Tri-Star sees echoes of game-changing US shales at Omega’s Canyon-1H discovery

Omega's Canyon-1H is a material oil and gas discovery says major investor Tri-Star. Pic: Getty Images

- Omega investor Tri-Star says the Canyon-1H is a material oil and gas discovery

- High pore pressures of Canyon Sandstone will help wells clean up faster and increase recovery factors

- Canyon compares very favourable with US unconventional liquids-rich shales

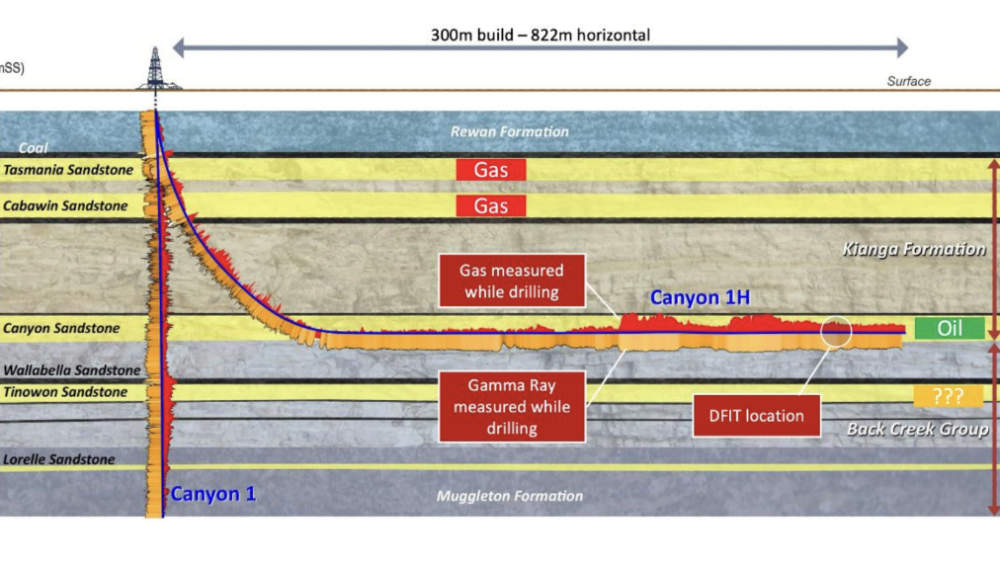

Omega Oil & Gas raised more than a few eyebrows when its Canyon-1H horizontal well in the Taroom Trough, Queensland, flowed significant quantities of light oil along with gas rather than pumping out strong gas flows with associated liquids.

During the flow-testing period, the well flowed at a peak rate of 452 barrels of oil and 600,000 standard cubic feet of gas per day and a sustained rate of 321bpd of oil and 472,000scfd gas from a 650m interval in the target Canyon sandstone.

For future development wells, this translates to a sustained rate of 987bpd of oil and 1.45 million (MM) scfd of gas from a 2000m lateral, which Omega Oil & Gas (ASX:OMA) said on March 26, 2025, demonstrated the Canyon project area hosted material oil and gas plays.

However, some punters were spooked by the well’s performance, presumably expecting that it would produce more gas than fellow Taroom Trough operator Elixir Energy’s Daydream-2 vertical appraisal well that managed a peak flow rate of 2.6MMscfd before dropping to a stabilised rate of 1MMscfd due to potential condensate or water banking around the corridor.

This neatly ignores the fact that OMA’s projected flow rates from a 2000m lateral would have been equivalent to gas flow of ~7.4MMscfd.

However, Butler family-owned Tri-Star Group – one of the largest shareholders in the company with a 19.9% stake and no stranger to the oil and gas sector in the US and Australian – is unfazed by the result with its chief executive officer Andrew Hackwood telling Stockhead the investment group is excited by the result.

Omega’s stacked oil and gas play

Hackwood said the results were unique as a lot of Australia’s gas is dry, that is to say that they are just methane (natural gas) with very little or no liquids (condensates or light oil).

“This is a potentially big play involving gas and liquids, so we just got a little bit of an unexpected result with oil being the pre-dominant commodity in the first well that we drilled rather than gas,” he added.

