‘There is no bear case for uranium in 2024’

Uranium has started 2024 the same way it ended 2023 – like a bull in a china shop. Spot prices are now agonisingly close to US$100/lb for the first time since 2008, with term pricing not far behind.

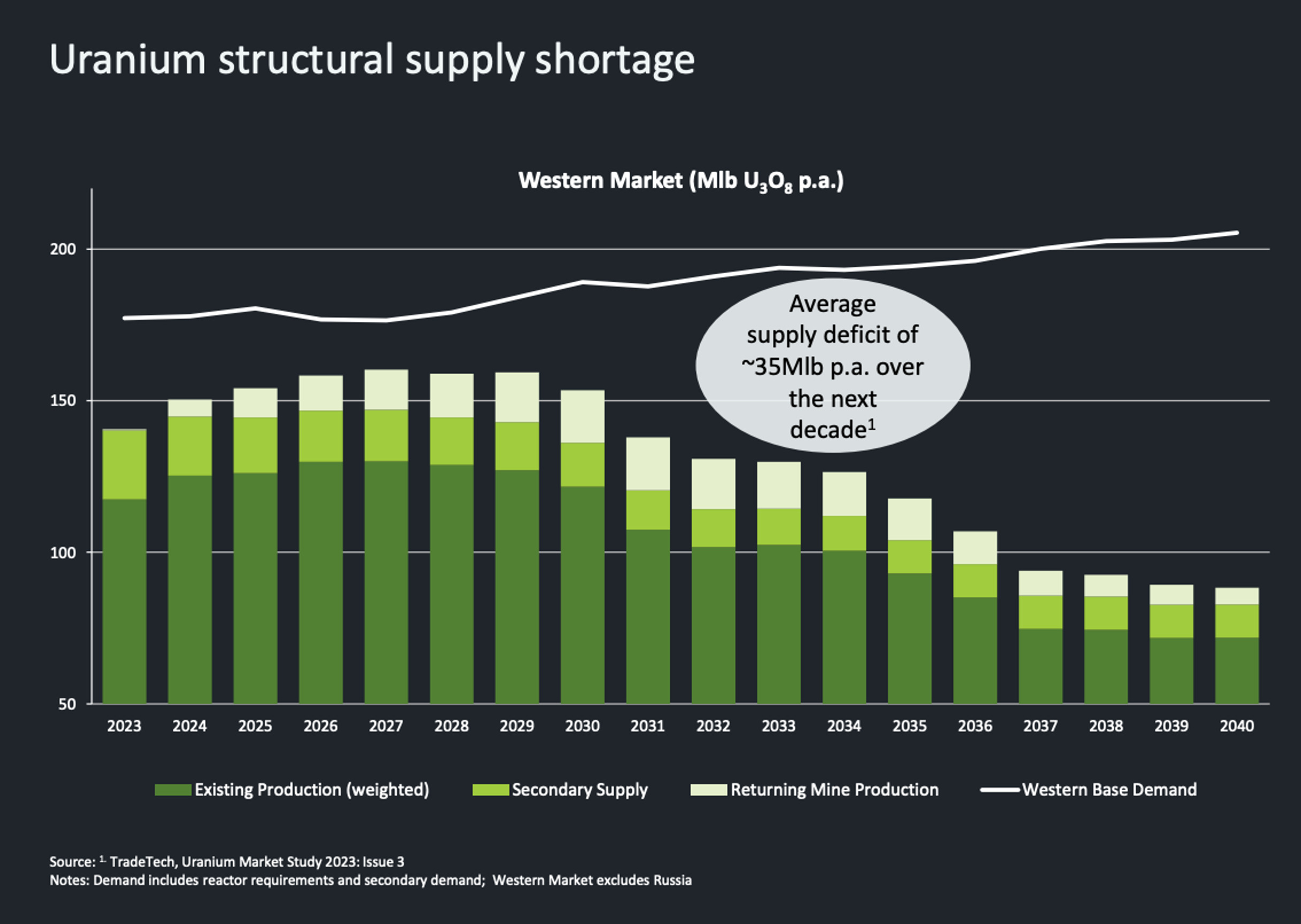

“This year alone, demand is around 200 million pounds and supply is about 160 million pounds,” says Justin Huhn, founder of Uranium Insider.

