Queensland’s Taroom Trough is the solution for the east coast’s gas supply woes

The Taroom Trough in Queensland is emerging as the answer to the east coast's gas supply concerns. Pic: Getty Images

- Queensland’s frontier Taroom Trough is looking increasingly positive for big gas potential

- Resources could help plug the growing supply deficiency the east coast is facing

- Omega Oil & Gas is confident about its upcoming Canyon-1H production test

As eastern Australia’s gas supply prospects continue to spiral down the drain, Queensland is looking increasing likely have the answer to the problem.

Whether it be incremental increases from mature areas or unlocking potentially massive resources in the frontier Taroom Trough, the state has no shortage of gas nor the lack of political will to make it happen.

Queensland’s contribution can be split into three categories. Existing production, new near-term production from mature areas, and new potentially large-scale discoveries.

The state is already one of the largest gas producers in Australia, trailing only Western Australia, though both states export the lion’s share of their production as liquefied natural gas.

Standing out in this field is QPM Energy (ASX:QPM), which owns the already producing Moranbah gas project in Queensland.

While the company has no plans for direct sales to gas-hungry Victoria and NSW, it does supply gas to industrial customers and the Townsville Power Station, a peaking gas plant that operates for three to seven hours per day during peak morning and evening periods when electricity prices are at their highest.

Meanwhile, companies such as Comet Ridge (ASX:COI) are working their way towards starting production.

The company recently started pilot production testing at its Mahalo East project, which will determine its ability to produce commercial quantities of gas.

However, production might come sooner from its Mahalo JV with gas major Santos (ASX:STO) – key front-end engineering and design work is now underway.

FEED studies are a pre-cursor for a final investment decision, so it isn’t s stretch to believe that development and production is on the cards from the project, which has proved and probable (2P) reserves of 266 petajoules of gas.

But the focus for many investors has also centred on a new field which could have enormous potential to supply large quantities of natural gas to a hungry market.

The big kahuna

While every molecule of natural gas that Queensland can send down pipeline to its populous southern neighbours is welcome, far larger quantities will be needed as production from the ageing Bass Strait fields off Victoria continues to plummet.

Gas pundits have flogged two areas as having the potential resources needed to do so, the Beetaloo Sub-basin in the Northern Territory and the Taroom Trough within the Surat Basin in Queensland.

The Beetaloo covers 28,000km2 about 500km southeast of Darwin and is estimated to host ~500 trillion cubic feet of gas in place just within the Velkerri B shale formation alone while the Taroom also hosts multi-Tcf gas potential within deep Permian coals.

Both are what are known as unconventional or tight gas plays and require fracture stimulation in order to produce commercial quantities.

However, Omega Oil & Gas (ASX:OMA) managing director Trevor Brown told Stockhead the former is unlikely to make a real impact, leaving the Taroom Trough as the only real contender.

“Both the Taroom and Beetaloo will contribute to meet Australia’s gas needs because demand is so strong, but the Beetaloo has some very big barriers that will prevent it from coming south into the east coast market,” he said.

“The tyranny of distance is really what it comes down to, because the Beetaloo is a long way away and it is going to take a big pipeline to get it down in the volumes they need.”

He added that, without an established oil and gas operating theatre, the remoteness of the Beetaloo meant that every single service – rig, frac spread, skilled personnel and materials – would have to be transported there, inflating structural costs.

“You have to add that structural cost base, you add the pipeline and their starting point is very difficult,” Brown noted.

“On the other hand, our operations (in the Taroom) are situated right near infrastructure that is already established (including the major Wallumbilla gas hub), we are right next to an existing oil and gas province, we have got very low levels of CO2 in the basin and we have liquids – condensate – in our gas stream, which really helps the economics.”

Confidence in Taroom performance

While the Taroom is very much a frontier region with limited exploration by companies ranging from supermajor Shell to ASX-listed juniors such as Elixir Energy (ASX:EXR), there are already promising signs that they are on the right track.

Sources have told Stockhead that notoriously tight-lipped Shell has enjoyed significant success at its acreage and has reportedly committed to further work, a strong sign that the Taroom has the right stuff.

Meanwhile, production testing at EXR’s Daydream-2 vertical well in October 2024 disappointingly resulted in lower gas flow rates than previously measured stabilised gas flow rates though this was attributed to faults commonly encountered in early stage tight gas plays.

But it didn’t prevent the company from executing a non-binding memorandum of understanding with Australian Gas Infrastructure Group (AGIG) to investigate the potential for developing gas infrastructure to support production for its Grandis project nor the definition of a maiden best estimate (2C) contingent resource of 245 billion cubic feet of gas.

