POWERLESS: Why renewable energy won’t stop your power bill rising for at least another decade

While the war is ongoing in Europe, it is hard to see us getting to substantially lower prices in the foreseeable future., experts say. Pic: Getty Images

- Grid-scale renewables will need to more than double to replace retiring coal generators by 2030

- With 8GW of coal expected to retire by 2030, experts say we need around 18GW of wind and solar to replace it

- There’s no short-term switch to bring additional new supply online other than smoothing the path for suppliers committed to coming into the market

We are in the middle of a crippling energy crisis and experts warn it could be several more years before we get a break from inflationary price pressures.

Until there’s enough renewables and storage in the market to replace ageing coal fleets and gas plants, Australia’s energy market remains vulnerable to international factors such as the war in Ukraine and the global rebalancing of supply to support European demand.

In fact, experts say it is highly likely we will continue to see rising energy prices until some resolution is met in the war.

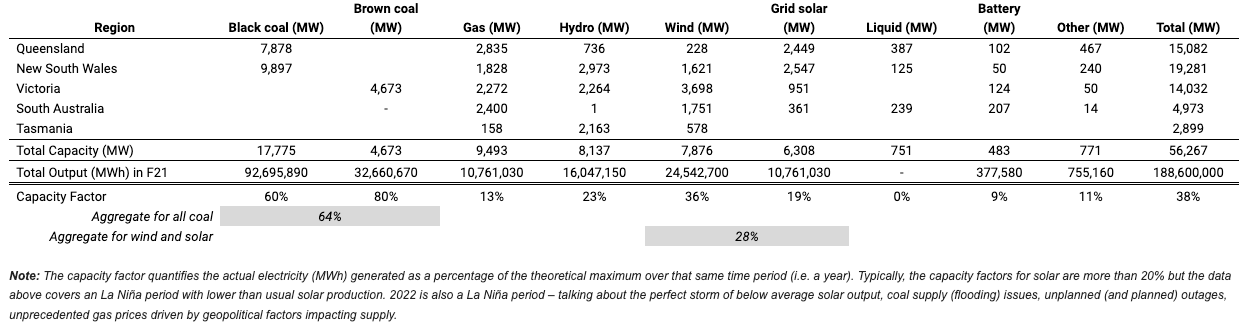

But with generators (black coal, brown coal, gas, hydro, wind, solar, liquid and battery) running at different capacities, the sheer scale of replacing traditional energy sources with renewables and storage should not be underestimated.

In an interview with Stockhead, Energetics head of renewable energy investments Anita Stadler said grid-scale renewables will need to more than double to replace retiring coal generators by 2030.

And for the transition to be a smooth one, where we avoid the kind of scenarios we’ve experienced in the last few weeks with the Australian Energy Market Regulator (AEMO) calling an unprecedented suspension to the National Energy Market (NEM), long and short duration firming capacity will be needed.

This means integrating technologies such as GE aero-derivative gas turbines or batteries to keep the grid stable in the face of potential wind, solar, and hydro intermittency, just like South Australia did.

How much renewable energy do we need?

When talking about replacement capacity, Stadler said it is not simply a 1:1MW replacement equation.

The below table, compiled by Stadler, shows the generation capacity and output by fuel source in the NEM – pulled together from two Australian Energy Regulator sources.

“We have about 22.5GW of coal capacity in the NEM,” she said.

“Around 5GW of coal capacity went offline in recent weeks during the market suspension just as a cold snap ripped through the east coast causing the system to strain as prices surged,” she said.

“This is equivalent to the 5GW of coal that was estimated to retire by 2030, however with further early closures announced, this number has been pushed to 8GW – or 35.6% of current coal capacity to be replaced by 2030.”

Given the capacity factors in the table above, roughly 18GW of wind and solar (more than the 14GW installed to date) is needed to replace 8GW of coal, Stadler said.

She says this is a conservative estimate, given that the AEMO’s 2022 Integrated System Plan’s Step Change framework released last year estimates that 14GW of coal could exit by 2030 and that is regarded by many in the industry as the most likely.

“This highlights the urgent need to invest in transmission capacity, which will in turn unlock the development pipeline of many renewable energy project developers,” Stadler explained.

The Integrated System Plan (ISP) is a whole-of-system plan that provides an integrated roadmap for the efficient development of the National Electricity Market (NEM) over the next 20 years and beyond – an updated version is expected to be released later today.

How do inflationary pressures impact renewable energy projects?

But with rising interest rates and inflation boiling on a hot stove in the background, Peak Asset Management’s Ali Ukani said the development pipeline of renewable energy projects could be in jeopardy.

With most ASX renewable energy stocks currently in the feasibility stage of their projects, aiming to begin construction in the next two or three years, inflationary pressures translate into higher borrowing costs which means feasibility studies will need to be recalculated at a higher discount rate.

“You’re going to see different NPVs and payback periods on projects and some of them might become unfavourable,” he said.

“From a timeline perspective, if it becomes harder and harder to find new construction crews, the timelines to build these projects could drag out well beyond their initial estimation.”

The market has also been witnessing a steep selloff in renewable energy stocks over the last couple of months as tailwinds subside and headwinds multiply.

“The reason people have oversold these stocks is because the near-term outlook for them is not as positive as say oil, gas, and gold,” Ukani explained.

“We’ve got energy security issues and hydrocarbons are the way to solve it.

“Take Europe, a country with a significant amount of investment in renewable energy infrastructure – the fact of the matter is, their immediate energy crisis is being solved through hydrocarbons.

“It comes down to energy density, and the fact is that at this point in time renewables don’t have that energy density and scale, but hydrocarbons like oil and gas do.”

One ASX renewable energy stock reaps the benefits

While this inflationary environment impacts negatively on projects yet to begin construction, those already in operation are reaping some pretty nice benefits – like ASX electricity generation company, Genex Power (ASX:GNX).

GNX has two solar farms in operation – the 50MW Jemalong Solar Project in central NSW, which is fully merchant, and the 50MW Kidston Solar Project, which has been in operation since 2017 under a 20-year power purchase agreement (PPA).

With prices up between $200 and $300 per MW hour compared with historical prices of around $50 or $60 per MW hour, GNX managing director James Harding said these increases have gone straight through to the company’s bottom line.

“We are lucky, at Jemalong we get the spot price all the time (together with the value of green certificates), while Kidston is under long term offtake, and we get the floor price there – so when prices are really high like they are now, we benefit from the upside.”

What needs to happen now?

For the current situation to moderate, Stadler says we need to wait for some of the coal fired generators currently in maintenance (whether planned or unplanned) to come back online.

“In Queensland, those generators are expected to be back in production by the end of June or beginning of July,” she said.

“But while the war is ongoing in Europe, it is hard to see us getting to substantially lower prices in the foreseeable future – there are price pressures which won’t go away that quickly.”

On a positive note, although not fast enough, renewables continue to be rolled out at a steady rate.

According to AEMO, grid-scale solar output on its own hit a new record of nearly 4.5GW in mid-February, accounting for 22% of total demand, excluding rooftop solar.

New wind generation recorded 6.8GW on May 31, meeting more than 33% of NEM demand at the time.

There is no short-term switch that can be flicked to bring additional new supply online, other than to smooth the path for suppliers committed to coming into the market over the coming months.

“Beyond 2026/27, there will be some massive new projects currently under development coming online and supply pressures will start easing, which should moderate prices significantly from there on,” Stadler said.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.