The world is switching on to alternative battery technologies

Solid state salt and vanadium redox flow batteries are a viable alternative to lithium batteries for grid applications. Pic: Getty Images

- Demand for rechargeable batteries is growing as the use of solar and wind grows

- While lithium-ion batteries are in the lead, other battery types are making waves

- Solid state salt and vanadium flow batteries provide credible alternatives for grid storage

No matter how you look at it, rechargeable batteries are front and centre of the push towards zero emissions, as there is simply no more convenient way that renewable energy can be stored for later use.

While there are certainly other ways of storing energy such as pumped hydro and molten salt, they simply do not have the flexibility that batteries of all stripes bring to the table.

Regardless of their specific chemistry – nickel manganese cobalt (NMC), lithium iron phosphate (LFP) and other lithium-ion batteries can be deployed far quicker and scaled more easily than alternatives.

They can be used for fixed applications – grid or home storage, battery electric vehicles or even small devices such as handphones.

Excluding batteries used in vehicles, devices or homes, the Australian Energy Market Operator has flagged in its Integrated System Plan that Australia will need 19 gigawatts of energy storage capacity in the grid by 2030, with this figure more than doubling to 43GW by 2040.

Batteries will be the key technology, which the Federal Government has recognised with the National Battery Strategy – itself part of the Future Made in Australia policy, which outlines how it will support the domestic battery industry by expanding manufacturing capabilities and improving skills.

More broadly, S&P has flagged that battery demand is expected to rise at a 18.9% compound annual growth rate between 2023 and 2030.

But lithium won’t be the only technology to play its part.

Solid state sodium chloride batteries and vanadium redox flow batteries will also bring their own strengths to the table, particularly for grid storage applications.

Solid state sodium chloride batteries

A common concern about lithium-ion batteries is the need for critical minerals like lithium, nickel and cobalt, which can be scarce and prone to price spikes.

This is something that Altech Batteries (ASX:ATC) is looking to correct with its CERENERGY technology, which uses common table salt and ceramic solid state technology to create batteries that are up to 50% cheaper than regular lithium-ion batteries and are ideally suited for grid storage applications.

ATC chief financial officer Martin Stein told Stockhead that the sodium in salt forms a molten sodium anode when the battery is heated, thereby charging and discharging the battery.

“This is different to lithium-ion batteries which have a liquid organic electrolyte that overheats and catches on fire and explodes,” he added.

CERENERGY sodium-alumina solid-state batteries also have the ability to function in a wide range of temperatures of between -20 degrees C to +60C, making them suited for operating in all but the most extreme conditions.

The batteries also have lifespans of over 15 years and have energy capacity that’s comparable to LFP lithium-ion batteries.

While they are not suited for use in electric vehicles, which require very high power in a short period, the performance characteristics of CERENERGY batteries make them ideally suited for grid storage.

“As the world transitions to renewable energy from solar and wind, massive industrial sized batteries are required to store the surplus of renewable energy produced, to return to the grid when the energy is not being produced – such as night time for solar – thereby stabilising the grid and providing energy 24/7,” Stein added.

He noted that ATC released its definitive feasibility study for the CERENERGY battery in March 2024 and is now progressing with sales offtake and finance to construct the 120 megawatt hour (MWh) plant to be built on its land in Germany.

The company is currently progressing manufacturing of the first of two 60 kilowatt hour (kWh) CERENERGY battery prototypes and has together with partner Fraunhofer, worked out design improvements that seek to improve the cell’s energy capacity and reduce nickel content while allowing for slightly faster charging and discharging.

“Altech is now fully focused on securing the sales and offtake,” Stein concluded.

