SA energy market provides push for Earths Energy’s geothermal ambitions

High energy prices during peak periods is an endorsement of the company’s geothermal power strategy. Pic: Getty Images

- Initial market assessment confirms excellent commercial conditions for EE1’s South Australian geothermal projects

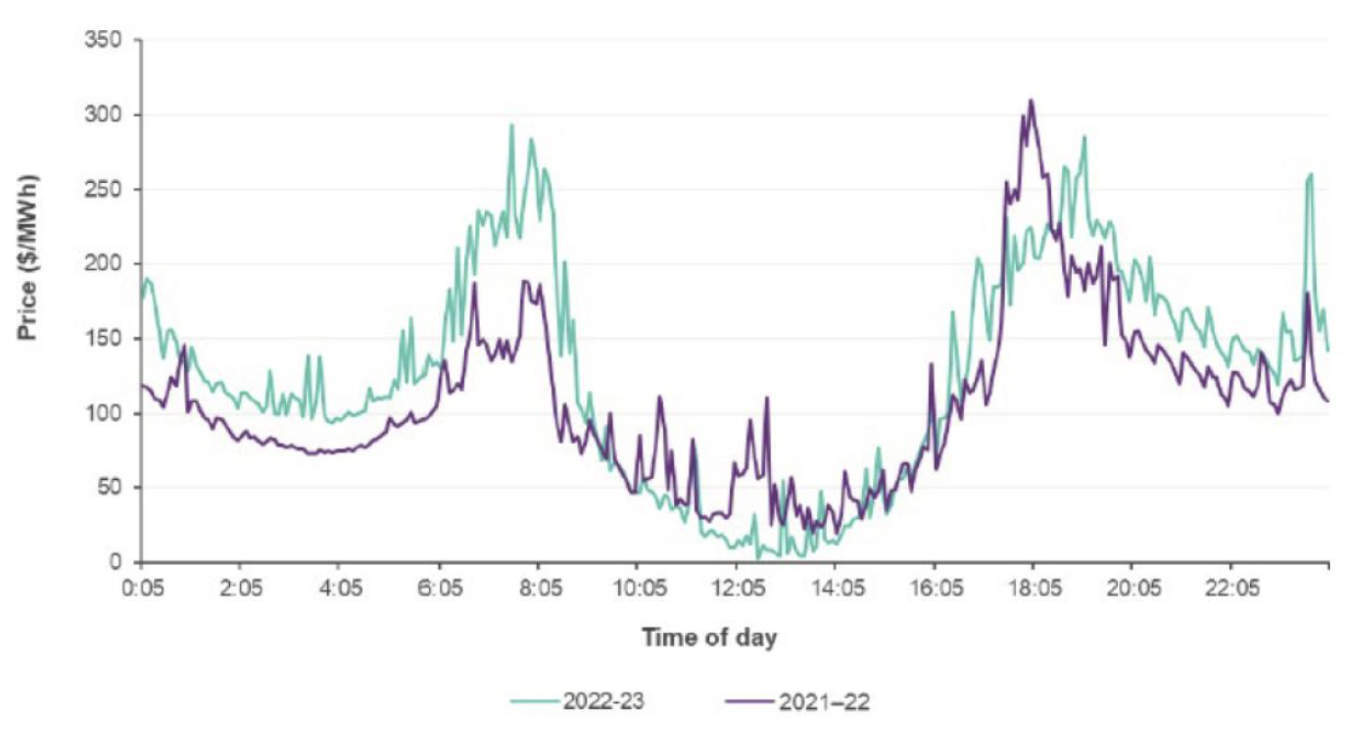

- Peak wholesale prices of $250-300/MWh as well as high ancillary services pricing of up to $999/MWh noted

- Power purchase agreements could help ensure the company enjoys prices of at least $150/MWh

Special Report: Earths Energy has unveiled an initial market assessment, which underscores the value of being able to supply power when wholesale prices peak – a feat that, of all renewables, only geothermal and hydropower can perform reliably.

The assessment by independent boutique energy consultancy Resources WA found that the large proportion of installed renewable generation in South Australia meant that wholesale power prices peak between $250-300 per megawatt hour (MWh) during the early morning and late afternoon whilst remaining elevated at >$100/MWh throughout the night.

This finding is hugely exciting for Earths Energy (ASX:EE1) as it will be able to take advantage of the higher pricing during peak periods due to the ability of its planned geothermal power projects to generate reliable baseload electricity.

EE1 is focused on developing its flagship Paralana and Flinders West projects, both of which had previously been developed for their geothermal hot rocks potential.

While these previous attempts by the first generation of geothermal companies in Australia had failed to achieve their goals due to high costs and competition from low-cost coal generators, new developments borrowed from the oil and gas sector have resulted in a drastic reduction in costs associated with drilling.

This is coupled with advances that have increased accuracy in the interpretation of data and resolution of seismic data used to model reservoirs and fractures.

Ancillary services and secured pricing

EE1 is also looking into the potential of storage options into its development plans after the report found that demand for ancillary services – the provision of electricity on call at a short notice – is a lucrative addition that could command rates of between $647-999/MWh.

Having storage will allow the company to store power at times when other renewable energy sources bring electricity prices down dramatically – as low as $0/MWh – and have that power available to meet far-better-paying ancillary services demand.

The company is furthering its investigations into the economics and efficiencies of various storage options such as thermal, mechanical and lithium-ion battery systems to determine which works best with a geothermal power plant.

Resources WA also found that with the primary market mechanism in South Australia being large-scale power purchase agreements (PPA) – which allow businesses to commit to the pre-purchase up to 100% of their energy requirements at fixed prices during the contract term – EE1 could enjoy a range of favourable prices.

This is especially true when combined with ancillary services sold into the wholesale market.

It found that the company can expect prices of at least $150/MWh for power sold from its Paralana and Flinders West projects.

A notable example of a PPA is green energy supplier Neoen agreeing in November 2022 to supply 70MW of power to BHP’s (ASX:BHP) Olympic Dam mine from July 2025 from its 412MW Goyder South Stage 1 wind park and 300MW Blyth Battery.

This represents half of the power requirements for the world’s fourth largest copper mine and also underpins the second part of the Goyder South Stage 1 development.

Potential pricing endorses geothermal strategy

“This initial market assessment independently confirms the excellent commercial conditions for the company’s South Australia projects to sell future green baseload power,” EE1 chief executive officer Josh Puckridge said.

“Confirming the power that we bring online from our South Australian projects can be readily sold under a PPA or into wholesale markets at prices that robustly support current commercial development, is yet another endorsement of the company’s projects and strategy.

“This work underscores the strong potential for our geothermal projects to generate commercial and consistent revenue streams while contributing to the transition towards renewable energy in Australia.

“We are confident that our South Australian projects are positioned to play a key role in meeting the growing demand for sustainable energy solutions in Australia.”

Other activity

Besides its investigation into storage options, EE1 is also continuing its techno-economic assessment of its South Australian projects.

This assessment will include the Resources WA report to ensure the company is considering its projects in the context of South Australia’s market conditions.

It expects to update the market on some of the assessment findings before the end of Q3 2024.

This article was developed in collaboration with Earths Energy, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.