The clock is ticking for Santos & Total to farm into Melbana’s project

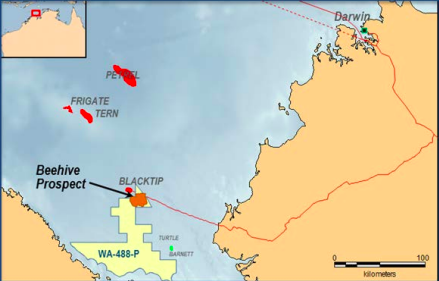

Shareholders of Melbana Energy (ASX:MAY) are eagerly anticipating October 2nd. That is the latest date when Santos and Total SPA can farm into its Beehive exploration well and confirm the drilling of its first exploration well.

Melbana has estimated a best case recoverable resource of 388 million barrels at Beehive (with 299 million being oil) and it will have the remaining 20 per cent interest.

The 80 per cent could be split 50-50 between Total and Santos or held entirely by one of them. This would be subject to them fully funding the costs of the first well and other joint venture costs.

West Australian broker Hartleys released a report this week noting that the option exercise was “the main potential positive catalyst” for Melbana.

Its most recent valuation of Beehive was $US20m but the broker said, “as time goes by [Beehive] looks more and more like the jewel in MAY’s crown”.

“Obviously if Santos and/or Total exercise their option to drill Beehive this valuation could increase further or vise versa.”

The broker has set a 12 month price target of 2.2c — double what it is today.

Cuban sunshine?

Hartleys also viewed Melbana’s flagship Cuban project, Block 9, bullishly — valuing it at $US24m. But the termination by Melbana of a farm-out agreement will likely leave investors nervous. Furthermore, its CEO quit in July and Melbana will likely need a $US2.3m bank guarantee for the project.

Block 9 is only 30km away from Cuba’s largest oil field Varadero or Block 10. Toronto-listed Sherritt International owns and is drilling the well.

Hartleys noted drilling results were coming soon and, “success here would obviously revitalise exploration interest in the North Cuba oil trend”.

- Subscribe to our daily newsletter

- Join our small cap Facebook group

- Follow us on Facebook or Twitter

Cuba is keen to source more of its own energy having relied for many years on Venezuelan imports.

Last November, Cuba announced it had oil and gas output potential of 22 million barrels per year. Of this amount, 72 per cent (16 million barrels) was crude.

Current production of petroleum in Cuba only meets 60 per cent of domestic demand.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.