Metgasco increases Vali Field gas reserves three-fold following independent evaluation

Pic: Matthias Kulka / The Image Bank via Getty Images

Following an independent evaluation of the Vali gas field reserves, the company has increased the reserves for the Patchawarra Formation – underpinning its planned pivot to gas producer in mid 2022.

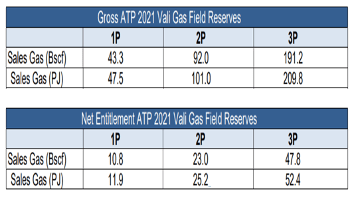

Metgasco Ltd has announced a three-fold upgrade to Vali Field Gross 2P reserves following an independent evaluation where the company owns 25%.

The reserves have been updated to 92 Bscf (101 PJ – 25.2 PJ net) versus its previous estimate of 30.3 Bscf (33.5 PJ – 8.4 PJ) by ERC Equipoise Pte Ltd (ERCE).

As a result, ERCE revised its 1P, 2P and 3P reserves estimates for the Vali Field to include the Toolachee Formation, on top of revising the previously booked reserves from the Patchawarra Formation.

The increase in the independently evaluated 2P gas reserves, when compared with the original reserves booking (which only accounted for the Patchawarra Formation) is 201%.

Validates ‘string of pearls’ thesis

Metgasco (ASX:MEL) managing director Ken Aitken said the independent evaluation of a material upgrade in the Vali gas field reserves is a great outcome.

“This confirms the decision to drill the Vali-2 and 3 appraisal wells.

“The study confirms the Toolachee reservoir has conventional gas flow potential to supplement the unconventional potential gas productivity in the Patchawarra zone already tested in Vali-1 ST1 and validates our ‘string of pearls’ thesis.”

He said the update also underpins the company’s planned pivot to a gas producer into the strengthening East Coast gas market in mid CY2022.

Looking ahead

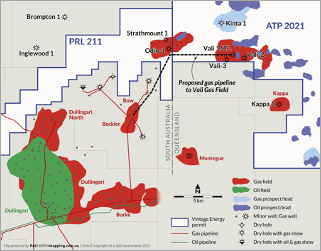

As previously advised, detailed engineering has kicked off for the connection of the Vali gas field to the South Australian Cooper Basin Joint Venture (SACBJV) infrastructure, with the work awarded to Logicamms, a member of the Verbrec group of companies.

This work is a crucial step toward first production and cash flow for the joint venture.

This article was developed in collaboration with Metgasco, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.