‘Some of the highest concentrations globally’: Greenvale’s new advanced helium, natural hydrogen play a springboard for growth

Greenvale is digging in to the tasty helium potential of EP 145. Pic: Justin Paget via Getty Images.

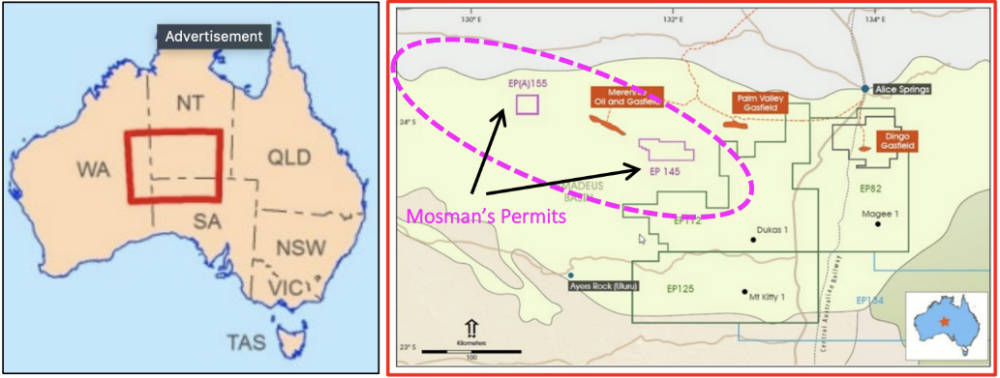

- Greenvale to acquire 75% of gas, helium and natural hydrogen project (EP 145) in Central Australia’s Amadeus Basin

- EP 145 has favourable geology for production of helium, which commands a high price due to its rarity and use in high-tech applications, and natural hydrogen

- Proximity to existing infrastructure ensures potential for rapid commercialisation

The opportunity to secure high-quality helium and hydrogen resources has proven irresistible to Greenvale, which has reached an agreement to farm-in to EP 145 in the Amadeus Basin in central Australia.

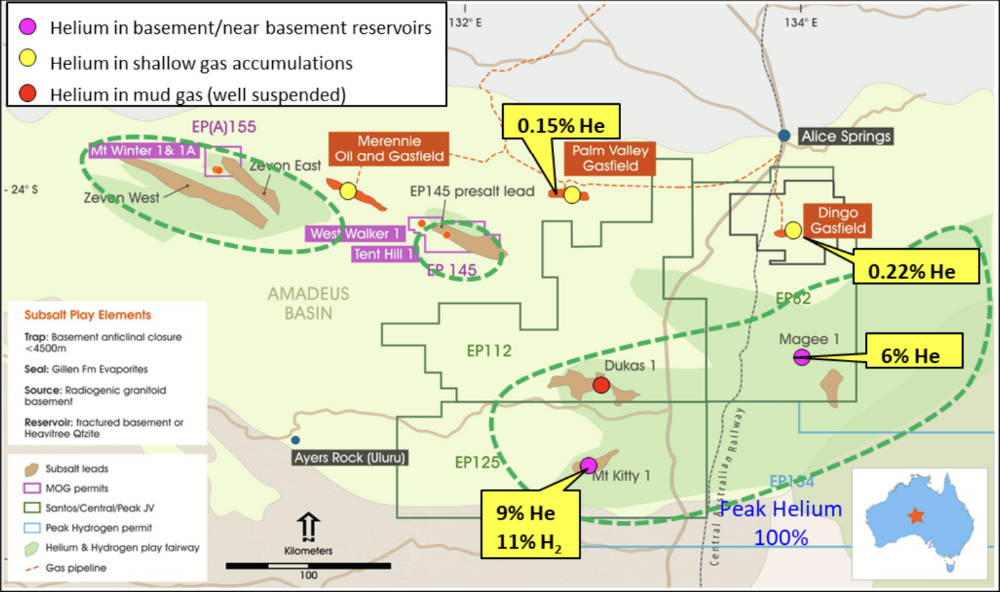

EP 145 sits within recognised play fairways for helium and hydrogen and contains proven hydrocarbon discoveries.

It hosts an existing best estimate prospective resource of 440 billion cubic feet of natural gas, 26.4Bcf of helium and 26.4Bcf of hydrogen and is on trend with the producing Mereenie oil and gas field.

Importantly, preliminary technical analysis has indicated that the tenement hosts favourable geology for helium production, with similar characteristics to other producing helium wells in the Amadeus Basin.

Helium is an extremely rare, high value gas that is used in semiconductor manufacturing, nuclear energy production, solar panels, optic fibre and the cooling of superconducting magnets in MRI scanning machines and more.

However, demand for the gas far outstrips supply, which is typically a byproduct of natural gas production, translating to prices that have soared into the stratosphere.

While natural gas was priced between $16.84 per gigajoule to $17.93/GJ in eastern Australia during the 2022-23 financial year, helium is considerably more valuable with current US short-term contract and spot pricing of between US$450 ($710) and US$3,000 per thousand cubic feet (Mcf) depending on its purity (98% to 99.999%).

For context, 1 gigajoule equates to about 947.8 cubic feet of gas.

Meanwhile, natural hydrogen – hydrogen found in naturally occurring reservoirs rather than produced by cracking water or methane – is an alternative clean, carbon free fuel that can be extracted for commercial use.

Adding further interest, the Amadeus Basin has a long history of hydrocarbon production with proximity to critical gas infrastructure that provides a near-term commercialisation pathway.

Helium and natural hydrogen have also been proven through exploration drilling with some of the highest concentrations of helium globally.

Seizing the opportunity

Greenvale Energy (ASX:GRV) has inked a farm-in agreement to secure 75% of EP 145 from Mosman Oil and Gas.

The company will earn this stake by paying Mosman $160,000 in cash and paying 100% of the cost of acquiring seismic and drilling one well before August 2025.

Acquisition of the seismic, which the company expects to begin once the farm-in is completed, is estimated to cost about $2m while drilling costs are capped at $5.5m with any costs over that amount to be split between Greenvale and Mosman on a 75:25 basis.

Greenvale will take over operatorship of the EP 145 permit and could deliver it alongside its flagship Alpha torbanite project in Queensland.

“This agreement provides an exciting opportunity for Greenvale to test for helium, hydrogen and hydrocarbon potential in the Amadeus Basin, which is known to host some of the highest concentrations of helium globally as well as confirmed accumulations of hydrogen,” chief executive officer Mark Turner said.

“Importantly, the EP 145 permit already has an existing high-quality prospective resource estimate in place – including a best estimate of 440Bcf of total gas – providing an outstanding platform from which to progress our initial exploration programs.

“With a global shortage of helium supply and continued growth in demand, EP 145 represents an exciting new addition to Greenvale’s asset portfolio and we look forward to getting underway with seismic data collection in the near future.”

Other activity

Earlier this month, the company completed Phase 2 drilling at its Alpha project with initial results expected to increase both the size and confidence of its current 18.6Mt shale resource that could deliver 21.29 million barrels of synthetic oil equivalent.

The Company is also currently assessing the merits for geothermal power generation in the Millungera Basin. An independent geothermal study by the Queensland Government in June 2018 has highlighted the Millungera Basin to be the most prospective geothermal site in Australia.

This article was developed in collaboration with Greenvale Energy, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.