What’s next for Armour Energy as east coast gas gets hot

Pic: Matthias Kulka / The Image Bank via Getty Images

Playing the east coast gas market is proving to be one of the best bets in the resources sector.

Though finding entry points is not easy — which is one reason why Armour Energy is starting to attract attention.

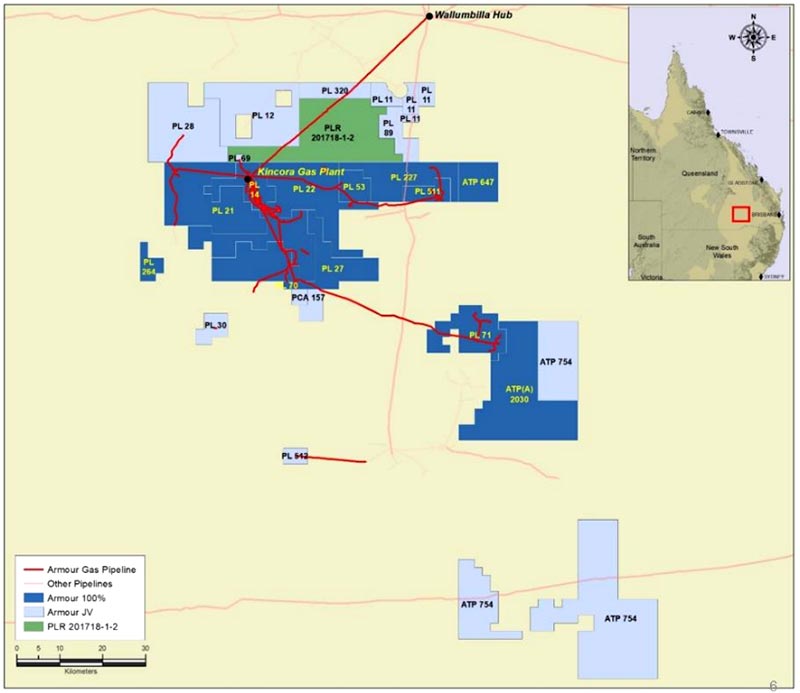

Extremely well connected at the corporate level, Armour (ASX:AJQ) is an oil and gas minnow generating modest revenue from a former Origin Energy oil and gas field near Roma in central Queensland — a region steeped in the history of the Australian oil exploration industry.

Armour’s key production asset at this stage of its evolution is the Kincora gasfield which it acquired from Origin Energy in 2015 for $13 million, elevating the small stock from the status of explorer to the more interesting status of producer.

First revenue from the Kincora purchase came in 2016 from the tiny Emu Apple oil project which is within the broader Kincora project area. The field re-started at just 50 barrels a day. Gas delivered into the nearby pipeline system followed soon after.

Small by any measure, Kincora generated revenue of $6.5 million in the latest quarter to June, up $1.45 million on March quarter revenue.

Despite the modest size of its producing asset Armour has growth plans.

It’s chairman, prominent resource sector investor Nick Mather, said at the time of the Emu Apple re-start that the Roma Shelf had spawned a number of Australian oil companies, including Beach Energy, Crusader Oil and Hartogen.

Early oil discovery

In fact, Roma is the site of one of Australia’s earliest oil discoveries, dating back to January 1953.

The Roma discovery was followed later that year with an oil discovery at Rough Range on the WA coast, with two discoveries within 11 months on different sides of the country putting Australia on the world oil map.

(Though that was premature in hindsight because it wasn’t until the 1960s that major oilfields were found, including Bass Strait.)

Mather said the return to Roma by Armour was aided by a new generation of oil-hunting technologies, including 3D seismic and extraction technologies such as hydraulic stimulation (pumping hot water into an oil reservoir to liberate viscous material).

More can be expected from Kincora and the surrounding tenements controlled by Armour, including a 318 sq km block recently awarded to the company by the Queensland Government.

The latest authority-to-prospect (ATP 2032) is immediately north of existing acreage held by Armour and close to the Kincora gas plant.

Armour is steadily increasing output at Kincora with the potential of a lot more to come as recent discoveries such as that made in the Myall Creek 4A well where a 300m section of gas-charged sands is being hydraulically stimulated.

The Kincora facility and surrounding tenements are the engine-room of Armour in its current form but the ambitions of the company’s management go well beyond the Roma Shelf and Surat Basin of middle Queensland.

A four-phase corporate development plan which started in 2015 has already reached stage three which is designed to expand gas sales to a targeted 20 terajoules a day, double the project’s current output.

What’s next

The next growth stage, planned for next year and 2020, includes a target of 30TJ of gas a day, refinancing of assets, new infrastructure, and a step out to exploit acreage across Armour’s broader portfolio which includes an extensive land-holding in north-west Queensland and the Northern Territory.

Watching the growth of Armour’s oil and gas interests will be one way of following the stock which has moved up from 7c to 10c since the start of the year (with 1c of that coming last week).

At its latest price (see graph above) the company has a market value of $48.8 million.

Another way of watching Armour is to keep an eye out for corporate activity because Mather has extensive resource interests through his master investment business, DGR Global, which is Armour’s biggest shareholder with a 22.4 per cent stake.

One of the better-known assets held by DGR is a 12 per cent stake in SolGold, a London-listed copper and gold explorer with a plum asset in Ecuador which has attracted the attention of BHP and Newcrest, and which might become subject of a future bidding duel.

Armour might be one of DGR’s lowest profile investments but it has the oil and gas history of Roma behind it and an east coast gas shortage ahead which makes it a business of interest.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.