Opportunities abound for ASX oil and gas plays as Asian demand soars

Energy

Energy

Chinese crude oil imports might have declined by 1.9% to 553 million tonnes in 2024, but it doesn’t detract from expectations that the rest of Asia will fuel oil demand growth in the coming years.

The International Energy Agency forecast in June 2024 that between 2023 and 2030 the needs of emerging and developing Asian economies will drive oil demand up by almost 3 million barrels per day, twice as much as China over that period.

Almost half of this growth will be powered by India, which still has limited overall use of oil despite being the world’s fastest growing major economy.

Gas demand is also expected to climb with BloombergNEF predicting that North Asian liquefied natural gas demand is set to rise by 5% year-on-year to 114 million tonnes over winter 2024-25 due to South Korea’s greater need for gas-fired power and city gas demand.

Smaller markets in Southeast Asia – such as Thailand and Singapore – are also expected to support LNG demand.

Conrad Asia Energy (ASX:CRD) non-executive director Mario Traviati isn’t surprised about Asia dominating oil and gas demand growth, telling Stockhead the region has the fastest growing economies with large populations.

“These are all developing economies with large populations with relative low wages that are attracting a lot of manufacturing and need energy,” he added.

“The larger economies in the region have relied on coal but the growing concern of carbon emissions have put pressure on these economies to transition away from coal into cleaner burning gas.

“As a result, Asia is now the fastest growing energy consumption region in the world and the fastest growing gas consumption region in the world.”

On oil, Finder Energy Holdings (ASX:FDR) managing director Damon Neaves believes the West’s pursuit of net zero targets and investing in renewables has driven oil and gas investment into the welcoming arms of Asian economies where demand continues to grow strongly.

“The reality is that despite trillions that have been invested in renewables each of the last years, the world has never consumed more oil than it does now,” he added.

“I think that reality is starting to set in. What has helped is energy security issues because of the instability in the Middle East and the Ukraine war.”

The continued strength of Asian oil and gas demand presents plenty of opportunities for ASX-listed juniors with assets in Asia and Australasia.

And it is more than just the demand and prospect of finding new resources.

Neaves said one of the key reasons why FDR had shifted its focus from its operations in Australia’s North West Shelf and UK North Sea to Timor Leste was just the headwinds it faced from the whole ESG regulatory environment.

“For Timor Leste, it is critical for their future to develop their natural resources including oil and particularly their large gas resources,” he added.

“So we are seeing much more supportive government, and it is allowing us to get things done without the red tape, bureaucracy and activism that has been particularly prevalent in Australia and the UK.

“There’s also strong alignment with the government and regulators in Timor Leste.”

There is certainly no shortage of ASX-listed companies that are keen to capitalise on the Asian demand for the two commodities with CRD focused on exploring and developing natural gas in Asia.

“Conrad currently has five gas fields in its portfolio which total in excess of 500 billion cubic feet and prospective resource of close to 15 trillion cubic feet,” Traviati said.

“These resources put Conrad in a position to become a substantial regional energy company in the fastest growing energy consumption region in the world.”

