Rising gas prices sway Asia’s power generators toward renewables

Pic: Matthias Kulka / The Image Bank via Getty Images

Renewable energy generation in Asian countries such as China and India may accelerate if, as expected, gas becomes a more expensive fuel for power generation in the years ahead.

Liquefied natural gas (LNG) cargo prices have doubled to $US4 per million British thermal unit from a record market low of only $US2/MMBTU in June.

Australia is a major exporter of LNG cargoes, and while better prices for the fuel is good news for producers, for consumers in Asia the reverse is true.

Beijing has drastically cut the tariffs gas-fired power plants receive for their electricity by 28 per cent since June, trimming generators’ profit margins.

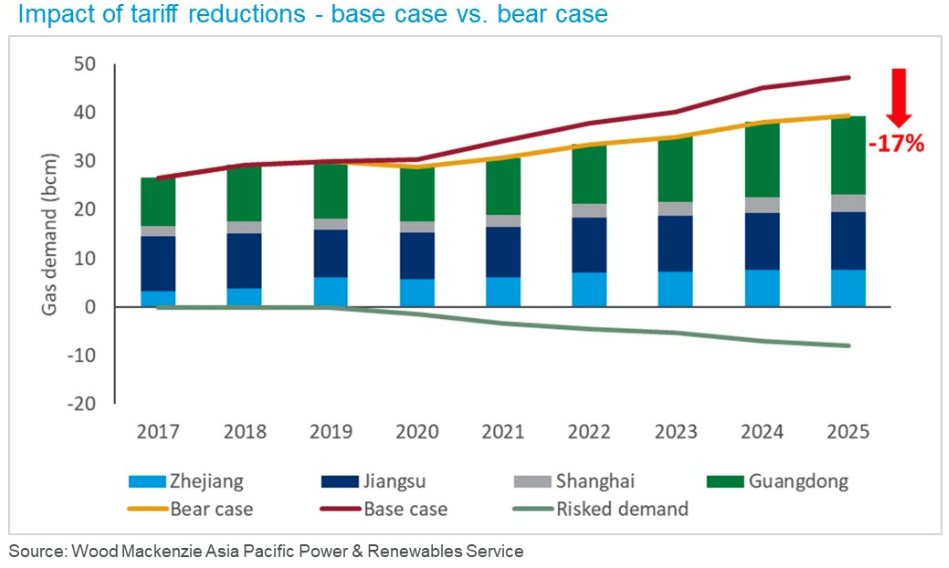

If this measure is maintained, it could put at risk additional demand growth for gas-based power generation in China, Wood Mackenzie Asia-Pacific vice-chairman, Gavin Thompson said in his APAC Energy Buzz blog.

“In China, gas power plants are struggling after tariff cuts intended to improve manufacturing competitiveness as trade tensions rise,” said Thompson.

Gas demand scenarios for China: Wood Mackenzie

Rising gas prices present threat to gas expansion plans

In India too, the expansion of gas-fired electricity generation is at risk from higher gas prices.

“A recovery in gas prices therefore risks slowing the progress in power sector gas demand seen in 2020,” Thompson said.

“Price is everything in India, and gas could still feel the squeeze,” he added.

Currently, low gas prices are supporting the growth of power plants fuelled by this fossil fuel in countries ranging from Korea and Japan to less developed markets like Bangladesh and Vietnam.

“The anticipated recovery in gas prices beyond 2022 will hurt the economics of gas-fired generation,” said Thompson.

On current trends, gas demand is set to double for China and India by 2040, powered by its cleaner-than-coal reputation and government measures to cut air pollution in Asian cities.

China and India lead charge toward renewable energy

While new coal-fired electricity plants continue to be built in Asia, albeit at a slower rate, wind and solar capacity is “booming” in the continent.

Renewable energy sources comprise 43 per cent of new power generation capacity in China, and in India the proportion is even higher at 64 per cent.

India’s renewable energy generation is expected to climb to 110 GW by 2022.

“Competitiveness is key as generation costs for new wind and solar installations tumble across Asia,” said Thompson.

“And, with renewables generation costs expected to fall by a further 30 per cent by 2030, gas-fired power will continue to cede competitiveness,” he said.

Coal expands electricity market share in Asia

In a surprise reversal of fortune, coal is regaining popularity in Asia as a source of power generation, just as it was being written off as a sunset fuel.

“Coal capacity across Asia is rising and will make up almost 30 per cent of all Asia’s additions by 2025 compared to only 12 per cent for gas,” said Thompson.

India is a prime example of this. The country’s gas-fired fleet is to stall in growth terms over the next five years, while India will add a further 26 GW of installed coal-fired capacity by 2025.

In India, half of all the country’s electricity generation capacity is from coal, largely from domestic mines.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.