The Ethical Investor: Election showdown and the fate of ESG if Trump wins

What would a Trump presidency mean for ESG investors? Picture via Getty Images

- Polls show tight race between Harris and Trump

- Economy remains top concern for voters

- But what would a Trump presidency mean for ESG investors?

With just 11 days to go until Vice President Kamala Harris faces Donald Trump in the 2024 election on November 5, Americans are getting ready to cast their votes in what many are calling “the election of a generation”.

One poll indicates that Trump leads by 7-8 points, while another shows Harris with a 1.7-point lead.

Experts believe the final outcome is too close to call and is anyone’s game.

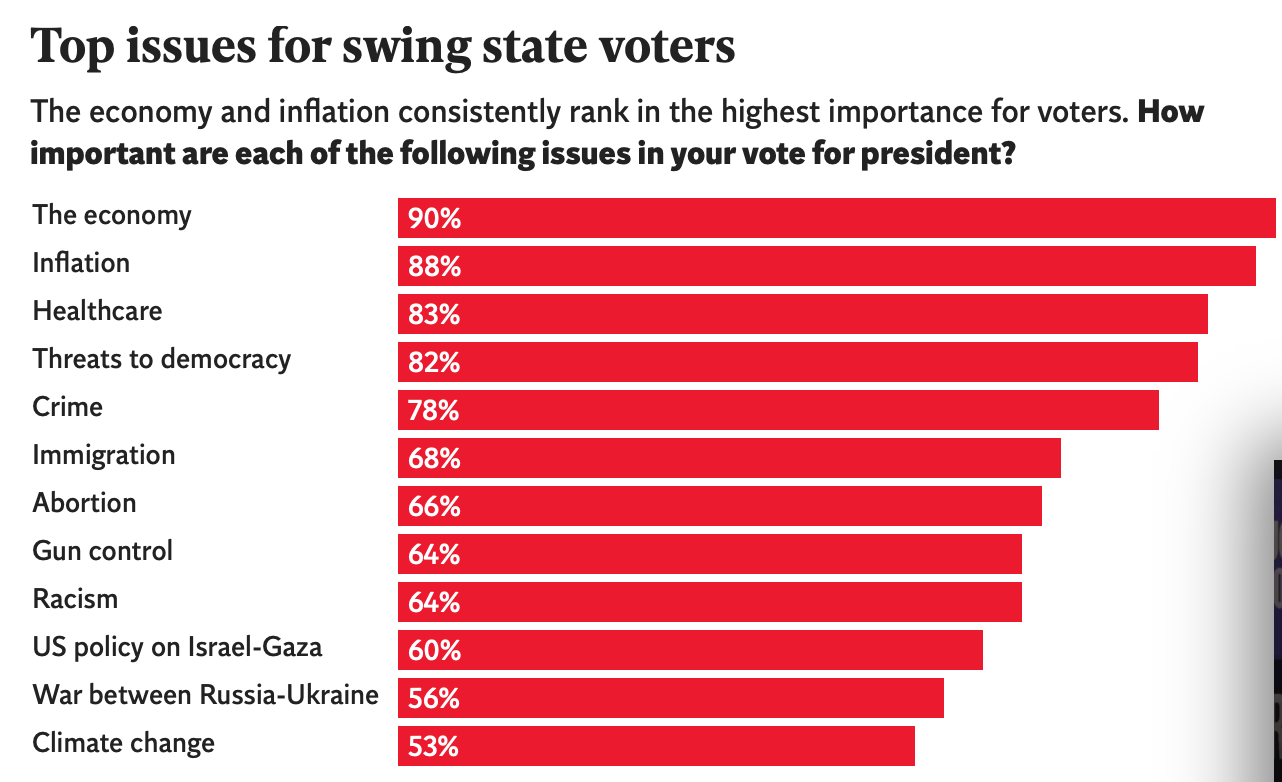

The economy remains the top concern for voters in this election. A Washington Post poll of swing state voters revealed that healthcare and threats to democracy are also crucial factors in choosing the next president.

How the election result will shape markets

Amundi, Europe’s largest asset manager, has highlighted several important points for investors.

The firm noted that the actual policies that will be implemented won’t be clear until after the elections, depending on whether Congress can agree on them.

Here are the five main takeaways for investors, according to Amundi:

Market sentiment

In the short term, the market’s response will likely depend on Trump’s proposals for lowering corporate taxes and the inflation risks associated with tariffs and immigration policies. On the other hand, if Harris is elected, she may continue existing policies, especially if the Democrats don’t have a majority in the House, which would lessen concerns about wealth taxes or increased corporate taxes.

Sector opportunities

Trump’s “Make America Great Again” agenda could create opportunities in US stocks, particularly benefiting small-cap companies and sectors like banking. A Harris presidency might lead to mixed outcomes for equities, favouring infrastructure and green companies.

Geopolitical factors

Changes in global politics will influence market opportunities, especially for emerging markets affected by supply chain shifts due to tariffs. Under Trump, Asia might face more pressure, while countries like Mexico could benefit from relocations.

Fiscal spending and inflation

If Trump wins, we can expect the government to spend more money, which might cause inflation to rise. This could change the yield curve and influence how investors choose where to put their money. In particular, bonds from emerging markets might face pressure. Investors may find commodities and assets linked to inflation more appealing in a Trump administration.

