The Ethical Investor: Despite EV slowdown, the future is still electric and lithium story remains intact

Despite EV slowdown,the future is still electric and lithium story remains intact. Picture Getty

- EV sales have slowed down on cost concerns, as market also matures

- Despite short-term challenges, advancing technology will support the market

- Global commitment to net zero will also keep demand for lithium strong

About 15% of greenhouse gas emissions come from road transportation, so switching to cleaner vehicles is absolutely critical for meeting our climate change goals.

Governments all over the world are pushing hard for it too with some hefty subsidies for electric vehicles.

But although demand for EVs keeps growing, it’s not skyrocketing like before.

So, how’s the EV market looking these days?

Well, globally, sales are still climbing, but the pace is easing up a bit.

According to BloombergNEF, sales of electric vehicles and plug-in hybrids doubled in 2021 and shot up by 62% in 2022.

But in 2023, that growth slowed to 31%, with plug-ins making up 15% of all vehicle sales.

In 2024, the forecast is for a 21% increase.

China’s leading the charge here, making up 59% of the 13.8 million plug-in sales in 2023, while Europe and North America trail behind at 23% and 12%, respectively.

Why the uptake of EVs is dropping off

First off, there’s been some concern about prices. With used EV prices dropping, people are starting to think more about the resale value of the vehicles.

There’s also a bit of an issue with the availability of rapid-charging stations. As more people jump on the EV train, the need for having these stations is becoming more apparent. Worries about the availability of charging spots are starting to weigh on potential buyers’ minds.

Also back in the early days, tech geeks were driving much of the EV sales. But now, the market is more mature, and we’re seeing more budget-conscious buyers who are mostly still on the fence about electric cars.

And finally, EV sales are dropping because China is not the reliable growth engine it used to be, and consumer spending there has slowed down tremendously.

How is China impacting the global EV market?

On the supply side, China is sitting on a surplus of around 5 million EVs. By 2025, that surplus is expected to be north of 20 million units.

The country is aiming to boost its EV game both at home and abroad, armed with some serious cost advantages and its domination in components like batteries.

Batteries account for 30% to 40% of EV manufacturing costs, and Chinese EV manufacturers can keep costs low due to the concentrated battery procurement networks they’ve established within the country.

According to Goldman Sach’s analyst, Kota Yuzawa, Chinese EV makers do pose a major threat to Japanese brands, which have maintained high market share in Southeast Asia for many years.

“The Southeast Asia market has been a major export destination for Chinese EVs since 2023,” said Yuzawa.

However, EV sales in Southeast Asia are minuscule compared to regions like US, Europe, and India.

.”Given that EV demand outside China is not very large apart from these three regions, we think it’s unlikely that China’s supply surplus will be eliminated easily,” Yuzawa added.

The surplus is causing a bit of a headache and raising some eyebrows in countries producing EVs, as there’s worry about possible additional price drops.

On 14 May, the US government announced that it would increase tariffs on Chinese EVs from 25% to 100%.

The US says that with all the excess that China has, Chinese EVs have been sneaking into American markets unfairly at bargain prices.

What’s going on with hybrid sales?

Meanwhile, sales of hybrid electric vehicles (HEVs) and plug-in hybrid electric vehicles (PHEVs) have been picking up speed, especially with the dip in battery EVs.

Over in the US, sales of hybrids have been outpacing battery EVs for the last few months.

Hybrids have quickly become the preferred choice for many buyers because many see them as offering pretty much the same perks with EVs, without the headaches like range anxiety.

“Your standard hybrid makes the most sense to most people,” Ivan Drury at Edmunds.com told PBS. “I think you’ll find that people don’t want to deal with the hassle or the difficulties of charging.”

Hybrids however do emit a bit of tailpipe pollution, but since they use less fuel compared to regular combustion engine cars, their emissions are lower.

They’re also priced pretty similarly to petrol vehicles, and are usually way cheaper than comparable EVs.

The future is still electric

While we might be dealing with some uncertainties in the short term, the fundamentals that have been driving the electric vehicle trend are still holding strong.

The market is still expecting government support, better economics, more charging stations, and the growing acceptance of EVs as the way forward.

According to the International Energy Agency, EVs are among the select few technologies that could really help us hit that net zero emissions goal by 2050.

There’s also some exciting tech on the horizon that could address current limitations of EVs and bolster adoption.

Next-generation battery technologies such as solid-state are expected to improve range, charging time, safety, and affordability of EVs.

“Widespread solid-state commercialisation is unlikely to begin until the end of the decade, but early iterations of this technology are already available to consumers,” said a research report from Global X, a fund management firm.

The research noted that in July 2023, Chinese electric automaker Nio has shipped the first ES6 SUVs with a 150 kilowatt-hour (kWh) semi solid-state battery pack that can support a range of 578 miles (930 kilometres) on a single charge.

Also, it’s important to understand that while EV sales growth is slowing, it’s not actually moving in reverse.

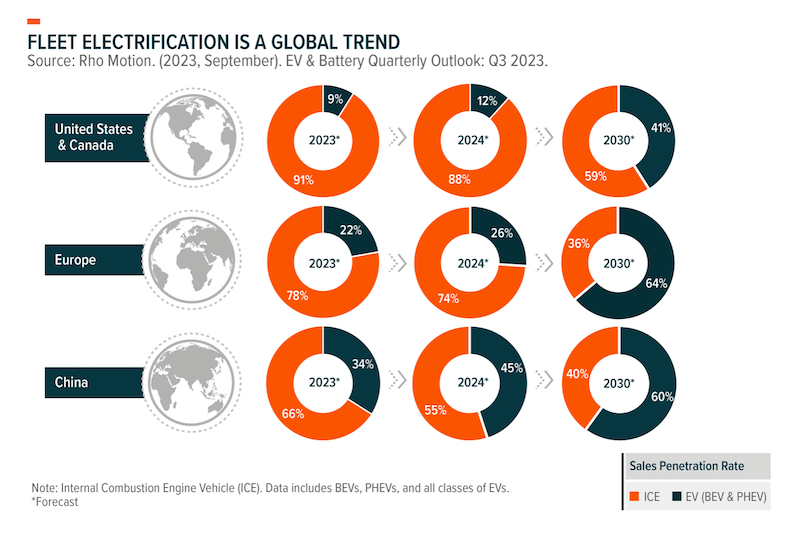

According to forecast, sales of all types EV vehicles (battery and plug-in hybrid) are expected to make up over 60% of all vehicle sales in Europe and China, and 41% in the US by 2030.

Lithium fundamentals also remain intact

Lithium prices hit all-time highs in 2022, caused by years of EV sales momentum that suppliers were simply not able to keep up with.

In 2023, lithium prices plunged but have bounced back modestly in 2024.

Over the longer term, experts say the global commitment to net zero by 2050 will see continued strong demand for critical minerals like lithium.

Lithium-ion batteries, which are key to us moving toward cleaner energy, will especially drive the demand for this soft white metal.

BloombergNEF for instance expects global demand for lithium to grow nearly 5x by the end of the decade.

And Global X says that while the EV industry may be moving into its next chapter as part of its maturation, the technology remains in its early stages of adoption.

“ In our view, the EV industry and adjacent lithium and battery tech companies have a long runway for growth ahead.”

NOW READ: A Live Cat Bounce: Canaccord’s Reg Spencer is positive on lithium’s revival

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.