The 4 ASX players turning to hydrogen to help reduce emissions in Australia’s transport sector

Pic: Getty Images

Decarbonisation has made hydrogen the element of the moment, yet actual deployment is lagging.

While scaling up is important to meet net-zero targets, it is also equally important for lowering supply costs and facilitating international trade.

The hydrogen market is still in its infancy, but experts believe the world’s transition to a greener economy is ushering in huge demand for low carbon energy sources to replace high-carbon ones, particularly in hard to abate sectors.

Hydrogen has a variety of different end uses including as a liquid fuel for transportation, an energy carrier to store and transport power, as a source of industrial heat, a feedstock for making other chemicals, and as a reducing agent for stripping oxygen from ore.

However, the strongest demand for hydrogen in the near-term, according to Monash University Department of Civil Engineering senior lecturer Dr Stuart Walsh, is poised to come from its ability to be used as a fuel in vehicle fleets where high uptime, fast refuelling and long range is key.

This is particularly true for a country like Australia where emissions from transportation are intensified by long distances between population centres, a lack of mandated emission standards for road vehicles, and poor public transport infrastructure.

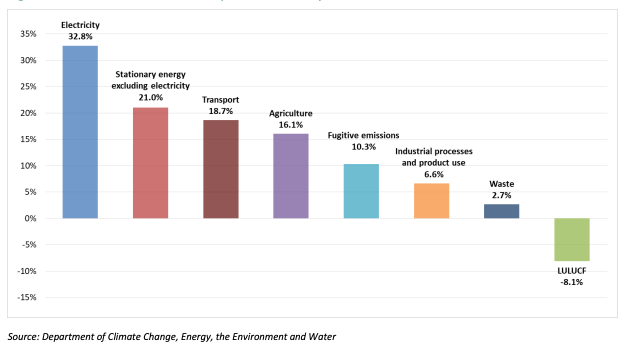

Australia’s transport sector contributes 18.7% of total emissions

Transport sector emissions include the direct burning of fuels for road, rail, domestic aviation and domestic shipping, but exclude electricity for electric trains.

In the year to March 2022, Australia’s transport sector produced 18.7% of our greenhouse emissions, according to the Australian Government’s National Greeenhouse Gas Inventory, with cars, buses, and trucks accounting for more than two-thirds of that total.

When it comes to trains, the Climate Change Authority estimates passenger and freight rail combined accounts for 4% of Australia’s carbon emissions.

While hydrogen and the fuel cells that use it have some cost and infrastructure barriers, the upside for transportation is huge.

The poster-child for these applications, according to Walsh, is forklift operations, where for large warehouses hydrogen fuel cells already have a competitive advantage over other types of engines.

In the US, more than 50,000 hydrogen powered fuel forklifts are already in use and their numbers are increasingly rapidly.

“Another sector that is showing increasing uptake of hydrogen powered vehicles is in garbage collection, which again benefits from rapid fuelling as well as the added advantages of lower pollution and reduced noise compared to conventional vehicles,” he explains.

“Slightly longer term we hope to see the uptake of hydrogen-powered long-distance transportation, where hydrogen’s higher energy density and faster fuelling will provide a competitive advantage over electric long-haul trucks.”

Aussie companies jumping in

One ASX player positioning itself to package up long-term hydrogen fuel and hydrogen fuelled buses, trucks, prime movers, and waste collection trucks is NSW-based company, Pure Hydrogen (ASX:PH2).

In 2023, PH2 managing director Scott Brown says the company is focused on advancing the development and trial of a hydrogen powered prime mover truck for global food conglomerate Pepsi, and the co-development of a hydrogen garbage truck for leading Australian waste management company JJ’s Waste & Recycling.

Both vehicle prototypes are expected to be delivered in Q2 2023.

The company also has a 23% stake in hydrogen fuel cell electric vehicle company, H2X Global, which it is working with to develop a range of products including vans, minibuses, SUVs, forklifts, and utes.

