Why CCS will be a key part of the clean energy transition

Pic: Getty

Carbon capture and storage (CCS) is a misunderstood technology and because of this is often viewed negatively, but for Australia to meet its net zero emissions target, several experts agree that CCS is going to have to play a key role.

In a world first, Australia recently shipped its maiden cargo load of liquified hydrogen from a Victorian project that will eventually produce up to 225,000 tonnes of clean hydrogen each year using carbon capture and storage technology.

While this first load of hydrogen was produced using brown coal from Victoria’s Latrobe Valley and the CCS component of the Hydrogen Energy Supply Chain (HESC) pilot project is not yet operational, partners in the project estimate they will ultimately slash global emissions by around 1.8 million tonnes per year through the use of this proven technology.

That equates to 350,000 less petrol cars on the road.

The Australian Financial Review reported that the carbon dioxide generated from the production of this hydrogen would be permanently and safely stored in a reservoir under the Bass Strait.

Australia is currently leading the global hydrogen charge, with the highest number of announced projects.

But without CCS, which has been in use since the early 1970s on a commercial scale, playing its part, clean hydrogen will take a lot longer to become cost effective.

S&P Global Platts says blue hydrogen produced using CCS is emerging as one of the most viable off ramps from fossil fuels in a deep decarbonisation regime.

Currently, “grey” hydrogen is produced using natural gas or coal as a feedstock and the emissions generated in the process are “vented”, which is where large and concentrated releases are abated with gas flares to produce less harmful CO2. However, this method still contributes substantially to climate change.

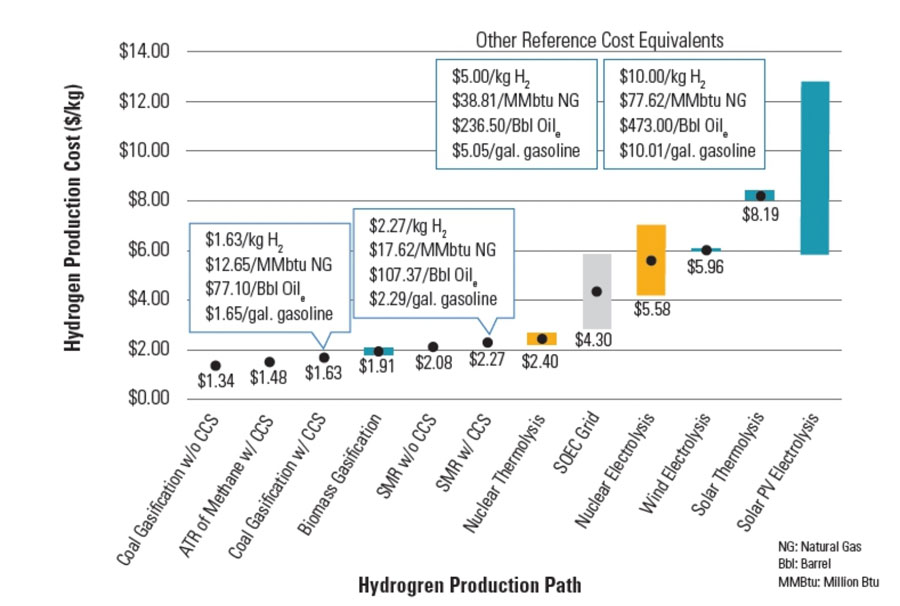

Utilising CCS to capture and store these harmful emissions turns it into the cleaner “blue” hydrogen, which S&P estimates can be produced for as little as $US1.40 per kilogram ($A2.00/kg) principally using the proven process of steam methane forming of natural gas (SMR).

By comparison, “green” hydrogen, which is produced using an electrolyser with water and renewable electricity inputs, more than triples in price to an estimated $US4.42/kg, ($A6.28/kg) according to S&P.

UBS, meanwhile, places the cost of SMR hydrogen production without CCS (grey) at $US2.08/kg ($A2.95/kg), while SMR hydrogen production with CCS (blue) comes in at about $US2.27/kg ($A3.22/kg). But there is a big leap in cost for hydrogen produced using wind or solar (green) to between $US5.96/kg ($A8.47kg) and over $US12/kg ($A17.04/kg).