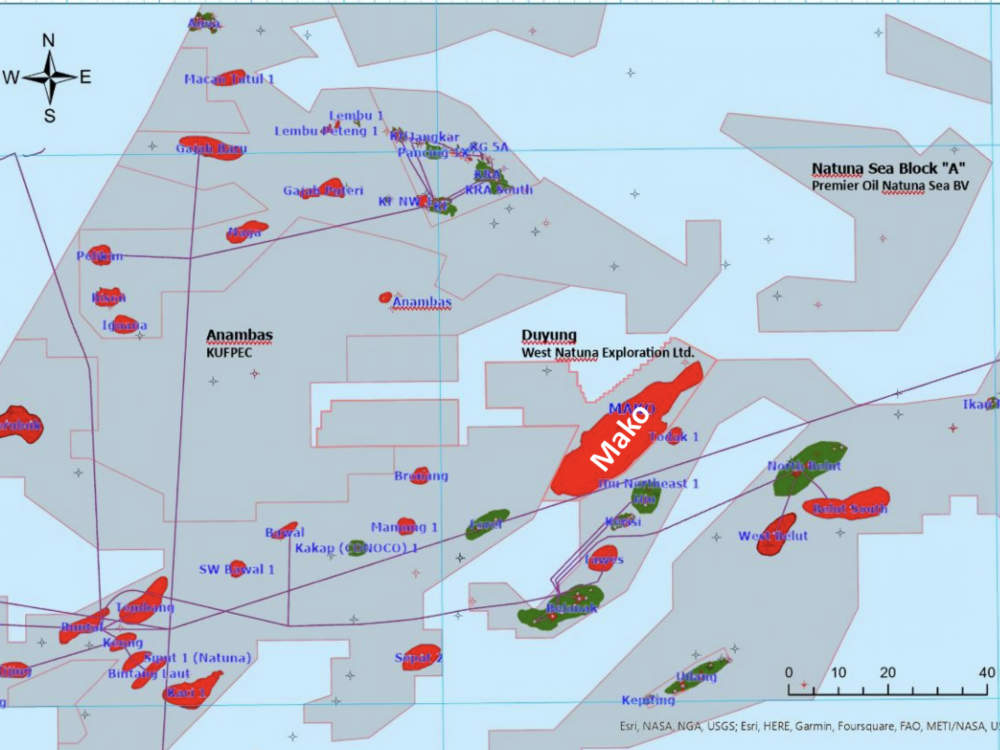

CRD is currently farming down its interest in the Duying production sharing contract in the Natuna Sea offshore Indonesia that hosts the Mako gas field, which has binding gas sales agreements in place with Singapore’s Sembcorp Gas and Indonesia’s PT Perusahaan Gas Negara that locks in the entirety of its best estimate (2C) contingent resource of 376Bcf gas.

It also expects to finalise financing and make a final investment decision for Mako to enable first gas production in late 2026.

Separately, the company is working with PGN to further advance a small-scale liquefied natural gas opportunity for its Offshore North West Aceh and Offshore South West Aceh PSCs gas assets and is seeking potential partners.

Its Aceh PSCs have gross 2C contingent resource of 214Bcf in three of four discovered shallow-water gas accumulations while small-scale LNG is being developed across Asia by numerous companies with proven technology and active plants that support gas supply of 20-40 million standard cubic feet (MMscf) per day.

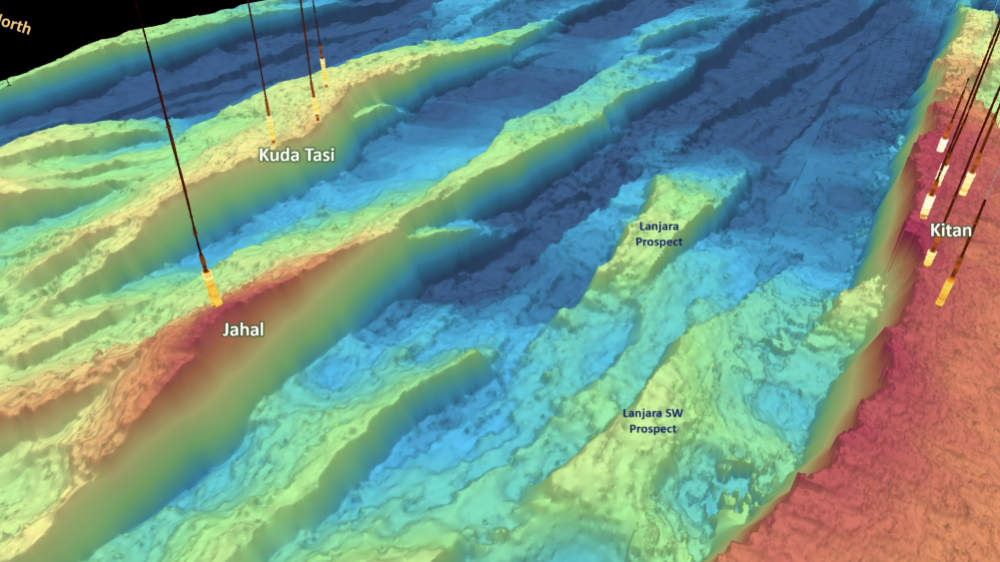

Meanwhile, FDR is progressing its Kuda Tasi and Jahal oil fields in the waters offshore Timor Leste towards development.

