Tamboran is positioned to be the Beetaloo’s rising gas star

Pic: Vertigo3d / E+ via Getty Images

The Beetaloo Basin in the NT has been touted as the solution for eastern Australia’s gas supply woes and Tamboran Resources is keen to be one of the key players.

It certainly helps that Tamboran Resources (ASX:TBN) is one of the first movers in the play.

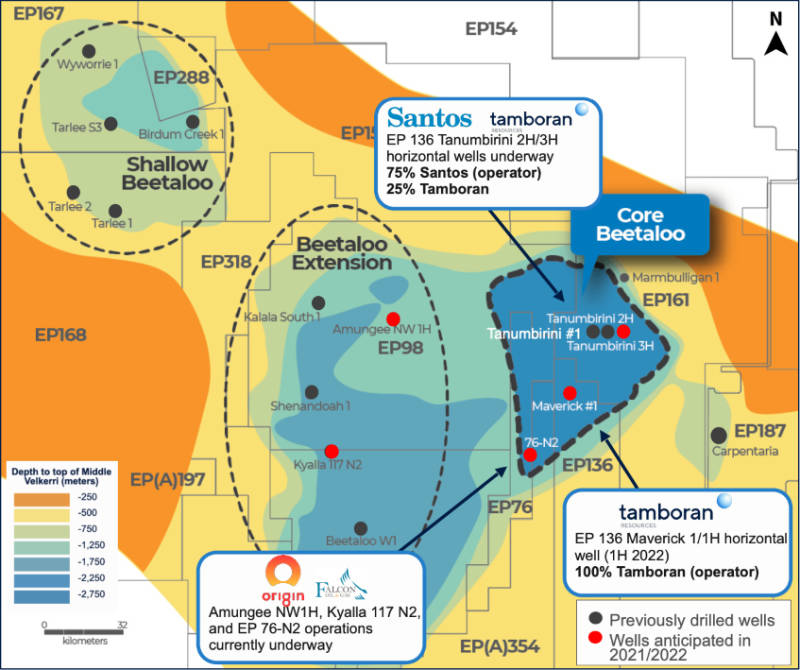

It picked up Exploration Permit (EP) 161 and other permits years before the Beetaloo even entered into the collective consciousness of oil and gas investors, and farmed out a 75% interest to Santos (ASX:STO) – a partnership that has delivered significant advantages and looks set to continue doing so.

While the other permits were relinquished in 2020, the company subsequently picked up complete control over EP 136, EP 143, and EP 197(A) after acquiring Longview Petroleum late last year.

The first – EP 136 – is especially interesting to Tamboran given that it abuts EP 161 to the southwest.

Both permits are located in the centre of the basin, and that has important considerations in a shale gas play such as the Beetaloo, as we will expand on later.

Here are the differentiating factors that managing director Joel Riddle believes places the company in the right position to achieve its strategy of delivering gas to the east coast market as early as 2025 through a pilot development.

Santos joint venture and the Beetaloo depocentre

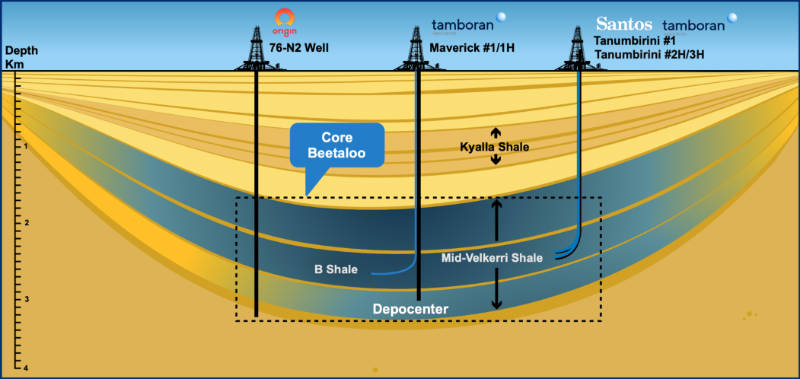

First up is the company’s EP 161 joint venture with Santos, which has already seen the drilling and testing of a vertical well – Tanumbirini-1 – that flowed at a peak rate of 10 million standard cubic feet of gas per day (MMscf/d) and an average rate of 1.5MMscf/d during the first nine days of testing.

Drilling has also been completed on the Tanumbirini-2H horizontal well while a third well, Tanumbirini-3H, is currently underway.

This is a point that Riddle highlighted, noting that while there have been a number of vertical wells drilled in the basin, there have been few horizontals drilled to date.

“The unique feature of these two wells that we are drilling with Santos is that they were designed as US-style horizontal shale wells,” he told Stockhead.

“It is going to provide a lot of line of sight around commercial potential on EP 161.”

The advances in horizontal drilling and fracture stimulation (fracking) were the keys to opening up the US shale plays and the same is likely to be true of the Beetaloo, which has been likened to the US Marcellus Shale.

Riddle explained that vertical frac of the vertical well included the pumping of isotope tracers that allowed the JV to identify where ~70-80% of the flow came from.

“It gave us the insight into where to land the horizontal sections of the two follow-up horizontal wells, which will expose 1,000m of the sweetest zone, so you would anticipate getting many multiples of the vertical frac’s flow rate.”

Equally important is the fact that both EP 161 and the company’s 100%-owned EP 136 are located in the core of the Beetaloo and the relative consistency of shale formations. Riddle believes that the wells being drilled in EP 161 will not only test its commercial potential but also provide strong indications for the commercial potential of EP 136.

