MST Access says accelerating orders and growing interest validate PH2’s hydrogen strategy

MST Access says accelerating orders for PH2’s solutions validate its hydrogen solutions. Pic: Getty Images

- MST Access says Pure Hydrogen is providing real “here and now” transport solutions for medium to heavy vehicles

- Such vehicles and associated infrastructure are helping customers achieve net zero goals

- This is validated by accelerating orders as well as strong interest in the US, with MST valuing PH2 at 35c per share on a Discounted Cash Flow (DCF) basis

Special Report: MST Access believes hydrogen’s emergence as an alternative to battery electric vehicles in medium and heavy transport bodes well for Pure Hydrogen and its commercial product suite.

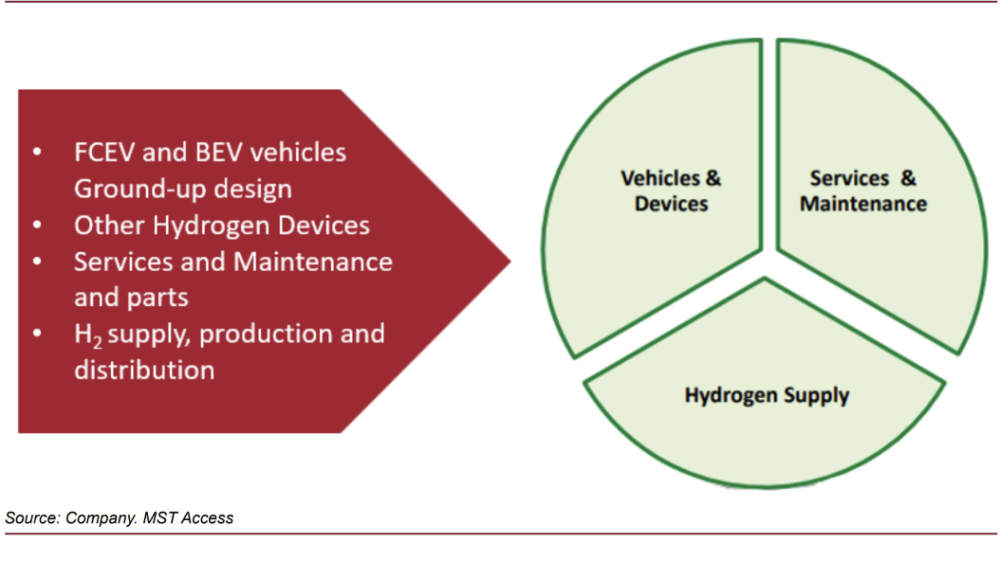

Accelerating orders are validating Pure Hydrogen’s (ASX:PH2) delivery strategy for zero-emission vehicles, MST senior analyst Andrew Johnston said, which includes heavy vehicles such as prime movers as well as the necessary infrastructure to both produce hydrogen and refuel vehicles, along with complementary battery applications in buses and trucks which are fulfilling gaps in customer demand.

The company has seen strong interest from both government and corporate customers in its battery and hydrogen-powered buses, waste collection trucks, prime movers, and refuelling solutions.

MST notes that initial interest from the US is promising and opportunities also exist in Europe.

“We expect US state government subsidies for battery hydrogen vehicles to continue with future Federal government support more complex,” Johnston added.

MST is also far from the only research firm that believes PH2 is on the right track, with Bridge Street Capital having initiated coverage of the company with a buy recommendation in August 2024.

Trading at 11c when the report was compiled, MST has placed a valuation more than 200% higher of 35c on the stock, which had a market cap of $39m on Monday.

Investment thesis

The research firm pointed out that while battery electric vehicles (BEVs) dominate passenger fleets for zero emissions transport, it has unique challenges for certain heavy vehicle applications that PH2’s real “here and now” successfully addresses.

Its heavy fuel cell vehicles and supporting infrastructure offer practical solutions to issues such as recharge time, infrastructure and power delivery while its BEV solutions solve particular heavy transport applications.

“Product sales and trials with local councils and major corporations (Pepsi, JJ Richards) provide validation of the strategy underpinned by net-zero targets,” MST’s Johnston noted.

“International opportunities are promising with sales in Asia, distribution MOUs in the US, and strong interest in Europe.”

In the past couple of months, the company has executed agreements to expand its distribution network with GreenH2 LATAM in November, ETHERO Truck + Energy in October and Riverview International Trucks in July.

It also sold vehicles and supporting infrastructure under agreements such as those with Vietnam ASEAN Hydrogen Club and another party worth ~$10m in late October.

PH2’s Taurus prime mover truck is on trial with PepsiCo and Barwon Water while multiple sales of waste disposal vehicles have been made to major waste recovery companies including JJ Richards and Solo, as well as prominent local governments such as the City of Newcastle.

Development is underway on Stage 1 of its initial hydrogen micro-hub at Archerfield Airport in Queensland as a demonstration plant that will supply nearby commercial customers – including JJ Richards – as well as aviation industry demand.

Key catalysts

MST noted that key catalysts for PH2 are ongoing growth in orders and debt structures to support working capital requirements.

“We forecast substantial revenue growth over the next 5 years on the back of 14 vehicle deliveries in FY25 (currently there are 12 vehicle orders in the process of being manufactured) and growing strongly in subsequent years,” Johnston added.

“We also forecast $5m of hydrogen, equipment sales and maintenance services in FY25.”

The company is also in the process of spinning off its Australian gas assets into a separate ASX-listed gas company – Eastern Gas – through a 1:5 in specie distribution followed by an initial public offering to raise $8-10m to fund near-term work.

This article was developed in collaboration with Pure Hydrogen, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.