The company may only have acquired the two fields in August 2024 – for the low upfront consideration of US$2m with an additional consideration of up to US$6.5m and a 5% royalty on reaching a final investment decision – but the existing combined 2C contingent resources of 22 million barrels of oil equivalent (22MMboe) has contributed to the fast pace.

“Our strategy is to rapidly get to first oil and the key step there is partnering up and finding a solution to the Capex funding,” Neave said.

“In parallel with that, we are accelerating all of the engineering, the pre-FEED engineering work, the concept design and select phase, to support that partial divestment process.”

He adds that with five well penetrations in those reservoirs and flow tests, the two fields are already de-risked technically, leaving just the engineering and funding over the next two months.

FDR’s focus on getting to first oil as fast as possible also has it leaning towards a change from its initial development concept of two wells at Kuda Tasi and one at Jahal to just an initial well at Kuda Tasi.

Neaves said this shift also considers the capacity constraints of available floating, production, storage and offloading vessels while reducing the initial capex required to get a well online and deliver cash flow.

He notes that this can still be incredibly productive as wells targeting the same Laminaria formation have been observed to produce more than 20,000 barrels of oil per day.

Should FDR choose to proceed with a single initial well, it could then follow up a second phase of development drilling after nine months.

While Cue has operations in both Australia and New Zealand, it also has fingers in producing oil and gas assets in Indonesia.

These are its 15% interest in the Sampang production sharing contract in the Madura Strait offshore East Java and the 11.25% stake in the Mahato PSC in Central Sumatra.

Sampang includes the Oyong and Wortel gas fields that consistently supplies ~19 million cubic feet of gas per day (MMcf/d) on a 100% basis to Indonesia Power for electricity generation. This delivered $8.5m in revenue for FY2024 for Cue.

Meanwhile, Mahato produces >6000 barrels of oil per day from 22 production wells and generated $19.7m in revenue to Cue in FY2024.

Production could increase further with the joint venture having approved 14 additional development wells to be completed over the next year or so.

However, the first well – PC-01 – was plugged and abandoned after failing to produce hydrocarbons.

Also operating in Indonesia is Bass Oil with its 55% stake in the South Sumatra KSO that produced 4201 barrels of oil net to the company in November 2024.

The company is currently preparing to drill the Bunian 6 development well, southwest of the prolific Bunian 3 well.

It has already completed the well pad, which can accommodate at least two wells – shortening lead times for future drilling considerably.

During the September 2024 quarter, Lion Energy’s 2.25% share of production from the Seram (Non-Bula) PSC yielded 2048 barrels of oil.

The company was also granted a four-year extension of the East Seram PSC (Lion 60%), where it has received new processed seismic data with improved imaging of the Kobi and Waru prospects.

A work program focusing on high-grading prospects and drilling a well in early 2026 has also been approved by its partner.

Jade Gas is progressing efforts to produce gas from its Red Lake coalbed methane field in Mongolia’s South Gobi region.

In December 2024, the company said the production well drilling and completion program was continuing with the initial two of four wells underway.

The program is aimed at delivering gas flows in 2025 to demonstrate commercial gas production and establish gas reserves.

It also seeks to take advantage of high local gas demand – particularly for liquefied natural gas sales to replace diesel consumption.

Red Lake has a best estimate contingent resource of 246 billion cubic feet of gas.

At Stockhead, we tell it like it is. While Conrad Asia Energy and Finder Energy are Stockhead advertisers, they did not sponsor this article.