The world is getting windier and there’s just three stocks that want to cash in on that

Wind power has been criticised for many reasons, one of which is that it is unreliable.

For three straight decades since the 1970s, the average wind speed slowed down by an average of 2.3 per cent per decade.

But Princeton University research, released on Monday found the 2010s have bucked this trend. Average wind speeds have risen by 7 per cent – more than three times the decline.

Large scale ocean and atmospheric circulation patterns are making wind speeds faster again and this is expected to continue into the 2020s.

The report said this would be good news for wind farm owners because they can generate more energy.

Specifically, it was estimated renewable energy generated by wind-farms could increase by more than a third to 3.3 million kilowatt hours by 2024.

“The reversal in global terrestrial stilling bodes well for the expansion of large-scale and efficient wind power generation systems in these mid-latitude countries in the near future,” said the study’s co-author Dr Adrian Chappell.

Wind will rise as coal declines

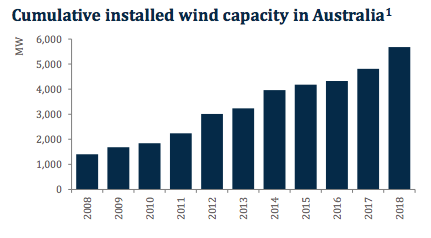

Wind capacity in Australia has been picking up long before this week’s report in conjunction with the decline of coal.

The Clean Energy Australia report 2019 found over 5,000 megawatts of cumulative wind capacity was installed in 2018.

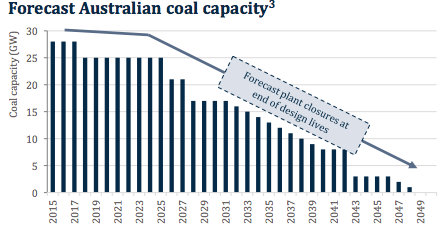

While coal is well ahead of wind power and will remain stable into the 2020s, it is expected to quickly drop after that.

Although the federal government has been slow to increase Australia’s renewable energy uptake, some states and territories have been more proactive.

New South Wales aims for zero net emissions by 2050 and the ACT targets 100 per cent by 2020. South Australia wants 75 per cent by 2025, Victoria 40 per cent by 2025 and Queensland 50 per cent by 2030.

So who’s involved in this space? While there are plenty of renewable energy stocks, only three ASX small caps are involved with wind power.

Infigen Energy (ASX:IFN)

Infigen has seven wind farms around Australia that are producing and several more in the development pipeline. Three of these are in New South Wales, three are in South Australia near Lake Bonney and the final one is in Western Australia.

In its October production update, the company reported that it produced 152 gigawatt hours of energy, 19 per cent more than the same month in 2018, from its seven wind farms across Australia.

In the financial year to date, it has produced 677 gigawatt hours, 10 per cent higher than this time last year. Last year it made earnings of $165.3m and a profit after tax of $40.9m.

In its results presentation, Infigen claimed it was leading Australia’s transition to a clean energy future.

A spokesperson for the company told Stockhead they found the Princeton study interesting, but declined to comment on whether it had any impact on the viability or productivity of its projects.

In the last three months Infigen’s shares are up over 30 per cent.

Windlab (ASX:WND)

Windlab has several projects in Australia and overseas – in Canada, the US and South Africa.

In Africa, it is aiming to help the 620 million people in sub-Saharan Africa without access to electricity.

In its half yearly presentation Windlab said it had completed over 1 billion megawatts in wind generation projects and had a total pipeline of 7.7 billion.

Chief operating officer Rob Fisher told Stockhead he was confident in the forecasts. However he also declined to comment on the Princeton research.

Windlab has had a tough couple of years since its 2017 IPO, having more than halved since then.

The company is currently undertaking a strategic review to improve shareholder value.

Windlab hired Moelis to assist, saying it is open to “alternative asset ownership models”.

Genex Power (ASX:GNX)

You’d probably know Genex as a hydro power company. Its signature project at Kidston will be a 186km-long single circuit transmission line that will have a capacity of 250 megawatts.

In September, the Queensland government agreed to invest $132m into this project.

But at Kidston, Genex also has a wind project that will ultimately have a capacity of 150 megawatts. The project is currently at the feasibility study stage.

Kidston used to be a gold mining town from 1907 until 2001. But the glory days ended in the 70s when the last hotel closed.

While it had been a modest year for Genex, the stock fell by more than a third at the start of November when it delayed a financing transaction for its hydro project into 2020.

Has the time come for offshore wind power to take its place in Australia?

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.