Power plays: Sundance is eyeing oil prices, Senex finds more gas, Leigh Creek wants yet more $$$

Pic: Vertigo3d / E+ via Getty Images

The ASX has two oil and gas small caps that investors have been watching all year, and one is reconsidering how it’s going to play 2019 in light of the shaky oil price.

Sundance Energy (ASX:SEA) is a market favourite for oil, with operations in the prolific Eagle Ford area in the US.

It’s reconsidering its 2019 development plan because of those prices, which have lost about a third of their value since October.

Sundance says in spite of that, its all-important breakeven costs are around $US30 a barrel and it plans to “flex” its plans based on how oil and gas prices move, in order to operate within its cash flows.

Sundance shares were down 3 per cent to 44.5c.

Senex finds yet more gas

The ASX’s other favourite gassy small cap is Senex (ASX:SXY), and it released data from its latest Cooper Basin well following a seven-day test. It recovered 44 million cubic feet of gas and 88 barrels of liquids — gases that have condensed into liquid form.

Senex’s other operations in the area focus on oil which is sold to the nearby Santos-Beach-Origin Energy joint venture or IOR Petroleum.

- Subscribe to our daily newsletter

- Bookmark this link for small cap news

- Join our small cap Facebook group

- Follow us on Facebook or Twitter

“This Cooper Basin gas discovery adds another potential supply source from our growing portfolio. [There is] potential for further upside through near field exploration and a new gas play in the Dullingari group,” said Senex managing director and CEO Ian Davies.

In November, Senex completed a seven-stage hydraulic fracturing program across depths of 2,360–2,730 metres.

The company estimates it may be able to recover more than 15 billion cubic feet of gas recovery, and plans to do an extended production test in early 2019.

Potential for first gas sales are pencilled in for the end of 2019.

Senex shares were down 3 per cent to 35c.

88 Energy sets itself up for an Alaskan summer

88 Energy (ASX:88E) now has all the right permits for its latest exploration well in Alaska, in the successful onshore Nanushuk oil play.

It plans to start drilling the Winx-1 well in February, and is in the process of building an ice road to the site.

Managing director Dave Wal says they’re ahead of schedule.

“The well itself is shaping up to be one of the most anticipated of the season due to its exploratory nature and because it is testing the extension of a fairway that has already yielded over one billion barrels in discovered resource in the last four years,” he said.

88 Energy shares were up 6 per cent to 1.7c.

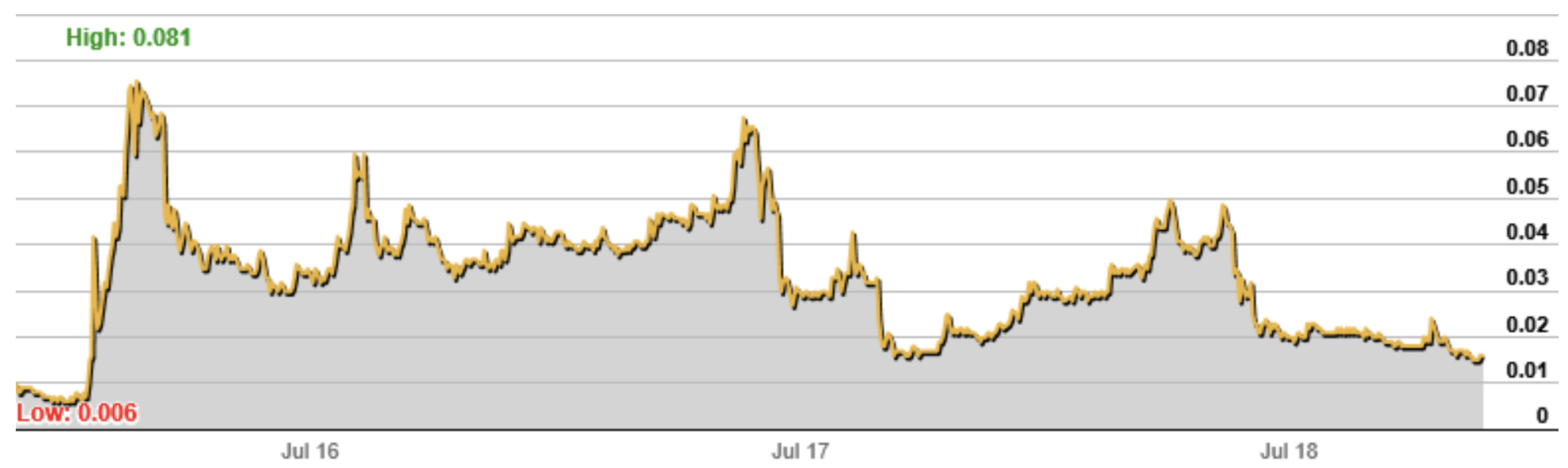

The stock has a habit of running hard upwards and rapidly diving. The last run began in December 2017 before tanking in the June this year.

Leigh Creeks asks investors for more money

Leigh Creek (ASX:LCK) is raising more money to get its South Australia synthetic gas plant off the ground.

The company wants to raise another $5.1m from investors, after taking $11.7m from them in June and July.

Stock dived 14 per cent on that news to hit 12.5c.

Leigh Creek is building a plant which converts underground coal into gas, which it plans to turn into products like fertiliser. It had first gas from its pilot plant in October.

The company will be tapping investors for money for some time yet: it now has to build the full plant which won’t be ready to go until 2023, at the earliest.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.