Tlou says it’s totally not running out of money

Pic: Thana Prasongsin / Moment via Getty Images

Tlou Energy looks like it is struggling to stay afloat, according to the ASX.

The little company (ASX:TOU), which hopes to turn Botswanian coal seam gas into power, turned in some quarterly accounts which didn’t add up long term.

Cash in the bank was $5.5m but it plans to spend $3.3m of that come April.

The ASX is concerned that without more funds arriving in the foreseeable future, Tlou will become one of those companies that vanish, taking much shareholder funds with it.

In a release today, the ASX noted:

“It is possible to conclude … that if TOU were to continue to expend cash at the rate indicated … TOU may not have sufficient cash to continue funding its operations.”

In response, Tlou says it’ll have negative cash flows while it remains a gas explorer and power station developer, but it’s cutting costs now that gas drilling has completed.

It also says it’s talking debt funding or an equity raise with “external parties”, and discussions are at “an advanced stage”.

“The company believes that there is a significant likelihood that this investment will be successfully completed in the near term,” it said.

- Subscribe to our daily newsletter

- Bookmark this link for small cap news

- Join our small cap Facebook group

- Follow us on Facebook or Twitter

Tlou is exploring for coal-seam gas in Botswana and has a 2P reserve of 41 billion cubic feet and a significant contingent gas resources of 3 trillion cubic feet (3C).

Typically ‘reserves’ refer to oil or gas discoveries that are commercially recoverable using existing technology while a resource is an initial, untested estimate. A 2P means it’s proven and probable, while a 3P includes ‘possible’.

The problem is that while Tlou has applied for a licence to develop a 100 megawatt (MW) coal seam gas power plant in October, it’s still waiting to hear back.

If accepted, it can then sign up power purchases agreements and find backers for the project.

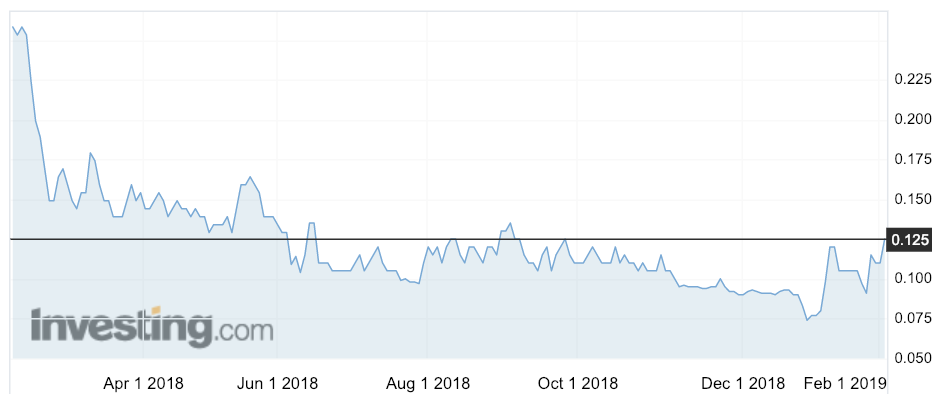

Tlou shares were up 14 per cent to 12.5c.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.