Real Energy raises $2.34m as it cashes in on Queensland gas rush

Pic: Matthias Kulka / The Image Bank via Getty Images

Oil and gas explorer Real Energy has raised $2.34 million, as it seeks to cash in on the Queensland gas rush.

The heavily oversubscribed share placement, which issued 26 million new shares at 9c each, will fund the company’s exploration and development program at the flagship Windorah Gas project — notably the next two Tamarama wells.

“The current gas crisis on the east coast of Australia is something we predicted when we formed Real Energy,” said managing director Scott Brown.

“We positioned the company to take advantage of this situation and our aim is to very quickly prove up at least 1 trillion cubic feet of gas and make this available for domestic markets.”

Pre-planning for a gas crisis

Real Energy (ASX:RLE), founded in 2009, is focused on the Cooper-Eromanga basin where it has a

3C contingent resource of 672 billion cubic feet (BCF) of gas — or the highest level of estimated, but as yet unproved, volumes of oil or gas.

It’s focusing on the Toolachee and Patchawarra formations, in an area where Santos has already made three nearby discoveries.

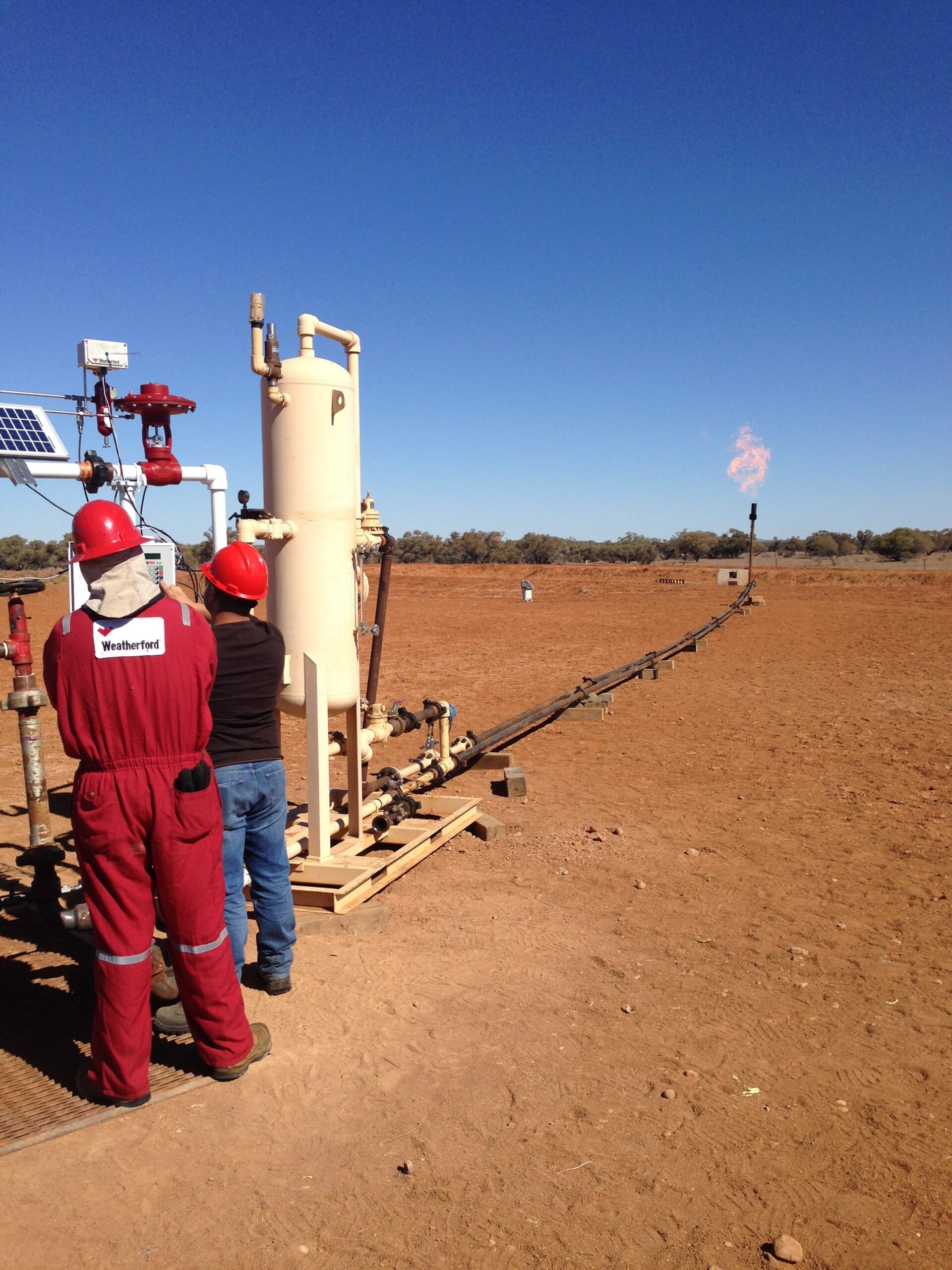

Real Energy started drilling in the area a couple of years ago, but only started using hydraulic fracturing — or “fracking” — techniques last year. This is a method where a liquid mixture is used to crack open fractures in the rock, allowing isolated pockets of gas or oil to escape.

“Tamarama-1 was drilled as an exploration well, and we now understand significantly more about the play and the geology. We are now using this knowledge to design future wells,” Mr Brown said.

“The first well is always like a science experiment, and obviously we got good results. We are looking to put that into production with the other two, which we’ll start building early next year.

“We are changing the drilling and completion design and considering deviated wells. The technical team is using a lot of science and technology to maximise well performance.”

Mr Brown says the flow rates of gas coming out of the first well are strong and it’s reinforcing their belief that the company is sitting on a gas windfall.

Gas windfall

The anticipated gas East Coast shortages could be a gold mine for Real Energy.

