Omega expands Taroom Trough position with 19.43% Elixir Energy stake

Omega has acquired a 19.43% interest in Elixir Energy, giving it exposure to the western flank of the Taroom Trough. Pic: Getty Images

- Omega snaps up 19.43% of Elixir for $13.9m to expand Taroom Trough grip

- Deal funds Elixir’s Lorelle-3 horizontal well scheduled to be drilled in January 2026

- Move positions Omega with multiple opportunities and optionality ahead of looming east coast gas crunch

Special Report: Omega Oil and Gas has acted on its belief in the prospectivity of the Taroom Trough in Queensland by moving to acquire a 19.43% interest in fellow operator Elixir Energy.

Under the binding agreement, it will initially acquire $13.9m worth of Elixir shares priced at 4.1c each in an unconditional placement.

The company will then – along with Nero Resources Fund – invest a further combined $2.68m in a conditional tranche 2 placement that is subject to shareholder approval.

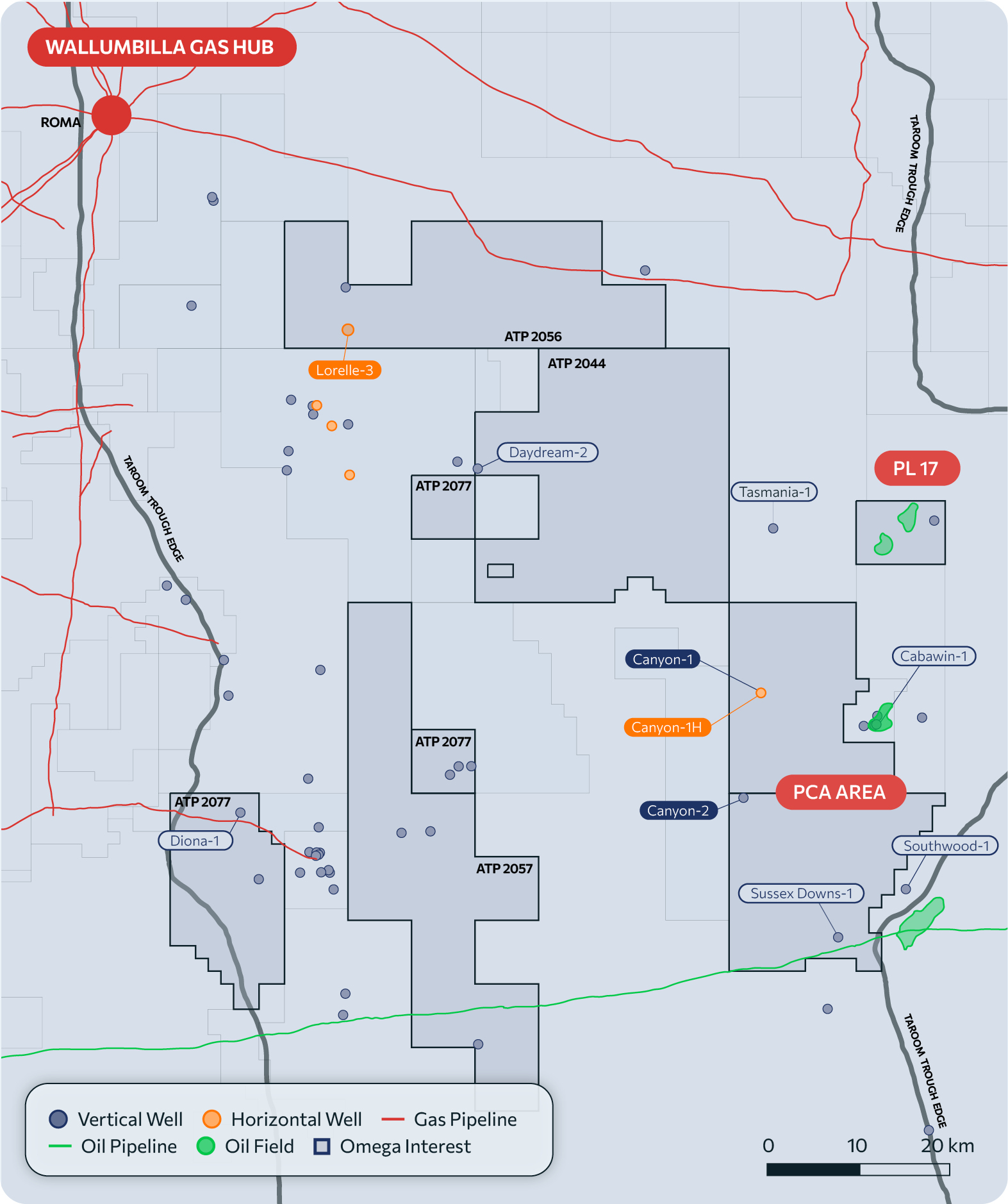

What the transaction gives Omega Oil and Gas (ASX:OMA) is an expansion of its Taroom Trough footprint by securing exposure to the region’s western flank, providing additional data to enhance its basin knowledge and exposure to a potentially significant near-term well.

It also gains the right to appoint up to two directors, participation rights, secondee rights and technical committee representation to assist Elixir Energy (ASX:EXR) execute their plans.

The acquisition gives the company exposure to various play types within the Taroom Trough, which it believes will see a value uplift in 2026 as the reality of a gas supply shortfall looms on Australia’s east coast.

OMA’s investment also ensures that EXR is funded to drill a horizontal section in the Lorelle-3 well in January 2026.

This has the potential to deliver significant value as horizontal wells have demonstrated effectiveness in unlocking the potential of unconventional oil and gas-bearing sands like those in the Taroom Trough.

Following the transaction, OMA remains well capitalised with access to more than $55m in funds to support its 2026/27 Canyon Project appraisal program.

“This investment is a further step toward achieving our goal to be the partner of choice in the Taroom Trough, a highly prospective basin we understand well,” Managing Director Trevor Brown said.

“Omega is very favourably positioned with exposure to multiple opportunities across the Taroom Trough, Australia’s most prospective onshore gas and liquids province.

“Our interest in Elixir provides a low-cost entry into complementary acreage. With the Lorelle-3 well planned for early 2026, Omega shareholders gain exposure to a significant near-term exploration catalyst.”

