RBS upgrades oil forecasts, reckons Brent could breach $US80 a barrel

Pic: Vertigo3d / E+ via Getty Images

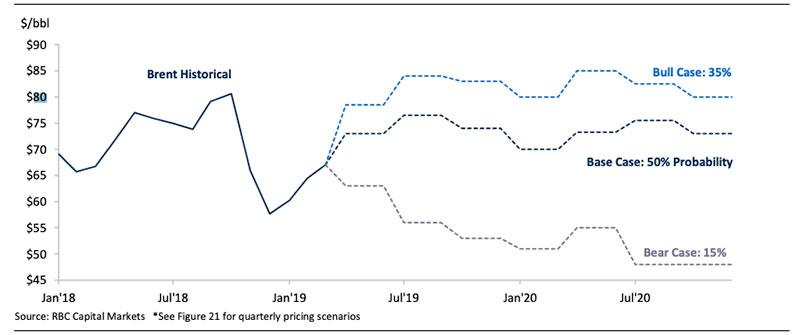

A positive buzz around the oil market has prompted RBS to upgrade their 2019 pricing outlook.

Brent will average $US75/bbl (up from $US69.50/bbl) and WTI $US67/bbl (up from $US61.30/bbl) for the rest of the year, RBS says.

Brent is the European benchmark price, while West Texas Intermediate (WTI) is the US benchmark. Australian producers tend to use Brent.

But there’s still room to run – a bullish scenario has Brent prices breaching $80/bbl.

Check this out:

Oil prices have bounced back by more than 30 percent so far this year after crashing violently in late 2018.

“The global oil market has been subject to seemingly endless bouts of volatility over recent years, with some price moves often trendless, erratic, and running divergent to the fundamental backdrop,” says RBS.

“The herd mentality has been fiercely strong, which has, at times, made investor positioning arguably more influential than fundamentals.”

This herd mentality was in full force in the fourth quarter when macro fears triggered a stampede out of oil market, RBS says, but prices in so far in 2019 have “accurately reflected improving market fundamentals”.

READ: What determines the price of oil and how it impacts ASX small caps

And there’s other positive market indicators.

In Australia the market for oil and gas drilling rigs is tightening, which Key Petroleum (ASX:KEY) boss Kane Marshall says could signal the start of a positive year for oil companies here.

At the big end of town, Chevron has just acquired US oil company Anadarko for a casual $US50 billion which Roy Martin, senior analyst at Wood Mackenzie calls “the biggest upstream deal since Shell and BG in 2015”.

It’s also at a 39 per cent premium to Anadarko’s last traded price.

“Chevron now joins the ranks of the UltraMajors – and the big three becomes the big four,” Mr Martin says.

“ExxonMobil, Chevron, Shell and BP are now in a league of their own.”

- Subscribe to our daily newsletter

- Join our small cap Facebook group

- Follow us on Facebook or Twitter

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.