A report by the Australian Energy Market Operator (AEMO) last week shows that it expects the supply shortfall to hit 107 petajoules next year, on demand of 650 petajoules.

AEMO’s previous forecast in March predicted shortages only beginning in 2019-2024, and between 10-54 petajoules a year.

It intends to capitalise on high domestic gas prices caused by the national slowdown in exploration thanks to low oil prices, and the bans on onshore gas exploration in Victoria and NSW.

The company said in a recent investor representation that it was receiving strong commercial interest in its Windorah Gas Project.

Real Energy has real evidence to back that kind of statement too. In May it signed a gas processing memorandum of understanding with major liquefied natural gas (LNG) exporter Santos.

“This gas-processing MoU would allow raw gas from Real Energy’s Windorah Gas Project to be processed into sales gas, which can then be supplied to the east Australian gas market,” the company said.

That was followed in July with a gas sales MoU with Weston Energy.

The MoU is a prelude to a binding deal for sales of 3 petajoules of gas a year for five years, but does include a $6 million prepayment to give Real Energy the financial muscle to develop the Windorah area further.

Real Energy isn’t short of cash — it had $7.5 million in the bank at the end of June after raising $2 million through a private placement earlier that month.

Mr Brown has taken the latest capital raising success as a vote of confidence in the company and the resource potential it’s sitting on.

“While the company’s cash position is strong with just under $7 million in the bank, this placement gives us additional financial flexibility to commit to the drilling of these two new wells. Now we have completed this placement, we can get on with our program.”

This special report is brought to you by Real Energy.

This advice has been prepared without taking into account your objectives, financial situation or needs. You should, therefore, consider the appropriateness of the advice, in light of your own objectives, financial situation or needs, before acting on the advice.

If this advice relates to the acquisition, or possible acquisition, of a particular financial product, the recipient should obtain a Product Disclosure Statement (PDS) relating to the product and consider the PDS before making any decision about whether to acquire the product.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.