Pure Hydrogen about to commence appraisal drilling in Botswana as part of its global hydrogen ambitions

The appraisal drilling announced today has come at the perfect time, as gas prices in Botswana are very high at the moment. Image: Getty

The appraisal drilling announced today has come at the perfect time, as gas prices in Botswana are very high at the moment.

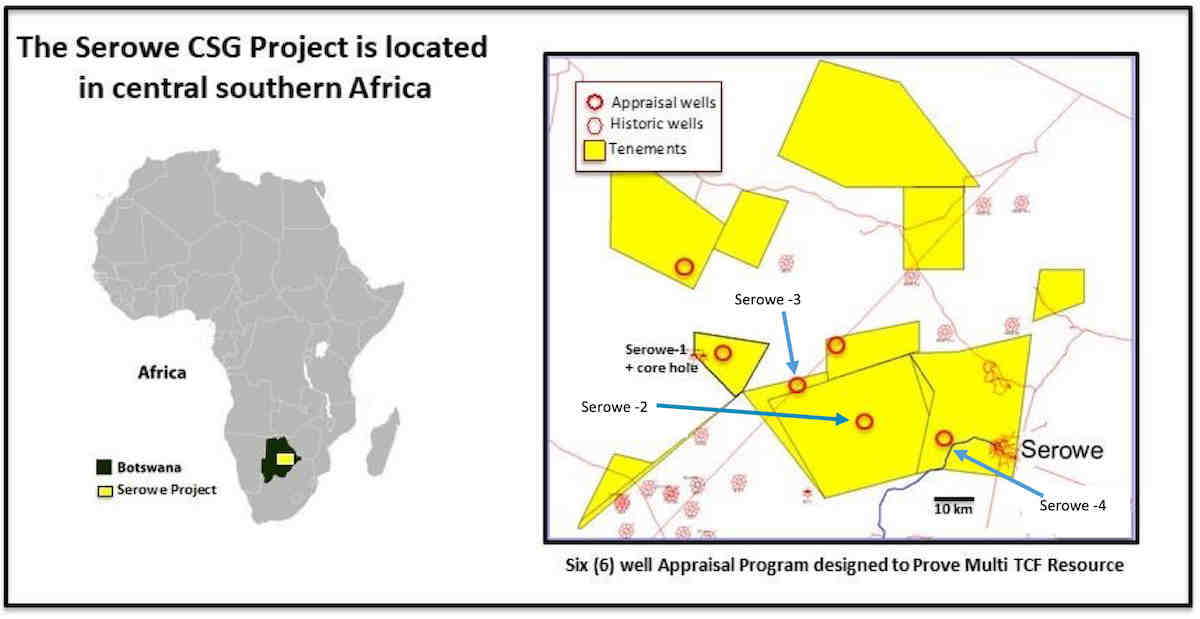

Clean energy company Pure Hydrogen (ASX:PH2) is about to begin appraisal drilling in its coalbed methane project in Botswana.

The company says that its joint venture partner, BotsGas, is about to spud the first of a six-well appraisal drilling campaign at Project Serowe within the next few days.

The drilling campaign will consist of two separate stages of three appraisal wells each, and is done to confirm the geological modelling, as well as to demonstrate the uniformity of the formation for coal bed methane (cbm) extraction.

The campaign will exceed the minimum acreage commitments, which should also ensure permit renewals in the future.

Two of the wells are to be converted to production wells, whilst the third is in an outlying region to test the presence of high grade cbm.

All the preparations are ready, along with a detailed Occupational Health and Safety Plan that will ensure proper protocols are being followed to prevent COVID-19 infections.

The plan is to drill the second stage-3 wells later in the year, after considering the results, and incorporate the knowledge learned from the first three wells.

“Serowe is an exciting asset with good upside, as the gas price in Botswana is very high at the moment,” says Pure Hydrogen CEO Scott Brown.

“BotsGas’ team is well-placed to execute this program. They have the experience and the technical skills to unlock the value from these highly prospective leases,” he added.

The Serowe Project

Pure Hydrogen owns a 51 per cent stake in the project with partner BotsGas.

The appraisal drilling today is part of a $6 million farm-out program, after an extensive internal mapping program was carried out by Botsgas.

The project aims to upgrade the existing 2.38 trillion cubic feet of high-grade Serowe coals that have been certified to date.

After delays due to the pandemic, drilling can finally begin. Pure Hydrogen says the successful appraisal wells will be “cased and suspended for subsequent completion and controlled drawdown testing similar to the Venus Pilot well”.

Becoming a major east coast hydrogen provider

Pure Hydrogen is focusing on an ambitious plan to become a major hydrogen provider on the eastern coast of Australia, and has recently inked strategic partnerships.

Last week, the company locked in a deal with Pure Haul to provide transportation services. The deal will see Pure Haul transport hydrogen from its hydrogen hubs to customer sites, and is set to turn Pure Hydrogen into a one-stop-shop supplier.

A week earlier, it signed an MoU agreement with H2H Energy to provide supply and maintenance services at its refuelling outlets, which includes a 350 and 700 bar refuelling capability that serves major clients like Toyota and Hyundai.

Part of the company’s strategy is also to develop large scale hydrogen plants on the east coast of Australia.

Initial projects are planned in Gladstone (Project Jupiter), Mackay (Project Mars), Port of Newcastle and Port Anthony (Victoria), and Project Venus in Queensland’s Surat Basin.

These ports have been specifically chosen as they are near transport hubs which have established infrastructure, and good connections to the electricity grid.

To build out the plants and refuelling network, Pure Hydrogen has recently tapped institutional investors for $9.4 million.

This article was developed in collaboration with Pure Hydrogen, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.