H2X recently signed an MoU with Norwegian Hydrogen AS, a green hydrogen production, distribution, and refuelling company, for the offering of a total ecosystem for the supply of hydrogen – from refuelling stations, commercial vehicles, and the production and purchase of green hydrogen.

Another player in the space is Lion Energy (ASX:LIO), who signed an agreement with Fueltech Hydrogen for the supply of a refuelling package and tube trailers for the new Port of Brisbane green hydrogen hub last week.

The package, which is scheduled for delivery in September 2023, is a key part of the hub that is geared towards heavy mobility fleets, with an initial focus on back to base public bus fleets.

LIO managing director Tom Soulsby says Lion Energy has been working with the bus industry on their specific requirements around refuelling reliability and speed, as part of its broader green hydrogen to industry strategy.

$LIO has signed a ~US$1.8m contract with Fueltech Hydrogen for refuelling and tube trailers to be located at Port of Brisbane’s green hydrogen hub. Delivery in Sep23.

Read more at https://t.co/eW8ChIZ2oT

#Greenhydrogen #Lionenergy #ASXnews #PortofBrisbane #EnergyNews pic.twitter.com/44h5ldUE9e— Lion Energy Ltd (@LionEnergyASX) March 13, 2023

NASDAQ-listed Hyzon Motors says it will be towing cars and potentially collecting garbage this year in an Australian designed and built 27-tonne hydrogen powered truck.

A Hyzon fuel cell electric truck is already in operation in Germany with DB Schenker, one of the world’s leading logistics services providers who is using the truck daily between Cologne and Eupen, Belgium.

Train companies getting on board the hydrogen chain gang

Australian rail and trucking companies have also started to investigate fuel switching options to hydrogen power.

Pacific National, one of Australia’s largest rail freight companies, is exploring ways of lowering fuel emissions by using biodiesel and hydrogen and is even looking into hybrid freight trains that use a combination of diesel and battery power.

Rival rail freight business, Aurizon (ASX:AZJ), is undertaking a $12m trial called the Hydrogen Mobility Project to replace its diesel trucks with hydrogen vehicles, beginning from late 2024.

Using renewables-based hydrogen produced in Queensland from the Ark Energy operated SunHQ Hydrogen Hub in Townsville, Aurizon says the project will see four hydrogen-powered prime movers haul goods in and around its freight operations at Stuart Terminal and the Port of Townsville and will also include the installation of a hydrogen refuelling station in Townsville, Queensland.

The company is also working on a feasibility study with global mining company, Anglo American, to assess the introduction of hydrogen-powered trains for bulk freight.

If the feasibility study is successful, the agreement could be extended to further phases of collaboration, which could include detailed engineering and the development of a hydrogen fuelled heavy haul locomotive prototype.

Hydrogen takes to the skies

Moving across to aviation, Twiggy’s Fortescue Future Industries – the green arm of iron ore giant Fortescue Metals Group (ASX:FMG) – has joined a group of companies aiming to operate commercial hydrogen-powered flights by the end of the decade.

The consortium, whose members include Air New Zealand, Airbus, energy company Hiringa Energy and hydrogen company Fabrum, will embark on a research project over the next six months to “design a hydrogen ecosystem for aviation”.

In its first phase, the project will focus on research which will be completed by the end of 2023, and in its second phase, the focus will be on whether hydrogen aircraft test flights can he held in New Zealand.

Airbus is already working to develop and put into service the world’s first hydrogen-powered commercial passenger aircraft by 2035.

Earlier this month California based start-up, Universal Hydrogen, completed its first 15-minute flight with a hydrogen-fuelled powertrain, built around Plug Power’s ProGen family of fuel cells at Grant Country International Airport in Washington, USA.

The flight represented the largest hydrogen fuel cell powered airplane ever to take to the skies and largest airplane to cruise principally on hydrogen.

Hydrogen stocks in transport share prices today:

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.