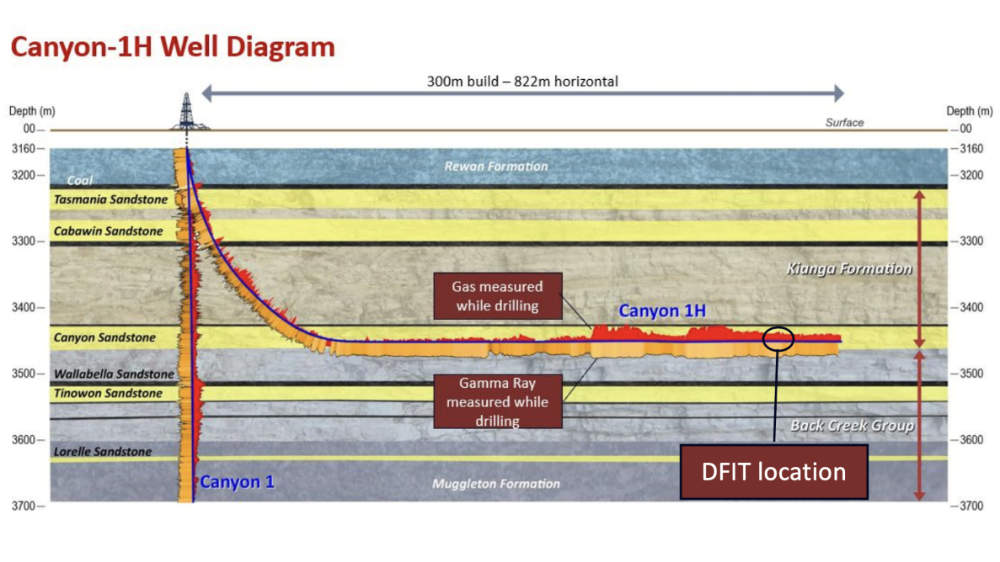

Brown is also confident that the upcoming frac and production test of OMA’s Canyon-1H horizontal well will perform well.

In early January 2025, the company completed a successful diagnostic fracture injection test which confirmed high overpressure of 0.79 psi/ft and favourable reservoir properties within the target Canyon sandstone reservoir.

“It is essentially a mini frac where we open up a sliding sleeve in the casing, which gives us access to the rocks and then pump an amount of fluid into the rocks, and measure carefully the pressure whilst you are doing this pumping and it gives you the exact pressure at which the rocks break down, they actually fracture,” Brown explained.

“This simulates the rates that we will be pumping while doing the big fracture, and then once you reach the target volume, you stop pumping and monitor the pressure.”

This allowed OMA to determine the rate of decline in pressure, which gives an idea of permeability – a key factor in how productive a well can be and the shut-in pressure when the fracture actually closes up.

“All of those things, when you consider them together, gives us a lot of confidence,” Brown said.

“One, the fact that reservoir does receive the frac fluids at the rate which we are planning, that’s really positive.

“Secondly, the fact that it has that good permeability response means that it will likely flow quite well.

“And thirdly, the level of overpressure in the reservoir – the high formation pressure – is a measure of the energy that is in the reservoir and so that has very big implications for the long-term development economics, because that will help the well flow faster and for longer as it means you will need less wells to be able to produce the same volumes.”

He used car engines as an analogy for the formation pressure – it’s like racing a V8 against a regular four-cylinder.

“It shows that this basin has a really powerful engine and that’s a very big positive for the long-term economic development for the basin,” Brown added.

“It means each well will produce more and will have a longer life because the high pressure will continue to flow for a longer time. Fewer wells means lower cost which in the long-run means better margins.

“All those parameters put together have given us a great deal of confidence that we will be able to carry out a good test and hopefully get a good – potentially commercial – flow rate, which is the primary aim of this well.

“If we can get that, it will give us a lot of encouragement to then go about a further work program to continue de-risk and show the potential of the Taroom.”

Omega looking ahead

Brown expects the frac spread – the equipment and materials required to carry out fracture stimulation – to arrive towards the end of February or the first week of March.

Once there, it will take up to eight days before it starts the frac job, which will take up to four days, before flowback occurs.

“It will be about mid-March before we get a stable rate that we can release to the market,” he noted.

“We will then be formulating our forward work program but it (a successful flow test) will give us great encouragement to contract for more drilling, some seismic, some more vertical and horizontal wells to really progress our appraisal program.

“Then it is a matter of finding the sweet spots in the reservoir and demonstrating repeatability across the entire reservoir to show that you can drill at a certain spacing and produce these rocks.”

However, any further plans will have to wait until the well is flow tested with Brown noting that its results will be folded into background work to determine the next steps.

“Suffice to say, it will be positive and we are doing a lot of thinking about what that might look like now,” Brown said.

“I think it will get the attention of some very large players in the industry as well.”

At Stockhead, we tell it like it is. While Omega Oil & Gas, Comet Ridge and QPM Energy are Stockhead advertisers, they did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.