MST Access believes Omega is on course to 64c as modelling highlights Canyon scale

MST Access has maintained its 64c price target for Omega Oil & Gas. Pic: Getty Images

- MST Access maintains 64c price target on Omega as shares soar on SLB modelling

- Modelling highlights strong potential of each Canyon horizontal well to produce oil and gas

- Securing farm-in partner could unlock project’s potential by securing capital for more wells and development

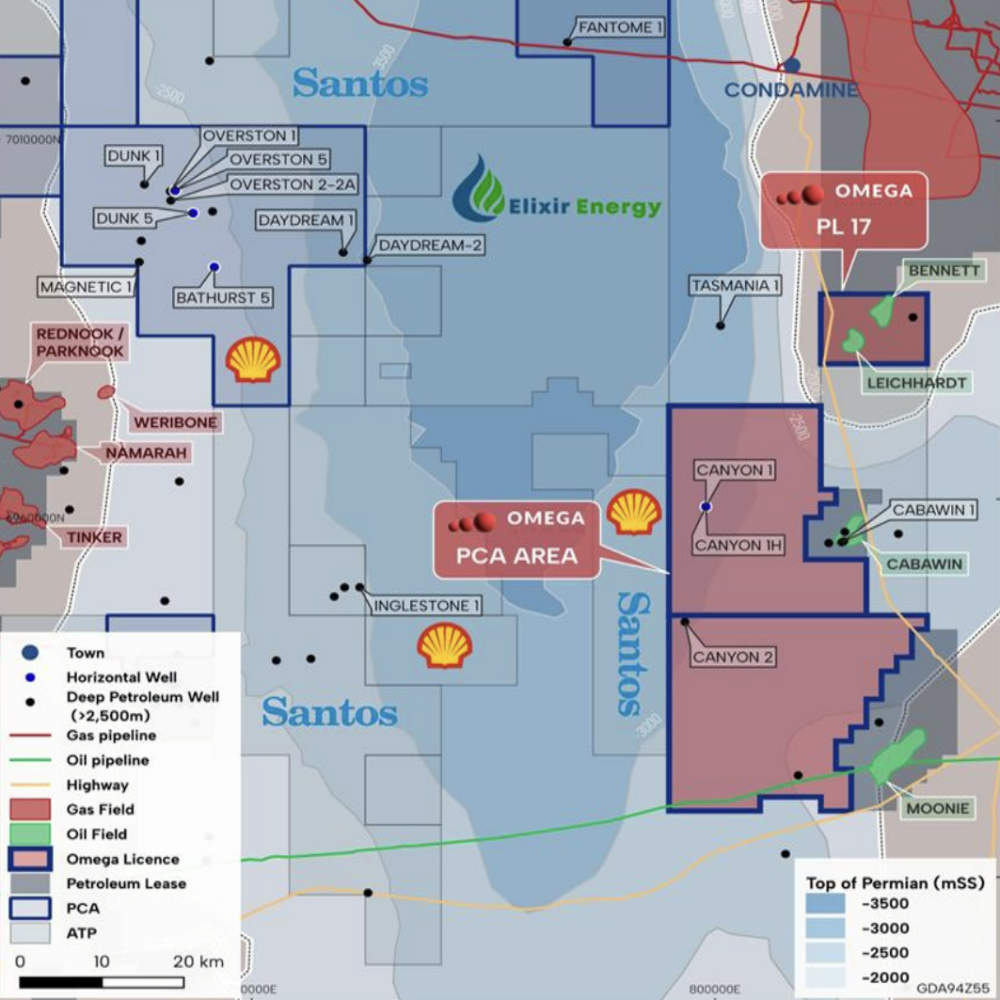

MST Access has maintained a 64c price target for Omega Oil & Gas following the release of modelling highlighting the oil and gas development potential of its Canyon project in Queensland’s Taroom Trough.

Shares in the company have been on a tear since the modelling by global oilfield services company SLB was released on August 26, rising some 35.4% over the past week to the current price of 44c.

And there are good reasons why investors have flocked to Omega Oil & Gas (ASX:OMA) .

The work found that a single horizontal production well could produce about 950,000 barrels of oil equivalent over 10 years from a single zone out of five layers within the Canyon Sandstone reservoir.

Couple that with the finding 418 such wells can be accommodated within the company’s current acreage at a 1000m spacing and the potential scale of the play starts to speak for itself.

To top it off, testing has proved the Canyon Reservoir is heavily over pressured and compares very favourably to analogous “liquids rich” US unconventional basins such as the highly productive Eagle Ford, where the average recovery is about 600,000bbl of oil equivalent.

This has the potential to be hugely significant as the Eagle Ford is one of the shale plays that transformed the US from being a net oil importer into a net oil exporter.

Significant results

Unsurprisingly, MST’s senior analyst Stuart Baker believes the results are significant. He says the modelling, the result of an evaluation by world-leading experts, implies that a very large resource is present in the Canyon project area.

This is highlighted by the initial Canyon drilling resulting in the definition of a best estimate contingent resource of 1.5 trillion cubic feet of gas equivalent.

Baker also calculated that each well could generate revenue in order of ~$87m and expects the SLB modelling to help the company move through the next “gate”, which is a farm-out of some of its working interest in Canyon in return for cash and a carry through expenditure.

But the scale of the opportunity outstrips OMA’s balance sheet. With Baker suggested it will need funding for more wells and ultimately development.

This ties into the company’s active interest in partnering and potentially selling down selected areas of its wholly-owned acreage to secure capital that can help fund growth.

He adds the discovery of oil rather than just gas at Canyon gives rise to the potential for early production and cashflow as there is existing oil refining capacity and opportunities in the east coast gas market.

Baker noted that as OMA is at a pre-production stage, MST applied industry benchmarks for undeveloped 2C resources in line with peers at the same stage.

This is based on the assumption of a gas resource though the discovery of oil has positive value implications, to be addressed when resource size and commercial options are better understood.

However, he noted that key risks are that OMA will need to establish commercial flow rates.

The company will also need to drill more wells, which would in turn require more investment that shareholders must approve and/or the introduction of industry partners.

Next steps and catalysts

OMA has flagged that its forward program is aimed at delineating the extent of the resource with the objective of defining locations for future wells.

This will be carried out in tandem with the partnering assessment and other strategies to secure capital and monetise the resource.

MST notes that locking in a strategic or industry partner(s) would be a major event that may provide a look-through value for the Canyon project acreage.

Doing so will bring in the funds and possibly development experience that will advance the project towards development.

Results from exploration wells are another catalyst, as success will validate the project’s potential.

At Stockhead, we tell it like it is. While Omega Oil & Gas is a Stockhead advertiser, it did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.