiss told Stockhead.

“Our ethical lending solution challenges the practices of traditional lenders whose hidden fees, high interest rates and complex terms can come with the risk of revolving debt.”

Other ‘ethical’ lenders on the ASX

On the ASX, there are other lenders (both banks and non-banks) which are considered as ‘ethical’ by fundies and customers.

We’ve taken a list of these lenders from the portfolio of listed fund manager, Australian Ethical Investment (ASX:AEF).

Stocks in the the AEF’s $6 billion portfolio must meet the requirements of the company’s Ethical Charter, which steers the fund into parts of the economy that are good for the planet, people and animals, and away from harmful sectors.

In the lending space, the AEF has taken stakes in lenders such as National Australia Bank (ASX:NAB), Westpac Banking Corporation (ASX:WBC), Bank of Queensland (ASX:BOQ), and Bendigo and Adelaide Bank (ASX:BEN).

In the smaller end of town, AEF also invests in these lenders:

Pepper Money (ASX:PPM)

Pepper Money is a non-bank lender focusing on the mortgage and asset finance markets in Australia and New Zealand.

The company uses technology extensively to originate loans in a completely paperless process.

Pepper recently acquired a 65% stake in car loan broker Stratton Finance for $78 million, bolstering its existing fast-growing asset finance business.

Pepper says it’s committed to responsible lending.

“Responsible business practices underpin everything we do. We’ve fostered a culture that values accountability, ethical behaviour and integrity.

“Underpinned by our code of conduct, this sets the standard for how we interact with our customers, shareholders and stakeholders at all times,” said the company.

Auswide Bank (ASX:ABA)

Auswide Bank (formerly Wide Bay Australia) has been around for 57 years, and provides an extensive range of personal and business banking products and services.

Queensland’s Wide Bay Burnett region, and in 2013 a decision was made by Wide Bay Australia’s board of directors to convert to a bank.

Auswide Bank’s loan book sits at $4.391 billion as at 31 March, and a growing customer deposits of $3.405 billion.

Auswide says it has evolved as part of local communities and will continue to play an active part in local communities, particularly in regional areas.

The company donates to various charitable organisations such as “Relay for Life”.

Australian Finance Group (ASX:AFG)

Australian Finance Group is a mortgage broking group that deals in mortgage origination and management of home loans and commercial loans.

The company has been around for 28 years, and has over 3,700 brokers in its network.

AFG says this large broker network provides the foundation for diversification into higher margin products and new markets.

The company is a participant in the United Nations Global Compact, formalising its alignment with the UN’s 10 principles and its Sustainable Development Goals.

“Of the 17 goals, we have identified eight in which our business can make the biggest difference,” said the AFG.

Share prices today:

Stockhead has not provided, endorsed or otherwise assumed responsibility for any financial product advice contained in this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.