WA test-drives the future of electric vehicles in a post-oil world

Energy

Energy

The Kwinana oil refinery’s closure in 2022 and its conversion to an import terminal has provided a remarkable opportunity to increase the take up of EVs among West Australians.

WA could be a test bed for ways to increase the popularity of EVs among the Australian public through different mechanisms such as government subsidies, lower vehicle taxes, or other incentives.

Electric vehicles are fast gaining in popularity, but they are starting from a very low level.

“There are around 1,100 registered electric vehicles in Western Australia,” said RAC of WA vehicles and fuels manager, Alex Forrest.

That means WA’s share is about 7.5 per cent of the total EVs in Australia, currently 14,730, according to insurer Budget Direct.

“Electric vehicle sales in WA are proportionally in line with uptake across the rest of the country and unfortunately, this is much lower than other developed nations across the globe where there is a wider choice of affordable EVs,” said Forrest.

Australian drivers and consumers are generally in favour of EVs, and a recent survey showed around half of respondents would be open to buying one.

“There is an appetite for EVs in Western Australia, with a recent RAC survey revealing that nearly one in two respondents would consider purchasing an electric or hybrid vehicle as their next car,” Forrest said.

There are several deciding factors in people’s purchase intentions for EVs including relative cost, access to EV charging points, and the range of choice on offer for make and model of EV.

“A key driver for EV sales in Western Australia is the number of new models coming onto the market each year, giving consumers more options to suit their needs and lifestyle,” said Forrest.

“There is now more choice than ever before for consumers wanting to make the switch to a low or zero emissions vehicle,” he said.

The RAC stressed it did not expect the closure of BP’s Kwinana oil refinery to impact EV sales in WA.

However, analysts have said that WA’s dependency on imported fuel products such as petrol and diesel will increase after the Kwinana oil refinery converts into an imports only terminal in 2022.

The refinery’s closure also has implications for WA’s fuel security, and the International Energy Agency recommends its member countries hold oil stocks equivalent to 90 days supply.

Australia’s three remaining oil refineries may also be vulnerable to closure in the next few years, effectively placing other states in the same position as WA.

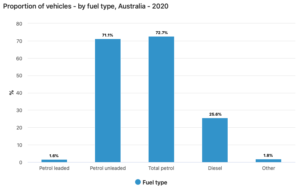

There are currently 19.8 million registered motor vehicles in Australia, an increase of 1.5 per cent on 2019 levels, according to the Australian Bureau of Statistics in its Motor Vehicle Census.

Petrol-driven vehicles accounted for 72.7 per cent of Australia’s motor vehicles, and diesel-powered vehicles 25.6 per cent.

Tesla is the top make of EV driven in WA, and all of the Elon Musk-led company’s models are popular, according to RAC WA data.

Japanese car maker Nissan’s Leaf model is highly favoured among EV drivers, as is the Hyundai Kona.

The Leaf retails for around $50,000, while the Kona ranges in price from $24,300 up to $65,290.

Some EVs on WA’s roads have been converted from petrol or diesel-driven engine models.

Other makes and models of EVs are available to drivers and prospective buyers in the WA market.

They include the Audi e-tron from $137,700 plus on-road costs, BMW i3 at $68,700 excluding on-road costs, Jaguar I-Place at $124,100 before on-road costs, and MG EZS at $49,990.

| Rank | Marque | Model |

|---|---|---|

| 1 | Tesla | All models |

| 2 | Nissan | Leaf 2010-2017 |

| 3 | Hyundai | Kona |

| 5 | Nissan | Leaf 2018 to present |

| 4 | N/A | Combustion engine cars converted to EVs |

Price is an important consideration for prospective purchasers of EVs and some higher cost models do attract higher taxes.

“The purchase price of EVs, which also often incurs the luxury car tax, continues to be a significant barrier to the uptake of EVs across the country,” said Forrest.

The luxury car tax (LCT) is applied at a rate of 33 per cent on the price of vehicles with a GST-inclusive value above the LCT threshold.

Currently, the LCT threshold is $77,565 for fuel efficient vehicles, and $68,740 for other types of vehicles, according to the Australian Tax Office.

That said, a second-hand EV such as a Tesla Model S, Nissan Leaf and BMW i3 can be acquired for as little as $16,000, although a top-of-the-range Tesla can cost $180,000.

It came to light Wednesday that the South Australian government has announced plans for a new road user charge for EVs from 2021.

The tax measure is intended to raise $1m in its first year, which works out currently to around $500 per EV in South Australia, according to reports.

Campaign group the Electric Vehicle Council said the new tax will disincentivise the take-up of EVs in South Australia.

The timing of the new tax is within a week of the South Australian government unveiling its EV transition plan for its government transport fleet.

Another factor that can inhibit the take-up of EVs in Australia is the number of charging points.

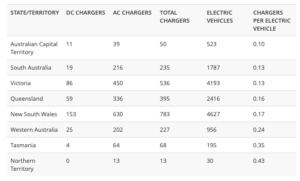

There are 2,300 EV charging points across Australia to service 14,730 EVs, according to research undertaken by Budget Direct.

Western Australia has 227 EV charging points across the state which covers one third of Australia’s land mass, according to insurer Budget Direct.

NSW has the most EV charging points at 783, followed by Victoria on 536, then Queensland with 395, and South Australia has 235.

Tasmania, the ACT and the Northern Territory each have fewer than 100.

An EV can complete a road trip across the Nullabor from Kalgoorlie in WA to South Australia’s Eyre Peninsula, a distance of 1,746km, as there are eight charging points en-route.

Still, there is effectively only one charging point for every four EVs in WA, according to Budget Direct.