The Ethical Investor: Buy this kind of mining stock if you love both profit and the environment

Expert says ethical miners could return not only profit, but are also good for the environment. Picture Getty

- Investors should change their outdated view on mining companies, says BlackRock

- Experts says ethical miners are not only good for the planet, but they could generate profits

- We look at recent ESG announcements by ASX miners

Evy Hambro, global head of thematic and sector investing at BlackRock, told Bloomberg TV that investors who care about the climate should buy mining stocks.

Hambro said investors could be missing out on the opportunity to profit from the energy transition because of their outdated view on the mining industry.

“Our view from speaking to our clients and investors at large is that the opportunity within this space has been massively overlooked,” he told Bloomberg.

“If you’re focused on sustainability, if you’re focused on the energy transition, don’t overlook this area. There’s a huge value opportunity.”

Hambro said recent changes in the mining industry meant that the mindset of most miners have shifted to a focus on reducing carbon emissions in metals production.

Miners these days also have a more disciplined approach to spending than in previous booms, Hambro said, adding that ethical investors could therefore miss out on a big opportunity if they shun this industry.

“It’s wonderful that we are going towards this future that’s going to be moving towards more of a mechanically-captured energy environment, rather than the hundreds of years we’ve been addicted to fossil fuels,” he said.

Hambro added that the metals boom isn’t about now, but what will happen over the next 10 to 15 years, calling on metals companies to invest in decarbonisation.

“If we’re just simply stopping burning fossil fuels for the production of energy, and continuing to burn them for the production of materials, and we need a lot more materials, then we’re not actually going to solve the challenge that we face,” said Hambro.

Australian Ethical Funds’s view on mining

Whilst lithium stocks are obviously one of the hottest investments right now, ethical investors are still encouraged to not turn a blind eye, and look at the ethical issues objectively.

Experts argue that materials like lithium traverse a complex supply chain – which could involve sourcing from conflicted areas before being transported to be refined in another country with human rights issues.

Australian Ethical Funds (ASX:AEF) says it has therefore taken a more measured approach toward investing in mining stocks.

The fund manager said that when looking at the mining sector, it balances three main factors:

- the value that the mined mineral has to the well-being of society,

- the harms of the mining process for people, animals and the environment,

- and whether or not the mineral is a limited resource

“For example, we may invest in lithium mining companies which appropriately manage their social and environmental impacts, because of the crucial role lithium plays in expanding battery energy storage needed for the transition from fossil fuel to renewable energy,” said AEF.

