Regnan reckons economics rather than environmentalism can explain much of the global renewables boom

Pic: Guido Mieth (Moment) via Getty Images.

- Pollution, consumer preferences driving shift to renewables

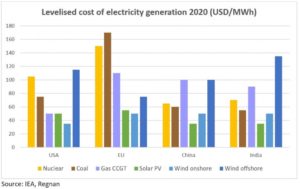

- Economics are clear: renewables now cheapest in all key regions

- Pursuit of net zero would turbo-charge this trend

The transition to a renewable energy system is a mega-trend that will drive investment returns for decades.

Renewables are expected to account for 70 per cent of the $US530 billion spent on all new generation capacity in 2021, according to the International Energy Agency.

But with almost every part of the global economy touched by the transition, picking investment opportunities can be daunting.

Successful investing in the transition is made even more difficult by noisy debate and political point-scoring about the best path to net-zero carbon emissions.

But beyond the noise, much of global shift to renewable energy can be explained by underlying forces that are with us today and offer some quite understandable and investable opportunities, says Regnan head of research Alison George.

“There’s a whole lot of change happening in energy systems — all from three key drivers,” says George.

“Emissions are important, but in developing countries it’s air pollutants that are key to changes happening now, with climate concerns coming up behind.”

Then there’s changing consumer preferences and technological advancement.

“The shifts that are occurring in the energy system are a combination of those three factors playing out over time.”

Focusing on these three drivers can give investors a much clearer understanding of how the transition will affect their portfolios.

“In China and India, they are much more concerned with the very real problem of air pollution, which is causing significant numbers of extra deaths right now,” says George.

“Similarly, Australia’s love of home solar panels is not just about incentives — it’s about people liking the idea of being in control of their own power, playing to a personal independence narrative.

“It’s not just a decarbonisation preference — it’s a consumer preference.

“Historically energy was a low-engagement purchase, then all these apps came along so you can see how much power you are generating and connect it all up.”

George says the advancement in technology, which will ultimately allow households to trade energy the same way they trade stocks, via an app on their phone, will further drive the interest in renewables.

‘It’s not environmental, it’s economic’

Even global scale changes like the phasing out of coal-fired power stations can be explained by underlying economic drivers.

“Even without new commitments from governments, energy coal is already on the way out.

“It’s not environmental – it’s economic.

“In the US there has been a huge changeover from coal to gas that was entirely economically driven because of the shale gas revolution.

“Suddenly the US had an abundant source of cheap gas and that has led to a lot of very economically rational coal to gas switching.”

This combination of an energy transition being driven by factors other than climate change allows investors to think differently about how they play the transition.

One implication is that the policy debate and regulatory overlay is perhaps less important than traditional economics.

The International Energy Agency says renewable energy is now the cheapest way to lift energy production in all key regions.

“If you need more supply, the next megawatt will be renewable.

As the graph below shows, solar is the cheapest option in China and India. In the US and EU, it’s onshore wind.

The nuclear option

Economics also explain why nuclear is being left behind renewables, despite being low carbon, George says.

“Nuclear is expensive in relative terms, even in developing economies where input costs like labour and land are lower.”

That’s why nuclear doesn’t get much of a boost, even under the most ambitious decarbonisation scenarios.

“Renewables are already the best bet. It doesn’t matter what scenario we look at, renewable investment is a runaway car — it’s happening of its own accord.

“That is the key expectation that people should have.”

“Pursuit of net zero would only accelerate these trends, while also bringing hydrogen into the picture.

“There is a still a big gap between current policies and what is needed to achieve the net zero commitments being made by countries around the world.

“This represents a huge investment opportunity – worth a cumulative US$27 trillion by 2050 according to the IEA.

“Solar, wind and especially batteries would all be winners from increased environmental ambition, turbo charging current trends as more energy comes from electricity and renewables get a larger share of an even bigger electricity pie.

“Electricity networks would also require substantial increased investment.”

This article first appeared at Pendal Group.

Alison George is Regnan’s head of research. She has deep experience in ESG, responsible investment and active ownership.

Regnan is a responsible investment leader with a long and proud history of providing insight and advice to investors with an interest in long-term, broad-based or values-aligned performance. Building on that expertise, in 2019 Regnan expanded into responsible investment funds management, backed by the considerable resources of Pendal Group.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.