Dollar trends

The US dollar might be facing a long-term decline, but if Donald Trump were to win the presidency again, it could lead to a stronger dollar. This could happen because his administration might implement policies that are more favourable for the Federal Reserve, as well as increase risk premiums, which can strengthen the currency.

What a Trump win would mean for ESG investors

Meanwhile, from an ethical and ESG investor perspective, a presidency under Harris would likely maintain the current trajectory of policies on sustainability.

However, if Donald Trump secures a second term, it could lead to significant changes that may undermine these priorities, as his administration has historically favoured policies that could conflict with ESG principles.

Here’s a look at key areas that could change under a Trump presidency:

Fossil fuel

Trump is likely to prioritise fossil fuel production, easing restrictions on drilling and mining to boost domestic energy production.

This could include rolling back protections for public lands and waters, thereby opening up more areas to extraction activities.

He might also push for policies that support the construction of new pipelines and infrastructure.

Trump supports fracking and has been a strong advocate for it throughout his first presidency.

He essentially opposes any ban on fracking, arguing that it is essential for energy independence and job creation.

For ethical investors, fracking poses major challenges due to its risks of water contamination, air pollution, and higher greenhouse gas emissions, conflicting with sustainability values.

Clean energy transition

Trump had previously exited the Paris Agreement, weakened environmental regulations, and imposed tariffs on Chinese solar manufacturing – actions that have not been reversed by the Biden administration.

“The best case is that Trump simply continues with BAU (business as usual); the worst is a four-year hiatus in the ‘reigning in’ of fossil fuel investments,” said Rahul Bhushan at ARK Europe.

Although Trump has criticised the climate change agenda, he may still support renewable investments if they align with energy security.

And with 80% of Inflation Reduction Act (IRA) investments occurring in Republican states, it’s unlikely Trump could easily repeal it without facing significant pushback.

Despite Trump’s past opposition to climate initiatives, data shows growth in solar and wind energy during his presidency.

Bhushan believes the momentum for the green transition will continue, regardless of Trump’s presidency, saying, “the market has accepted that the energy transition will happen and that fossil fuels are going to be history.”

For investors, this suggests opportunities will persist in the renewable energy space regardless of who wins the election.

Electric vehicles

The incentives for Americans to purchase electric vehicles are likely to be among the first items under scrutiny in a Trump administration.

In his speeches, Trump has repeatedly said that he would “end the electric vehicle mandate on day one”.

“Incentives for people to buy electric vehicles would certainly be on the chopping block,” said ANZ commodity strategist, Daniel Hynes.

But Trump has been very vague about how his would-be administration would pump the brakes on EVs.

Auto and policy experts believe Trump could take several actions to discourage EV sales.

He may target consumer incentives, such as the US$7,500 tax rebate under the IRA, making it harder to qualify.

Trump might also look to repeal new air pollution limits set by the Environmental Protection Agency, which currently encourage automakers to produce more electric vehicles

For investors, these actions could see EV stocks drop, and the long-term outlook for mining stocks tied to clean energy, like lithium, could become uncertain.

How will a Trump win impact Australia?

A 51-page research report released by the Australian National University warns that if Donald Trump wins and raises tariffs on Chinese imports, it could negatively impact Australia’s economy in the long run.

Trump’s proposed 60% tariffs, cuts to immigration, and threats to the Federal Reserve’s independence could lead to reduced investment in China, which is Australia’s largest trading partner.

This would harm Australia’s economy since we heavily rely on exports of mining, energy, and agricultural products to China.

Initially, Australia’s economy might see a temporary boost of up to 1% by 2028 due to Trump’s policies, but by 2034, GDP could decline by 0.2%.

The research also suggests that only China would face a greater long-term economic hit.

ESG industry will still survive

Investment funds focused on ESG can weather a potential Trump victory, according to Ian Simm, CEO of Impax Asset Management.

Trump and his Republican allies have criticised ESG, labelling it as “woke capitalism” or “radical left garbage”, and have also targeted wind power and electric vehicles.

However, with renewable energy often being cheaper than fossil fuels and efforts to bring solar and electric vehicle supply chains to the US benefiting many Republican areas, Simm believes the economic shift towards clean industries will continue.

Simm acknowledged that if we end up with Trump as president, then it’s quite possible that there will be more pressure on asset owners in the US to reduce their ethical requirements from investment.

“But our view is that it’s hard to see the momentum stopping, or even slowing down, in the economic transformation in favour of clean industries,” Simm said.

In conclusion – not great for ESG

Overall, if Trump wins the election, it could have major effects on ESG investing.

He has a history of supporting fossil fuel production and may roll back environmental regulations, allowing oil, gas, and coal companies to operate with less oversight.

This might boost short-term profits for these industries but could undermine broader sustainability goals.

Trump’s administration may also criticise ESG initiatives, labelling them as “woke capitalism,” which could pressure companies to reduce or abandon their ESG commitments.

This could create a divide in the market, with traditional industries prospering while ESG-compliant companies facing challenges.

Also, Trump’s policies are likely to focus more on economic growth than on social equity, with less attention given to diversity, labour rights, and income inequality.

During his first term, he opposed mandatory climate-related financial disclosures, arguing they placed unnecessary burdens on businesses, which runs counter to the global trend toward greater transparency.

Now read: Tim Boreham’s Relax! The US election outcome is out of our hands

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.