Modelling outlines excellent oil production potential of Finder’s Timor-Leste fields

Finder Energy could flow oil at initial rates of between 25,000 and 40,000 barrels per day from its Kuda Tasi and Jahal fields. Pic: Getty Images

- Finder Energy’s dynamic reservoir modelling outlines strong oil flow from its Kuda Tasi and Jahal fields

- Fields predicted to flow at initial rates ranging from 25,000-40,000 barrels of per day

- Results expected to support activities to secure a development partner and funding

Special Report: Finder Energy’s Kuda Tasi and Jahal oilfields in the waters off Timor-Leste look to have real firepower with dynamic reservoir modelling predicting initial oil flow rates ranging from 25,000 to 40,000 barrels per day.

The exact rates will depend on the oil-handling capacities of the leading floating production, storage and offtake vessels that are currently under consideration as initial reservoir and well performance are modelled to exceed their capacity.

Finder Energy’s (ASX:FDR) modelling using Eclipse dynamic reservoir simulation software also found that the two fields would produce ~10 million barrels of oil in the first 18 months of production.

This indicates the field reserves will be produced quickly thanks to the high-quality reservoir sandstones of the Laminaria Formation, highlighting the strong cash flow potential of the project given the current Brent crude price of about US$75 per barrel.

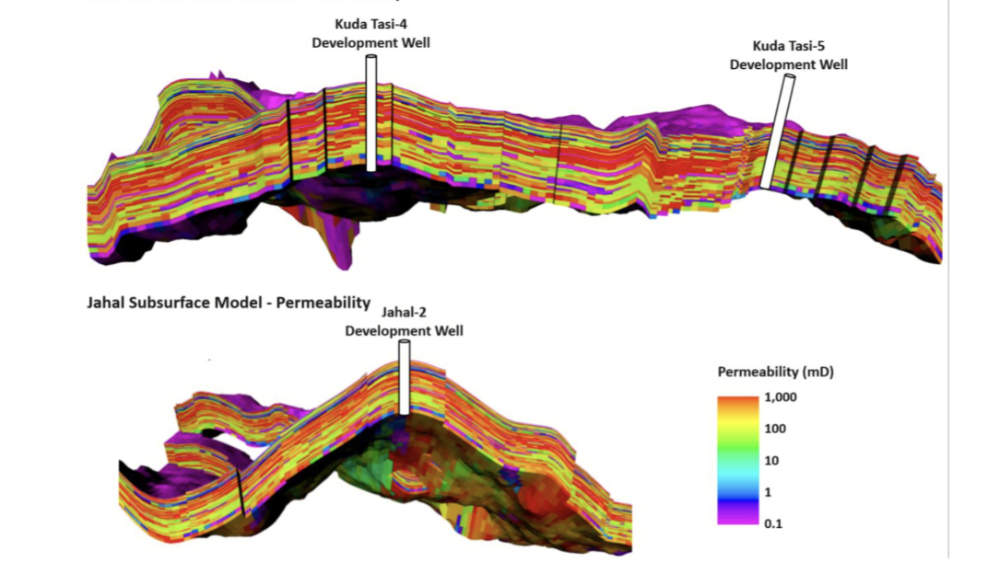

The company adds that it has confidence in predicted flow rates due to the significant dataset available on the Kuda Tasi and Jahal reservoirs, which includes five well penetrations, logging and pressure data, well bore samples as well as core and flow tests.

Notably, testing of the Kuda Tasi-2 appraisal well demonstrated potential for flow rates in excess of 20,000bpd per production well, which is in line with the performance of wells producing from the same reservoir in adjacent fields such as Laminaria/Corallina, Buffalo and Kitan.

This is coupled with other key reservoir and field characteristics such as the good permeability and porosity demonstrated by core and well petrophysics, regional aquifer providing strong pressure support, high-quality light sweet oil, and low levels of gas and impurities.

Early results from reprocessing of 3D seismic have also demonstrated excellent improvements in imaging the subsurface and is expected to de-risk exploration targets such as the near-field Lanjara and Lanjara SW prospects.

“The results from the latest dynamic reservoir modelling show the exciting potential of the Kuda Tasi and Jahal fields due to a combination of high-quality reservoir, aquifer pressure support and light oil,” chief executive officer Damon Neaves said.

“The forecast high production rates demonstrate the cash flow potential of the project, reinforcing our confidence in the commercial viability of the project.”

Low-cost oil bounty

The latest findings continue to highlight the wisdom of the company’s August 2024 move to acquire a 76% stake in PSC 19-11, which hosts both Kuda Tasi and Jahal along with a string of other prospects.

Of particular interest is the low price of just US$2m up front, US$6.5m on a final investment decision, and a 5% royalty on production that FDR is paying for a hefty 34 million barrels (MMbbl) of discovered oil.

The discovered fields are ready for development and only require more geological work to de-risk the sub-surface reservoir models.

This will leverage the Ikan 3D reprocessing, which is currently 70% complete and on schedule for completion in April.

Low-risk, near-field prospects such as Lanjara have the potential to double the size of the project and represents significant upside potential.

FDR has initiated discussions with oil traders within the Asian region and expects the light sweet crude from Kuda Tasi and Jahal to be sold to Asian refineries by reference to the benchmark Brent crude price.

It also expects the modelling results to support activities to secure a development partner and funding.

This article was developed in collaboration with Finder Energy, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.