Oil prices to surge by 42.9% in 2021, then remain stable in 2022: IBISWorld

Two workmen adding a length of drilling pipe at an oil well in the Seminole Oil Field, Oklahoma. (Photo by Russell Lee/Library Of Congress/Getty Images)

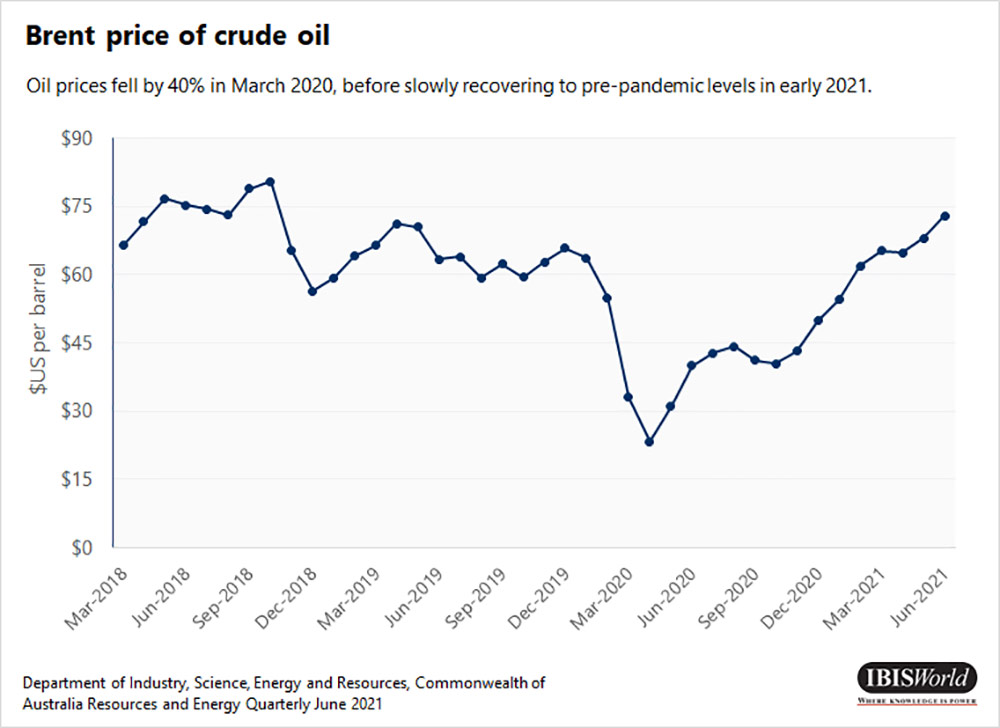

World crude oil prices are expected to rebound substantially this year before stabilising in 2022 – welcome signs for a market which has suffered significant volatility over the last 18 months.

Oil and gas operators have been hit hard by volatile prices, with revenue falling by 32.6% in 2020-21. Travel restrictions continue to weigh on global oil demand, but conditions have been improving, with oil consumption projected to return to pre-pandemic levels in 2022.

“Oil prices remain volatile, with demand conditions still depressed due to the ongoing pandemic,” IBISWorld senior industry analyst James Thomson says.

“However, recovering demand conditions and OPEC’s willingness to limit supply will likely support prices in the short term.”

Oil revenues, demand to keep rising

Despite rising environmental concerns, global oil demand is projected to continue rising over the next five years. Most of this growth is expected to come from Asia, according to IBISWorld.

Revenue is forecast to increase at an annualised 4% over the five years through 2026-27, to $69.4 billion.

Industry enterprise and employment numbers are projected to grow as rising oil prices and recovering demand conditions attract new entrants.

Industry profit margins are forecast to increase over the next five years, as oil prices recover and extraction efficiency improves.

“Australian oil producers are well placed to benefit from rising demand in Asia,” Thomson says.

“With more firms committing to net zero targets, Australian producers have an opportunity to export oil and certify shipments as carbon neutral using offsets.”

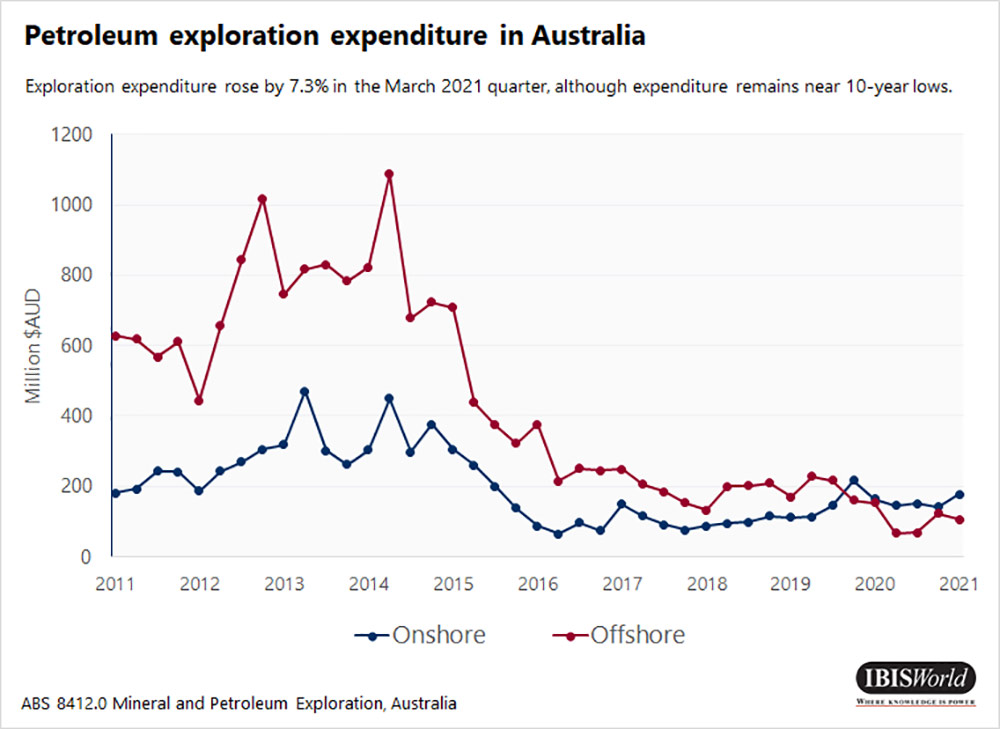

Exploration is rebounding

Spending on petroleum exploration rose by 7.3% in the March 2021 quarter, to total $283.4 million, signalling improved conditions for exploration companies.

However, exploration expenditure remains near 10-year lows.

“IBISWorld anticipates exploration expenditure to continue recovering, with revenue for the Oil and Mineral Exploration Drilling industry projected to rise by 9.7% in 2021-22,” Thomson says.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.