NASA wants a nuclear reactor on the moon by 2030 and nuclear fusion development attracts more private investors worldwide

Pic: Vertigo3d / E+ via Getty Images

It sounds like a sci-fi movie plot, but NASA wants a nuclear reactor on the moon by the end of the decade.

Battelle Energy Alliance, a contractor for the US Department of Energy’s Idaho National Laboratory (INL), is teaming up with NASA to seek proposals from nuclear and space industry leaders to develop innovative technologies for a fission surface power (FSP) system for lunar power applications.

Basically, the idea is to put a fission reactor on the moon which would pave the way for sustainable operations and even base camps on the moon and Mars.

“Plentiful energy will be key to future space exploration,” NASA’s Space Technology Mission Directorate associate administrator Jim Reuter said.

“I expect fission surface power systems to greatly benefit our plans for power architectures for the moon and Mars and even drive innovation for uses here on Earth.”

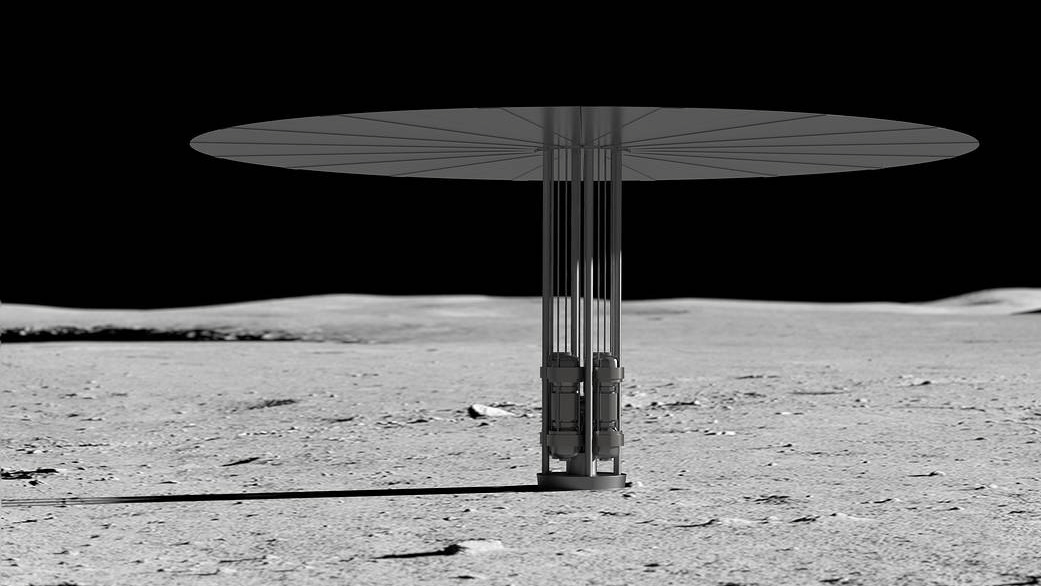

The plan is to design, fabricate and test a 10-kilowatt class FSP which might look something like this:

Rolls-Royce secures UK funding for small modular reactors

But nuclear fission is also attracting attention, new policies and investment down here on planet Earth, driven by the dual climate and energy crises.

At the COP26 conference, the UK Government announced it invested £210 million into Rolls-Royce’s next generation nuclear reactors.

Which along with $195m across three years from the Rolls-Royce Group, BNF Resources UK Limited and Exelon Generation Limited, will allow the Rolls-Royce Small Modular Reactor (SMR) business to deliver a low cost, deployable, scalable and investable programme of new nuclear power plants.

“Our transformative approach to delivering nuclear power, based on predictable factory-built components, is unique and the nuclear technology is proven,” Rolls-Royce SMR CEO Tom Samson said.

“Investors see a tremendous opportunity to decarbonise the UK through stable baseload nuclear power, in addition to fulfilling a vital export need as countries identify nuclear as an opportunity to decarbonise.”

Micro-reactors can be built fast at 1/10th the size

UK Business and Energy Secretary Kwasi Kwarteng said that Small Modular Reactors offer exciting opportunities to cut costs and build more quickly, “ensuring we can bring clean electricity to people’s homes and cut our already-dwindling use of volatile fossil fuels even further.”

A Rolls-Royce SMR power station will have the capacity to generate 470mw of low carbon energy, equivalent to more than 150 onshore wind turbines.

It will provide consistent baseload generation for at least 60 years, helping to support the roll out of renewable generation, helping to overcome intermittency and will occupy around one-tenth of the size of a conventional nuclear generation site and power approximately one million homes.

But Rolls isn’t the only company eyeing micro-reactors.

The US is close on its heels, with TerraPower planning to replace an aging coal-fired plant with a set of its mini-reactors which would be assembled in a factory and transported to the plant location – and be up and running by 2028.

And the Biden administration plans to shore up existing reactors and invest in new ones, with the $1.2 trillion infrastructure bill directing billions in research into the next generation of mini reactors.

“It’s the SpaceX moment for fusion.” CEO Chris Mowry talks to @Bloomberg about the new technologies enabling breakthroughs in #fusionenergy development: https://t.co/xdqNjOfYOd

— General Fusion (@GeneralFusion) January 3, 2019

Nuclear fusion beginning to attract investment

According to the Fusion Industry Association, there are currently more than 30 private fusion firms around the world, with 18 declaring funding totalling $2.4 billion combined.

Five companies – Commonwealth Fusion Systems, Helion Energy, General Fusion, TAE Technologies and Tokamak Energy – currently account for 90% of this funding.

Helion just nabbed $375 million from Silicon Valley investor Sam Altman, with plans for its demonstration reactor Polaris to be in operation by 2024.

Commonwealth Fusion Systems is targeting a pilot reactor by 2025 at a cost of around $3 billion and has major shareholder Italian energy player Eni poised to invest in the next round of financing.

Then there’s TAE Technologies, which has raised around $880 million, with investors including Goldman Sachs.

And just last month, Canada’s General Fusion announced it had closed a $130 million funding round to commercialise Magnetized Target Fusion (MTF), with an impressive line-up of individual investors including Jeff Bezos.

The company is scheduled to start operating in 2025 and aims to have its reactors for sale early in the next decade.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.