Permits held by both Omega and Elixir. Pic: Omega Oil and Gas

Exploring the Taroom Trough

OMA is of course no stranger to the Taroom Trough – a highly prospective unconventional oil and gas basin in Queensland’s Bowen Basin.

The company has been operating in the region since listing on the ASX in 2022 with early successes at the Canyon-1 and Canyon-2 wells.

However, the scale of its discovery started to be realised when the Canyon-1H well flowed at a peak rate of 452 barrels of oil and 600,000 standard cubic feet of gas per day and a sustained rate of 321bpd of oil and 472,000scfd gas during testing of a 650m horizontal interval.

This translates to a sustained rate of 987bpd of oil and 1.45 million (MM) scfd of gas, or ~7.4MMscfd gas equivalent, from a 2000m lateral.

Follow-up cased hole logs in the Canyon-2 vertical well in May 2025, confirmed the presence of five stacked reservoir intervals while a multi-stage DFIT – essentially a miniature fracture stimulation test – returned highly encouraging results.

Subsequent modelling by global oilfield services company SLB concluded that a single horizontal production well at OMA’s Canyon project could produce about 950,000 barrels of oil equivalent over 10 years from just one out of five reservoir layers.

This also found the acreage could accommodate 418 such horizontal wells, enabling the recovery of 397.1 million barrels of oil equivalent or 2.39 trillion cubic feet of gas equivalent.

The potential was recognised by existing and new domestic and international institutional investors, who chipped in for an overwhelmingly oversubscribed $46m placement in September 2025.

OMA’s 2026/27 appraisal program will comprise at least three vertical wells and options for multiple follow-up horizontal sections.

Over on the western flank, EXR has also seen its share of success with its Daydream-2 vertical appraisal well delivering peak flow of 2.6MMscfd during testing.

It is now moving to drill the Lorelle-3 horizontal well in ATP 2056 to earn its 50% interest.

Lorelle-3 will be drilled to a total depth of 3600m using Shell’s newly imported Taroom Trough specialised FlexRig, which is a heavy duty drilling rig, to test the primary target Tinowon ‘Dunk’ sands and the secondary Overston and Lorelle sands.

It will then be plugged back after logging is completed and a +1000m lateral drilled, cased, stimulated and tested within the Tinowon Dunk sands.

This article was developed in collaboration with Omega Oil and Gas, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.