“That means we’re about 40 million pounds short.”

The years of deficits which helped push prices up 90% last year are not going away, even as mothballed mines enter restart mode and advanced projects hit the button on development.

This speccy graph explains why global resources stocks, pundits and punters are boarding the yellowcake train.

A 35Mlb a year deficit is huge.

Boss Energy’s (ASX:BOE) Honeymoon and Paladin’s (ASX:PDN) Langer Heinrich will produce a collective ~9Mlb per annum once fully ramped up. In 2023, production from global major Cameco amounted to around 19Mlb, which will increase to ~22Mlb from 2024.

Basically, we need another 1.5 Cameco’s to hit base demand out to 2040. A tough ask, considering a uranium mine takes 10-15 years to come online, from discovery hole to first production.

Even noted contrarian investors Goehring & Rozencwajg don’t have a bear case for uranium in the near term.

“The reason being that underlying market fundamentals are still ratcheting tighter,” Leigh Goehring told Stockhead.

“However, when a consortium of utilities is forced to approach the Sprott uranium trust (SPUT) in order to secure supply, that will be the signal to get out of everything uranium (but we are nowhere near that point yet).”

Hold on. What’s a SPUT?

In 2021, the Sprott Physical Uranium Trust (SPUT) started buying up physical uranium, taking it out of market circulation.

This uranium will not be on-sold for a quick profit.

Instead, pounds bought by SPUT will be impounded for the long term and, crucially, each pound bought will be one less pound available for end-users during the next cycle.

Called “a spark for a uranium market stuffed with dry tinder” by Bannerman Energy (ASX:BMN) boss Brandon Munro in 2021, it has been credited with accelerating the bull market.

It currently has over 63Mlbs of yellowcake under lock and key, worth over US$5.8 billion dollars.

Could SPUT sell out and snuff the bull market?

Not easily. Talk of a redemption feature being added to SPUT — involving up to 5% pa of their inventory being available for on selling, once or twice a year –has been quashed, for now.

Cantor Fitzgerald reaffirm their BUY Rating and raise Price Targets from US$23/C$31 to US$26/C$35⏫ for @Sprott Physical #Uranium Trust (TSX: $U.U $U.UN OTC: $SRUUF) as new $1.5B Preliminary Base Shelf Prospectus has “Redemption Feature Out, Uranium Stays In” #Nuclear pic.twitter.com/MqXdckzPXa

— John Quakes (@quakes99) January 2, 2024

Not that a redemption feature would’ve been a bad thing, says Munro, who believes a mechanism logically limited to traders (punters can’t redeem a drum of uranium and put it in the garden shed) would attract more generalist funds to SPUT and limit its volatility.

“When the Silicon Valley Bank collapse was wreaking havoc on equities, [SPUT] traded as low as 14-15% discount to the value of the uranium,” he says.

“What the redemption mechanism is designed to do is to create an arbitrage opportunity for traders, so it would never gap down that much.

“Once it is more than a 4-5% discount to the value of the pounds, uranium traders would be able to come in and buy SPUT units and on sell those positions ahead of a redemption opportunity and make 2-3% on the turn, which is pretty attractive for effectively zero risk.”

Either way 5% of pounds, twice a year, wouldn’t make a dent in the supply-demand story, Munro says.

But that isn’t what Goehring is talk about.

He is talking about a multi-billion-dollar buyout of the entire fund by desperate utilities.

“Goehring & Rozencwajg, a super smart hedge fund in the US, say a top of the market signal will be when a bunch of utilities get together and try and take over SPUT,” Munro says.

“Yes, it’s all possible, but to takeover of the entire trust and access the pounds that way would cost, on today’s numbers, US$7bn.

It’s a long way from the market being so tight that they would be capable of doing that.”

Looks like 2024 will be another good year for uranium.

“I think it’s going to be a great year,” Munro says. The punters certainly think so.

#Uranium was red-hot in 2023, gaining ~90%. Where do prices (in US dollars) go in 2024?

— Stockhead (@StockheadAU) January 4, 2024

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.