Vanadium redox flow batteries

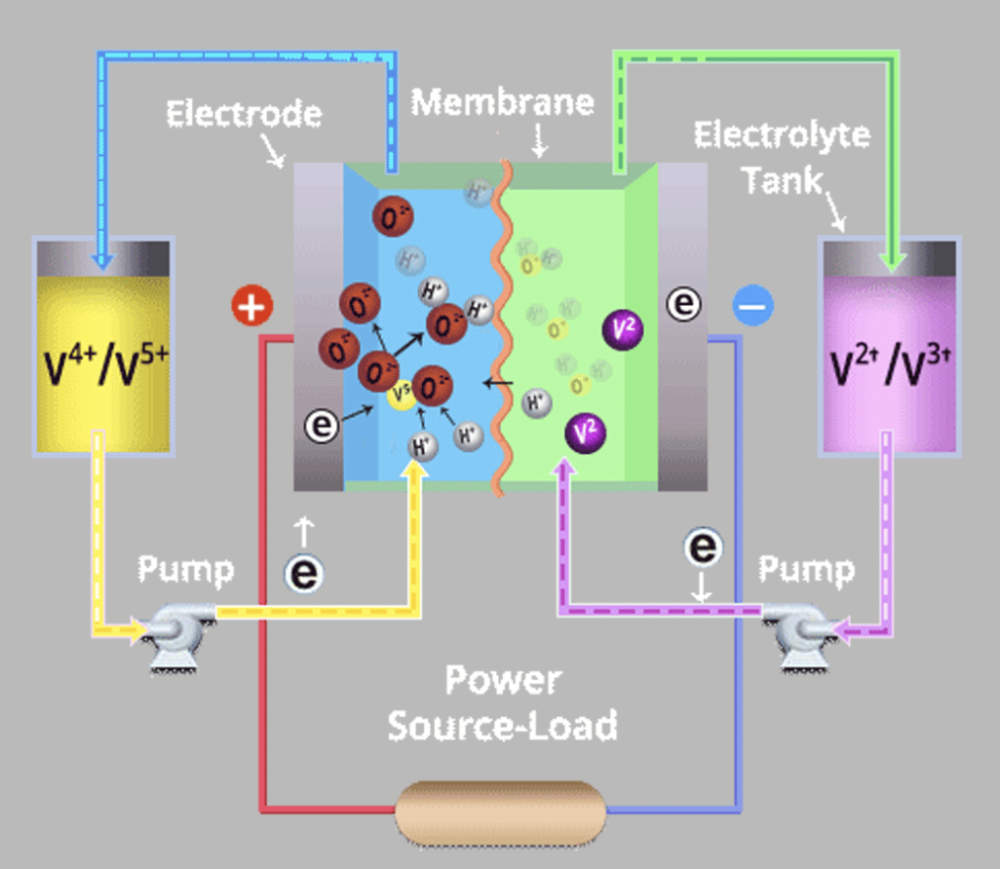

The other major battery technology that’s poised to make waves in grid (and potentially home) storage is vanadium redox flow batteries (VRFBs).

VRFBs use vanadium in the electrolyte solution and do not require critical minerals such as nickel or cobalt that could be expensive or have constrained supply chains.

They are considered to be safer, more scalable, and longer lasting than their lithium counterparts with a lifespan of more than 20 years, or up to 25,000 cycles.

These are far safer than lithium-ion batteries and have a broad range of operating temperatures.

They can also be discharged completely – that is to be completely drained of energy – and store energy for long periods of time with no ill effects, which is not the case for lithium batteries.

VRFBs are already starting to be rolled out commercially, a prime example being China’s Rongke Power in Dalian province, which connected its first phase 100MW/400MWh system in 2022.

Rongke recently conducted the world’s first black start – restoring a power plant to operation without relying on external power – of a large-scale thermal power unit using its VRFB technology.