“So for 25% of the dollars, we are able to de-risk both our 25% acreage and 100% acreage,” he added.

Riddle is also excited about being located in the depocentre – the deepest part of the basin – as the depocentre of US shale basins is where the highest pressures, the highest productivity and hence the highest recovery per well can be found.

“This is where industry in the US is typically developed first because this is where the best economics are,” he explained.

“Our permits are in the centre of the basin, which is the highest quality part of the basin, and therefore we own the acreage that has the highest potential value.”

Jemena joint venture

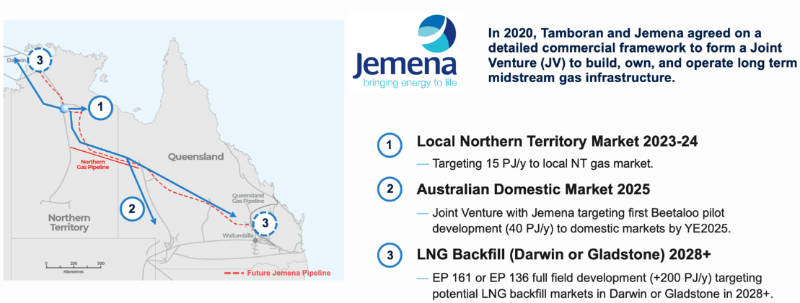

The second differentiating factor is Tamboran’s agreement to form a JV with major energy infrastructure company Jemena to build, own, and operate long term midstream gas infrastructure.

Jemena spent $800m in 2018 to construct the first northern gas pipeline that connects the Northern Territory to the east coast market.

While the JV includes the potential to supply gas in the NT’s domestic market in 2023-24, it’s the potential to sell gas into the much larger east coast market that’s a real drawcard.

“What the joint venture with Jemena will provide Tamboran with is the right of first refusal to produce up to 100MMcfd or 40 PJ per year into the northern gas pipeline into the east coast market by 2025,” Riddle said.

“When you think about near-term production driving early commercialisation, that’s a significant competitive advantage that we have.”

Net Zero strategy

Tamboran’s third differentiating factor is its strategy and commitment to ensuring that its pilot development is a net zero project.

Key to this is the low 2% to 3% carbon dioxide content of Beetaloo gas, which contrasts with the high CO2 content in Western Australia’s giant offshore gas fields – such as Gorgon’s 14%.

“What that will do is allow us to utilise a relatively low cost combination of integrating renewables into our pilot development, carbon capture and storage as well as buying credits to produce a net zero carbon gas stream,” Riddle told Stockhead.

“When we are accessing capital, when we are getting approvals from the government, it actually dovetails quite well with this theme you are seeing in the energy industry’s commitment to 2050 net zero.”

He noted that 15 Japanese buyers have come out about in early 2020 with commitments to only buying net zero liquefied natural gas cargoes by 2050.

“I believe that is the direction the world is going to, so we have to be able to adjust. And part of that adjustment, we are advantaged by developing net zero CO2 gas out of the Beetaloo,” he added.

Shortening the learning curve

There’s more than just these three factors that could deliver success for Tamboran.

While it is acknowledged that there is plenty of gas in the Beetaloo, the company is focused on the quality and economic value of its assets that could result in it being the first to develop.

To assist with this goal, Tamboran has leveraged the Beetaloo’s similarity to the Marcellus Shale by hiring a US team with experience in the Marcellus and other shales.

“The advantage we will have is that the team that is going to be designing, drilling, developing the assets that we own are the guys that have drilled actual wells into the Marcellus in the past,” Riddle explained.

“They understand the Marcellus shale learning curve, they understand what it takes to get the well cost down.”

“In the Marcellus, the early wells cost $15-20 million to drill and frac and US operators got them down to $5m or less. We see a very similar learning curve happening in the Beetaloo in the next few years.”

He added that leveraging on the team’s expertise will be key to getting the learning curve down quickly.

This compares to the 1,000m laterals with 10 frac stages at the two Tanumbirini horizontal wells, though data from these wells have also helped by providing the company with the data it needs to design a cutting edge horizontal.

“I like to tell people that what we are trying to do in the Beetaloo is very similar to Twiggy and his early days in the Pilbara,” Riddle told Stockhead.

“It’s a different industry, but he’s sitting there with BHP and BHP was kind of slow to get up the curve and it took a small – at that time – Fortescue to really drive the initial commercialisation plan. A lot of the same aspects of what Tamboran is focused on in the Beetaloo.”

Milestones

Looking ahead, the key milestones for Tamboran include the flow test results for the two Tanumbirini horizontal wells, which are expected before the end of this year.

The company is also keeping a close eye on the results of third-party wells such as Origin Energy’s (ASX:ORG) Velkerri 76-N to the south, which targets the same shales.

Additionally, the initial flow test results from Origin and Falcon Oil & Gas’ Amungee NW-1 well, which Falcon suggests is equivalent to “a normalised gas flow rate equivalent of between 5.2-5.8 MMscf/d per 1,000m of horizontal section”, will be a key data point for Tamboran.

This is well above the 3MMscf/d level that an industry analyst recently suggested would be required for the Beetaloo to be commercial.

All of which bode well for the drilling of Tamboran’s Maverick-1H well, which is anticipated to spud during the first half of 2022.

This article was developed in collaboration with Tamboran Resources, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.