Only one small cap is set to cash in on Anadarko’s $29b LNG project in Mozambique

Pic: Matthias Kulka / The Image Bank via Getty Images

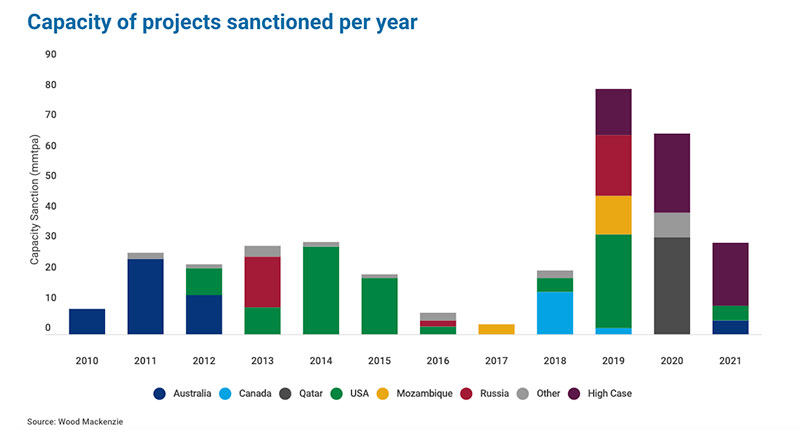

“The LNG boom is back,” proclaimed Wood Mackenzie global LNG supply research director Giles Farrer in April.

He’s not exaggerating. Almost 90 million tonnes per annum (Mtpa) of liquefied natural gas (LNG) projects are slated to begin construction over the next two years.

The capital spend will reach a combined $US200 billion ($291.1 billion) between 2019 and 2025.

Mozambique will be one nation at the heart of this new boom, with three massive projects boasting a collective start-up capex of $70 billion about to ramp up in a big way.

On Tuesday, US energy firm Anadarko officially committed to developing its $US20 billion Mozambique LNG project. The largest single LNG project approved in Africa will now advance to the construction phase.

Labour hire and training company RBR Group (ASX: RBR) has been working behind the scenes for five years to get a slice of this $70 billion construction spend.

For RBR, this Anadarko final investment decision (FID) has opened the door to a raft of potentially lucrative contracts.

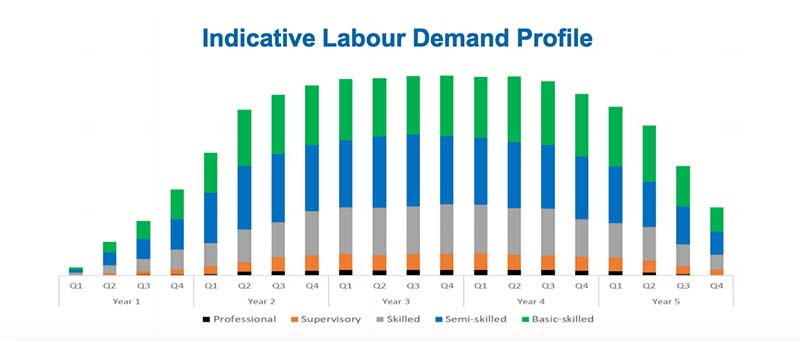

This project (and the rest) are going to need a lot of skilled workers – at least 50,000 of them during construction. It’s a veritable labour-hire gold mine.

RBR can either earn a one-off fee for placing workers into jobs or be paid an ongoing daily commission for supplying workers on a temporary basis.

Based on a target market share of 10 per cent — or 5000 workers — RBR says it could make $30m clear profit per year from workforce placements.

RBR can also earn additional revenue by assessing the skills of potential workers in the key areas of health and safety, welding plate/pipe, scaffolding, rigging, pipefitting and steel erecting.

So far, RBR is the only ASX-listed company with exposure. Not only that, the company says the barriers to entry are so arduous it has a major head start over any latecomers.

- Subscribe to our daily newsletter

- Join our small cap Facebook group

- Follow us on Facebook or Twitter

RBR chief executive Richard Carcenac says the company’s $13m market cap doesn’t reflect the size of this opportunity.

“We are very confident we will get contracts because we are so uniquely positioned,” he told Stockhead.

“We are often asked ‘what’s stopping another company, like Programmed in Australia, going into Mozambique and completely destroying RBR?’

“The answer is that the barriers to entry in Mozambique are extremely onerous from a bureaucratic perspective.”

The big barriers to entry are getting the licenses and accreditation you need to be able to deliver these skills to the workplace, he says. Only one other small private company has reached a similar stage.

“It’s not about money – it’s taken years to get the kinds of capabilities and licenses that we have,” Carcenac says.

RBR “certainly” expects to have signed contracts by the end of the year, but a lot will happen over the next three months as construction activity ramps up.

This is when they expect many of these contract opportunities to arise.

“The thing people don’t really realise is that in order for Anadarko to make its final investment decision they had to secure project financing,” Carcenac says.

“To get project financing they had to pre-sell 85 per cent of their production, starting in 2024. It’s going to take them at least five years to build this facility, so they are under a bit of pressure to get moving.”

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.