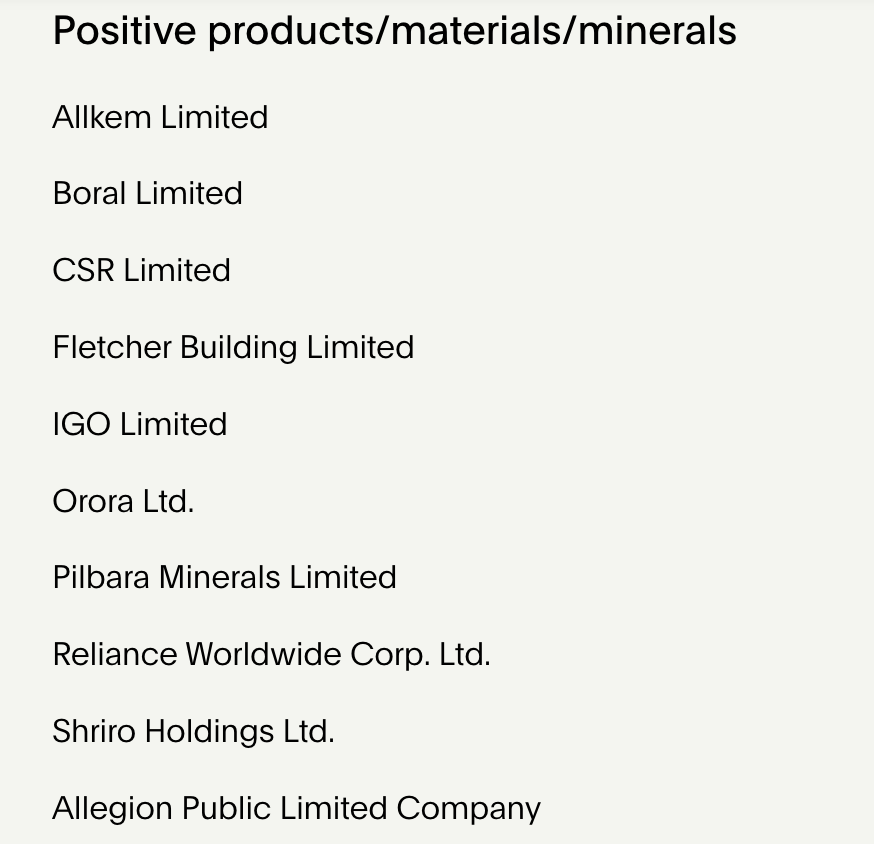

A quick look at AEF’s portfolio shows that it does own a few lithium mining stocks: Allkem (ASX:AKE), IGO (ASX:IGO), and Pilbara Minerals (ASX:PLS).

Alphinity also endorses ethical mining

The debate over green metals mining has given rise to a more basic question: can investing in any mining companies – gold, iron ore or any metals at all – ever be ethical?

The simple answer is YES, says a report from Alphinity Management.

“Some mining companies produce materials that we believe are not necessary to achieve the United Nations’ Sustainable Development Goals (SDGs), and some mine in a way that is unnecessarily destructive to the environment…,” said a report from Alphinity.

However, Alphinity said that a lot of the commodities that mining produces are essential to raising living standards, as well as creating a more sustainable world.

“We use the SDGs to determine whether particular commodities are really needed to achieve one or more of the goals.

“In our view, mining can be ethical if it produces raw materials that are really needed as long as the mines are operated in a socially responsible way.

“We will invest in companies only if they meet both criteria,” said Alphinity.

Recent ESG-related announcements by ASX miners

The pure-play manganese miner released its ESG strategy report this week.

Jupiter said its 2024 environmental focus will be on emissions control, progressing in dust monitoring, greenhouse gas management and clean water initiatives.

“We aim to be leaders in energy efficiency. With innovations like solar installations at Tshipi, improved conveyors, fleet management and transport strategies, we strive for continuous improvement across the company in energy efficiency,” said the report.

Health, safety and wellbeing of employees are also paramount, it said.

“We’re introducing wellness strategies, enhancing employee capabilities and shifting towards proactive health initiatives.”

As for governance, Jupiter says it believes in the importance of diversity on the board, in management, and in its workforce.

“Through Tshipi’s Employment Equity Policy, board skill enhancement and our Tshipi Women in Mining program, we are working towards a more diverse and inclusive environment.”

Jupiter’s core asset is a 49.9% stake in Tshipi é Ntle Manganese Mining, which operates the Tshipi manganese mine in South Africa’s Kalahari region.

The vanadium miner said its FY23 Greenhouse Gas (GHG) emissions inventory assessment conducted by Carbonhalo revealed total GHG emissions have been reduced by 21% over 12 months to 116.15 tCO2e.

The company said this will be offset each month, and reassessed at the end of FY24.

QEM CEO, Gavin Loyden, said the company’s sustainability goals are on track.

“We have steadily progressed since early 2022 in our ability to report on each one of WEF’s 21 core metrics.

“QEM was early to take this proactive approach to sustainability reporting, just as ESG became one of the core drivers in the global investor landscape.

“Our transparency in this area allows our investors and other stakeholders to see how QEM’s ESG progress is aligned to the company’s goal to help meet increasing global demand for vanadium for safe, long duration energy storage systems,” Loyden said.

Resolution Minerals’ strategy to focus on new-energy-metals continues to move forward.

Analysis of the recently staked 100% owned Allegra Nickel Project has revealed a strong opportunity to capitalise on increasing demands for nickel, to support the global energy transition.

Christine Lawley, exploration manager, Resolution Minerals, said:

“The 100% held Allegra Nickel Project in Alaska is prospective for high-grade massive nickel sulphides in addition to the high-tonnage, lower grade disseminated nickel sulphide.

“Nickel is critical for the global energy transition, and it’s important this be underpinned by a supply chain that is aligned with positive ESG, which the opportunity at the Allegra Project offers.”

Stockhead has not provided, endorsed or otherwise assumed responsibility for any financial product advice contained in this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.