‘Very positive for the gas industry’: Omega’s Trevor Brown on ADNOC’s Santos bid

The ADNOC consortium's bid for Santos could boost Australia's gas sector. Pic: Getty Images

A consortium led by Abu Dhabi National Oil Company subsidiary XRG made waves last month after it launched a “final non-binding indicative offer” that valued Australian gas major Santos at close to $30bn.

Santos’ (ASX:STO) leadership clearly felt the cash offer of US$5.76 ($8.89) per share – representing a 34% premium to the one-month volume weighted average price of $6.61 – valued the liquefied natural gas exporter fairly and recommended the offer, subject to reaching a binding agreement.

While there’s little doubt that the offer is a positive for Santos shareholders, it could also be a distinct positive for the Australian East Coast gas sector.

Omega Oil & Gas (ASX:OMA) managing director Trevor Brown has a storied career in oil and gas with over 35 years’ of experience in exploration, development and production in Australia, South East Asia and the US.

He also has more than passing familiarity with Santos given that he spent 15 years with the company first leading the Exploration and New Ventures Business, then as its Queensland vice president, where he led the Upstream (Exploration and Production) division of the $25bn Gladstone LNG project through development, construction and start-up.

In a chat with Stockhead, Brown touches on his thoughts about the ADNOC offer and what impact it might have.

What do you think motivated ADNOC and its partners to make the bid for Santos?

That’s a good question. I think probably strategic exposure to the LNG sector primarily and Australian resources and resource capability in particular.

I think competing offers are possible but I wouldn’t like to comment really as it is speculation.

In the event that it is successful, what impacts can we expect to see from the takeover for the Australian gas sector?

I think the entry of ADNOC to the Australian gas sector could be viewed as a very positive input.

It highlights the value and attractiveness of Australian resources in particular and Australian resource capability – the human capability of entering and prosecuting large international projects using Australia’s know-how of exploration, appraisal and development.

Australia’s attractive resource base requires capital and skills to develop and ADNOC will bring both of those.

Hopefully they intend to utilise Australia’s skills and the obvious attraction of the significant resources that are in Australia.

ADNOC’s investment also highlights the need to utilise capital to develop new volumes of gas into the market. That is the root problem for Australia.

Talking about diverting from export to the domestic market does not solve the root problem.

The root problem is to replace the volumes that are diminishing from the Bass Strait and add new developed volumes into the market.

Anything that adds to the capital and the ability to develop new sources of gas in Australia is very welcome.

Do you think this will have an impact on juniors such as yourself?

I think it’s very positive for the industry as a whole that significant foreign interest is investing in Australia’s resources for the long term.

It highlights the fact that there’s growing international demand for our resource base, in particular gas and LNG, also liquids.

It highlights that there’s a lot of value that can be accrued by Australia in the responsible development of our resource base. I think that’s really encouraging.

For a company like ADNOC to be investing, they have to be confident of significant scale as they have a large portfolio, value the attractiveness of the resource base and they must have confidence that we have regulatory settings and government policies that enable their responsible development.

Do you think the Queensland state government’s energy roadmap contributed to that bid from ADNOC?

Yes, I think so, because they must be well aware that while offshore resources are governed by the federal government, onshore are regulated by the state government.

They’ll be looking carefully at the long-term policy settings that each of the state governments are putting forward.

In recent times, we’ve seen a shift in some of our bigger resource states towards more encouraging policy settings for the development of any particular gas resource.

What are Omega’s plans going forward in the next 12 months or so?

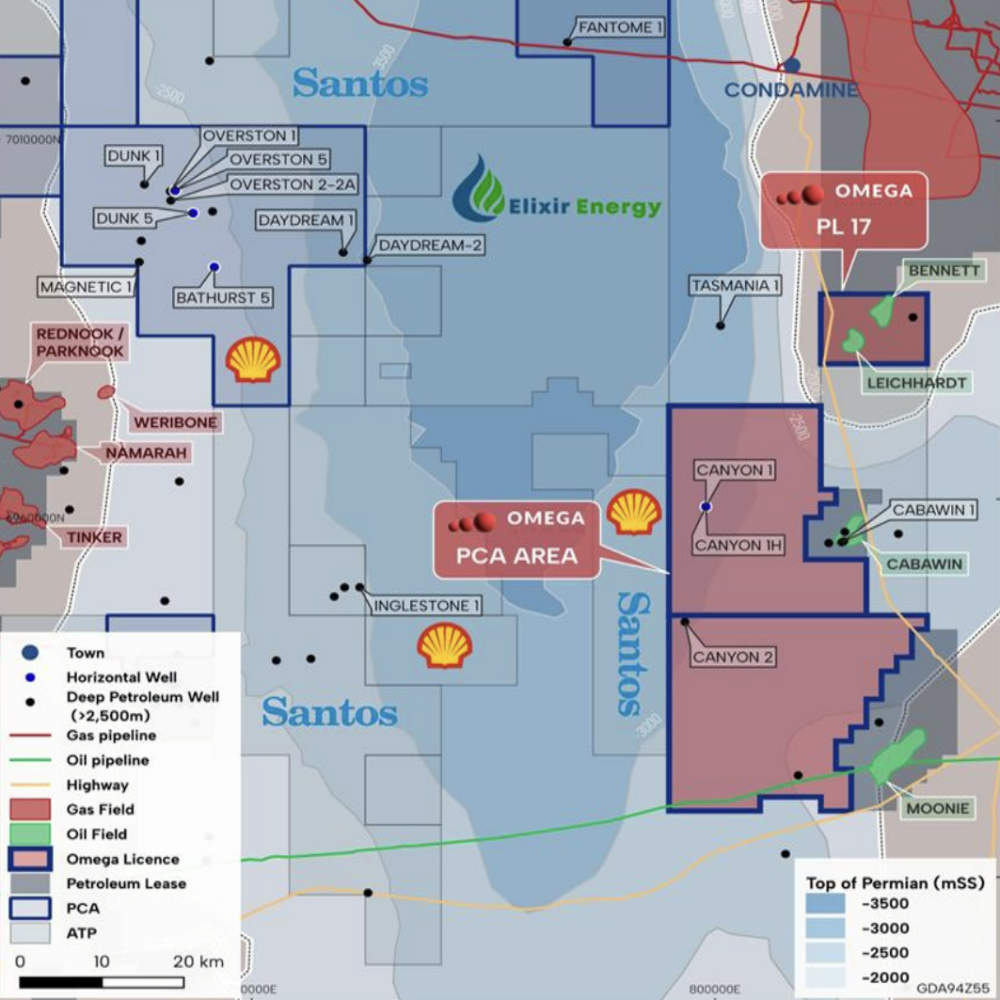

We will be looking to really understand the scale and distribution of our resources across our broad block, to determine the commercial pathways for the development of both gas and oil.

Omega will also work with some key industry partners to be able to look at our long-term partnering and funding options.

We are open to all sorts of arrangements including farm-ins as we have 100% equity and recently completed the purchase of the overriding royalty interest that was pertinent to our acreage.

This gives us complete strategic flexibility at both an asset and corporate level.

At Stockhead, we tell it like it is. While Omega Oil and Gas is a Stockhead advertiser, it did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.