State Gas is now worth $100m more than the company that birthed it

Pic: Vertigo3d / E+ via Getty Images

A little over a year ago WA oil producer Triangle Energy offloaded a gas project onto the ASX.

Today, that little gas project is worth $98 million more than its parent.

Triangle (ASX:TEG) spun out a single project in the Bowen Basin in Queensland into a company called State Gas (ASX:GAS), retaining 35.47 per cent.

That shareholding is proving to be profitable.

State Gas had a blockbuster IPO in October 2017 and a year later struck coal seam gas and conventional gas in its first Reid’s Dome well, a location in the gas-rich Bowen Basin in Queensland.

Despite a squabble with a partner — State said it was taking over the whole project while the owner of the remaining 20 per cent said it categorically was not, thank you — this week it appointed an advisor to handle “inquiries from potentially interested parties”, the kind of comment that hints of takeover offers.

Today Triangle is worth about $31m on the ASX, even with oil production of 1000 barrels bringing in $32,420 pure profit every day.

- Subscribe to our daily newsletter

- Bookmark this link for small cap news

- Join our small cap Facebook group

- Follow us on Facebook or Twitter

Its minority stake in State Gas, however, is worth $46m.

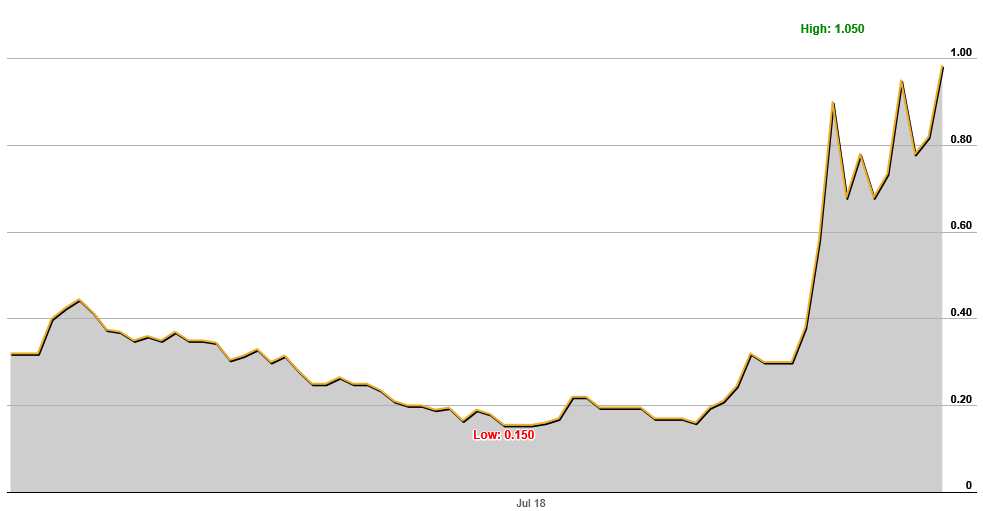

State Gas shares hit $1 for the first time on Wednesday, valuing the company at $129m as investors chase the blue-sky dream of potential gas, a potential takeover, and the ever-present knowledge that gas producers will almost be able to name their price on the East Coast in the coming years.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.