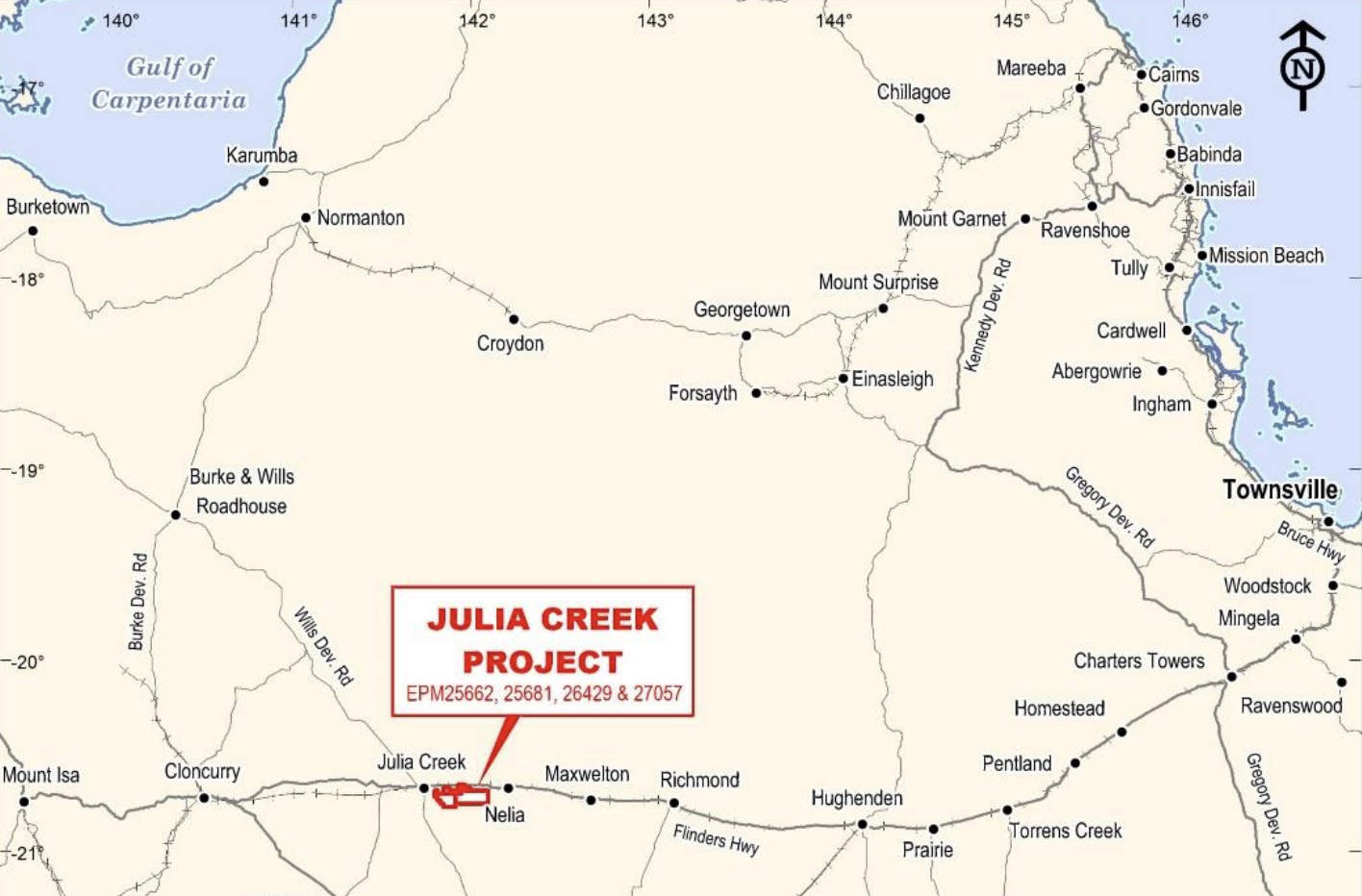

While there are a number of ASX plays with vanadium assets, QEM (ASX:QEM) has been making good progress with its Julia Creek vanadium and oil shale project in Queensland.

The company recently released a scoping study which estimated life of mine revenue of $11.5bn from vanadium production with another $10.1bn from the sale of transport fuel, which will generate post-tax net present value and internal rate of return – both measures of profitability – of ~$1.1bn and 16.3% respectively.

Pre-production capex inclusive of contingency costs and indirect costs is estimated at $1.095bn with payback in about five years.

Julia Creek will produce about 10,571t (23.3Mlbs) of vanadium pentoxide and 313 million litres of transport fuel per annum over the estimated 30-year life of mine.

The project currently has overall resources of 2.87Bt grading 0.31% V2O5 with 461Mt at 0.29% V2O5 reporting to the higher confidence indicated category.

At Stockhead, we tell it like it is. While Altech Batteries and QEM are Stockhead advertisers, they did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.