“You still got pretty solid gas rates and I think the really exciting thing is you could have a stacked play.

“A lot of investors in Australia have seen this as a binary test when it was really just one pay zone out of roughly 150m of pay that we tested.

“There’s still lots of untapped potential both regionally and in terms of it potentially having chambers above where we drilled, which could contain more oil, but also gas.”

He added that from a US perspective, unconventional projects can generally be very difficult and often require a steep learning curve to optimise well performance.

“It is very rare that you get it right first go and for Omega to deliver a really strong result on the first attempt demonstrates the significance of the discovery because the potential for optimisation beyond this well is enormous.”

US comparison

While an oil and gas find with potential for commercialisation and further growth is exciting in its own right, Hackwood was particularly enthusiastic about the similarities with the unconventional liquids-rich shale plays that transformed the US into a net oil exporter.

He noted that the rocks in Australia – such as those in the prolific Cooper Basin – are generally harder than those in the US, which impacts on their amenability to fracture stimulation.

However, Tri-Star (and OMA) was surprised about how well the Canyon Sandstone responded to the fraccing.

“We think the results may indicate that the rocks responded more in line with US basins than typically what we see in Australia,” Hackwood said.

“I’ll preface that with saying that we have got early well results, but we have looked at comparable basins in the US, looked at the fluid system and production profile, and it is similar to US benchmarks like the Bakken, the Permian, Wolf Camp A and also certain areas of the Scoop and Stack formations in Oklahoma.

“These are prolific liquids plays and they’ve generated significant revenue and it’s been the application of horizontal drilling and fracture stimulation that has unlocked their potential.”

The US experience has also proved that drilling more wells allows the process to be optimised, which reduce costs.

“There’s lots of opportunities when you do things at scale and when you do them repeatedly and when you have others in the area who are doing the same thing,” he said.

“Shell are exploring in the Western Taroom Trough in a very similar play and my understanding is that they’re deploying a lot of capital with the follow-up drill program.

“That must suggest that this opportunity compares very favourably with their global portfolio.”

Hackwood was also encouraged by the high pore pressure of the Canyon Sandstone, which will help the wells clean up faster and increase recovery factors.

“We did see oil and gas almost immediately when we started flowing this well which was a really good sign as we told the market,” he added.

“The well flowed a lot more strongly than we’d expected and even some of the best liquids players in the US, after three to six months on a development well, they require artificial lift.

Looking ahead

Given the strong well performance and favourable comparison to US, it is unsurprising that Tri-Star is very confident in OMA’s prospects.

“I think the key will be narrowing down the litany of future pathways that we have to those that make the most sense for Omega,” Hackwood said.

“You could focus locally around the well that we had great success on or you could explore regionally and you can certainly partner in different respects which is something we’re looking closely at across this whole place.”

He added the oil discovery was just another string in OMA’s bow and could generally be commercialised much quicker than gas as it could be simply trucked.

Hackwood also believes that Canyon could still play a role in easing the coming gas supply crunch on Australia’s east coast.

“Firstly, we think there are some gasier zones above the zone that we’ve just tested. Secondly, in our opinion, based on the early results, we believe it has the potential to be a world-class asset and have a great impact on both the Australian oil and gas markets into the future,” he said.

Canyon also benefits from higher gas prices in Australia as the US shales are focused on liquids with gas being almost a byproduct.

The US Henry Hub currently prices natural gas at US$4.165 ($6.64) per thousand cubic feet while gas on our east coast comes in at more than twice that at about $14 per gigajoule (which equates to ~947.8 cubic feet of gas).

Hackwood believes the market hasn’t really picked up the strong economics of gas in Australia’s east coast, which really helps when it comes to assessing commercialisation of both commodities.

“There are a lot of options that Omega needs to assess to ensure the best possible outcome for shareholders. We’re very confident that we have a lot of options in front of us that are extremely exciting and positive,” he concluded.

At Stockhead, we tell it like it is. While Omega Oil & Gas is a Stockhead advertiser, it did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.