Brad Lingo, chairman of Pilot Energy (ASX:PGY), says this shows a “significant cost advantage” in using CCS to make blue hydrogen.

“Carbon capture and storage is the principal enabler of being able to deliver low-cost, clean blue hydrogen, because you can’t clean up grey or brown hydrogen unless you have carbon capture and storage,” he told Stockhead.

“That’s why Pilot has specifically highlighted that carbon management is a principal component of our business strategy, not only for the production of hydrogen but also production of clean low-cost blue hydrogen as part of the energy transition.

“And our feasibility studies are absolutely validating that.”

Pilot has formed a consortium to jointly undertake and fund the feasibility study for the Mid West Blue Hydrogen and Carbon Capture and Storage project.

The consortium includes heavyweight gas infrastructure major APA Group (ASX:APA), which will also provide the expertise for the infrastructure component of the project.

Pilot will bring its carbon management expertise to the table while Warrego Energy (ASX:WGO) will deliver natural gas supplies.

The feasibility study is scheduled for completion in the first quarter of this year.

Pilot’s feasibility studies are designed to assess blue hydrogen and CCS projects that can integrate with its Cliff head oil and gas field and existing infrastructure, to deliver competitive clean energy.

Previous pre-feasibility screening of the Cliff Head oil field’s potential for CCS indicated that it could sequester about 500,000 tonnes per annum of CO2 for 13 years at an injection cost of about $16/t of CO2, using the existing onshore and offshore infrastructure.

Using CCS to clean up industries

CCS isn’t just important in hydrogen production; it also has a key role to play in helping big polluters clean up their CO2 act.

Lingo pointed to gas projects like Waitsia in the Perth Basin as a prime example of where CCS could substantially cut CO2 emissions.

“The Waitsia Project at the current gas production, and you can read this right out of their environmental impact statement, is processing 300,000 tonnes of CO2 associated with their gas production and that is currently being vented,” he explained.

“Many of the gas fields in the Cooper Basin have 30-40% CO2 in the raw gas, all processed out and vented.

“The same is true for the Longford gas plant and with the development of new gasfields like Santos’ Kipper. That development environmentally approved them to emit CO2 emissions of over a million tonnes a year. That should be captured, cleaned up and sequestered.”

Lingo also noted that industries like cement works, fertiliser manufacturing and biofuel production also produce and vent CO2 and could benefit substantially from CCS.

He said it involved having the right regulatory and market settings to create an economic landscape that incentivised people to capture, store and eliminate CO2 emissions through CCS and other means.

The market fundamentals for delivering carbon emissions reduction solutions through CCS has delivered extremely strong price growth over the last 18-months.

Reputex Energy, a leading provider of modelling and forecasting services for the Australian renewable energy, electricity and carbon markets, reported in its Market Update of 18 January 2022 that 2021 was a year of records in the Australian carbon market, with prices and volumes of Australian Carbon Credit Units (ACCUs) up across the board.

Key outcomes (from 2020) include a 209% increase in prices, a 76% increase in ACCUs transacted in the secondary market and a 170% increase in ACCU market value.

Reputex Energy further reported in its latest Market Update of 27 January 2022 that the Australian carbon market had continued its positive run into 2022, with the tight supply setting translating into higher spot prices and increasing activity in the forward market.

The spot price for ACCUs is already up 11.8% in January, surging to record highs with the ACCU spot price rising to $57/tonne.

With such strong fundamental growth in the price of ACCUs and a focus on fundamentally strong CCS projects in Mid West Western Australia leveraging off an ownership and co-operatorship position in the Cliff Head Oil Field and the 100% owned and operated South West Blue Hydrogen and CCS Project near Kwinana, Pilot is very much leading the charge to merge a focus on renewable energy development with providing complimentary carbon reduction capability through CCS to deliver both competitive low-cost clean energy solutions.

This article was developed in collaboration with Pilot Energy, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.